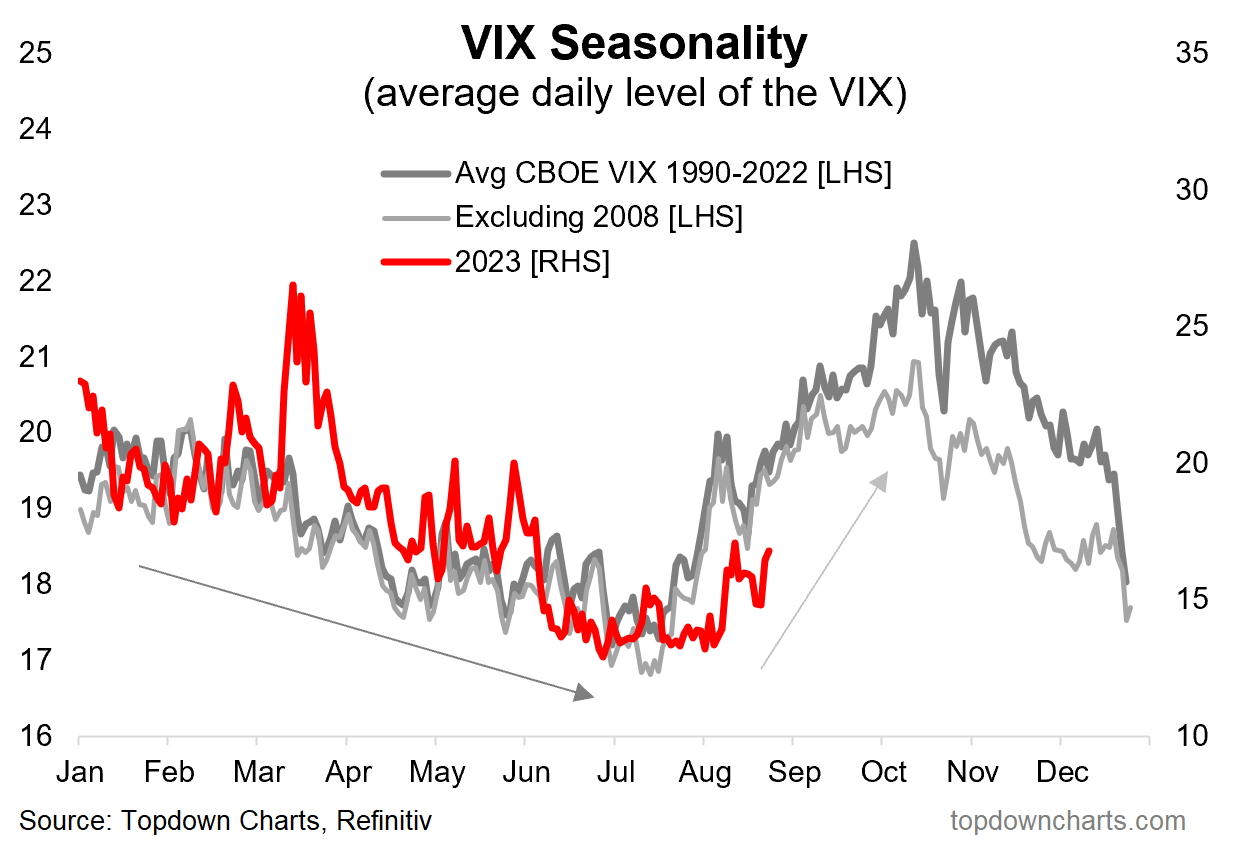

Chart Of The Day - VIX Seasonality

A seasonal up-shift in volatility is underway...

It’s Volatility Season: seasonal patterns are well documented in the physical world, with reliable seasonal swings seen in economic data and socio-behavioral trends. So it only makes sense that we also see seasonality in the markets, and around this time of the year volatility has a seasonal tendency to push higher …and as if right on que, here comes the VIX.

The tendency for higher volatility mirrors the trend for weaker stock prices around this time of the year (sometimes referred to as the Halloween effect).

As a technical note, seasonality is simply an average of what happened in the past, and it is important to note that there are exceptions to the seasonal rule (i.e. seasonality doesn’t always work!).

In terms of the current context, as noted last week, the market has kicked into correction mode from overbought, overvalued, and overly-optimistic conditions. We went from everyone being bearish in October 2022, to everyone being bullish in July 2023… but meanwhile monetary & credit conditions are tighter than ever, inflation risks resurging, and multiple leading indicators point to recession. So it’s probably a good idea to pay attention to this seasonal signal.

SUBSCRIBE —> Important Note: if you would like to subscribe to receive the Chart of the Day series straight to your inbox;

1. first subscribe to the Weekly ChartStorm as either a paid or free user;

2. navigate to Account Settings, and turn on emails for the Chart of the Day section.

(alternatively you can bookmark the Chart of the Day section page and check-in daily for an interesting variety of timely + timeless updates on the market)

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Founder and Editor at The Weekly ChartStorm

Follow me on Twitter

Connect on LinkedIn

The Chart Of The Day series is brought to you by The Weekly ChartStorm…

Subscribe to the Weekly ChartStorm for a carefully selected set of charts and expert commentary to help you stay on top of the evolving market outlook —> see why over 31,000 people choose the ChartStorm as their filter on a noisy world ↓