As previously noted (see the original post for FAQ), I am going to be running my regular weekly surveys here on Substack — see results from the initial test run (+ data/charts back to 2016).

Please cast your votes below…

(feel free to add any thoughts/color/questions in the comments section)

Equities Survey (for practical purposes assume this is S&P500)

Bonds Survey (for practical purposes assume this is US ~10-yr Treasuries)

For more details on the surveys, please see the FAQ (including the comment section Q&A). The main thing is to just select the answer which best fits your primary/strongest view and most relevant timeframe.

Other than that, you are welcome to add any further thoughts in the comment section.

Thanks for taking part! :-)

Timeless Charts — as a thank you, here’s another couple of charts to ponder…

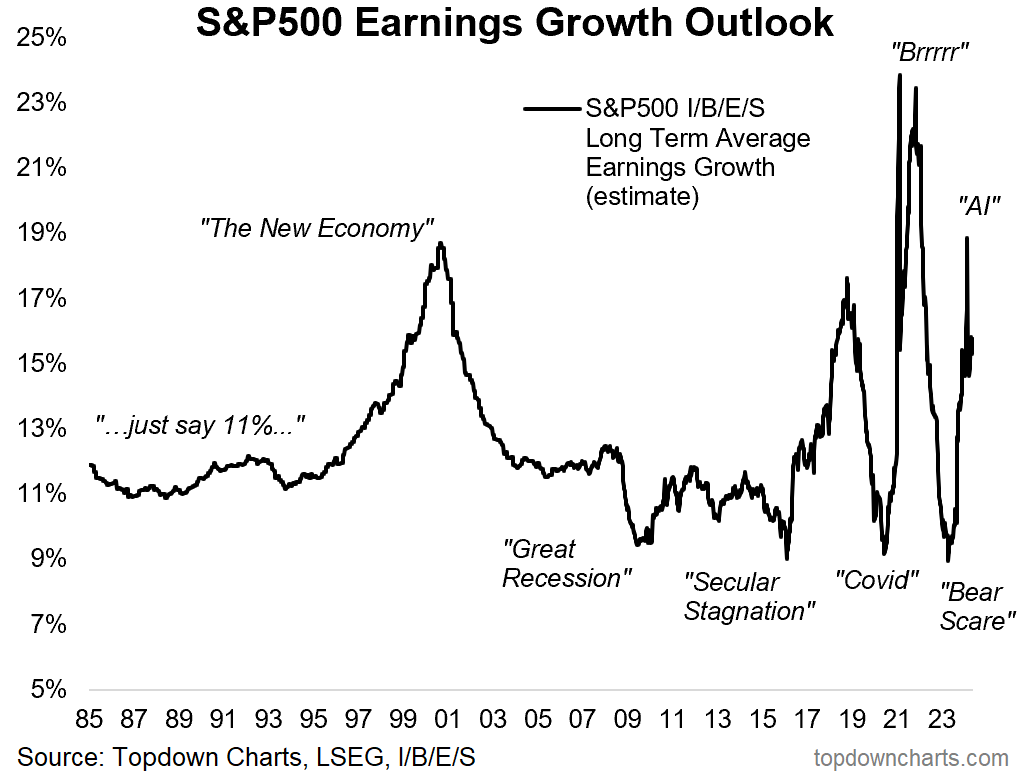

What to Expect when you are Expecting High Growth: I often find Fundamental indicators like the PE ratio function more like Sentiment Indicators, and here's a key example.

The more bullish Wall Street analysts are on Earnings Growth, the weaker subsequent stockmarket returns are likely to be:

1. it's in the price

2. it's a sentiment signal

(source: Weekly ChartStorm 3-March-2024)

And were do things sit now?

Naturally — I wouldn’t say we are doomed (I don’t like hyperbole and sensationalism), but certainly the probabilities are less favorable than usual at these levels…

(source: Topdown Charts )

—

Thanks and best regards,

Callum Thomas

Founder & Editor of The Weekly ChartStorm

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

not enough choices - shud have mildly bullish and mildly bearish

extremely weak volume means upside limited

Interesting chart.