Chart Of The Day - Credit Tightening

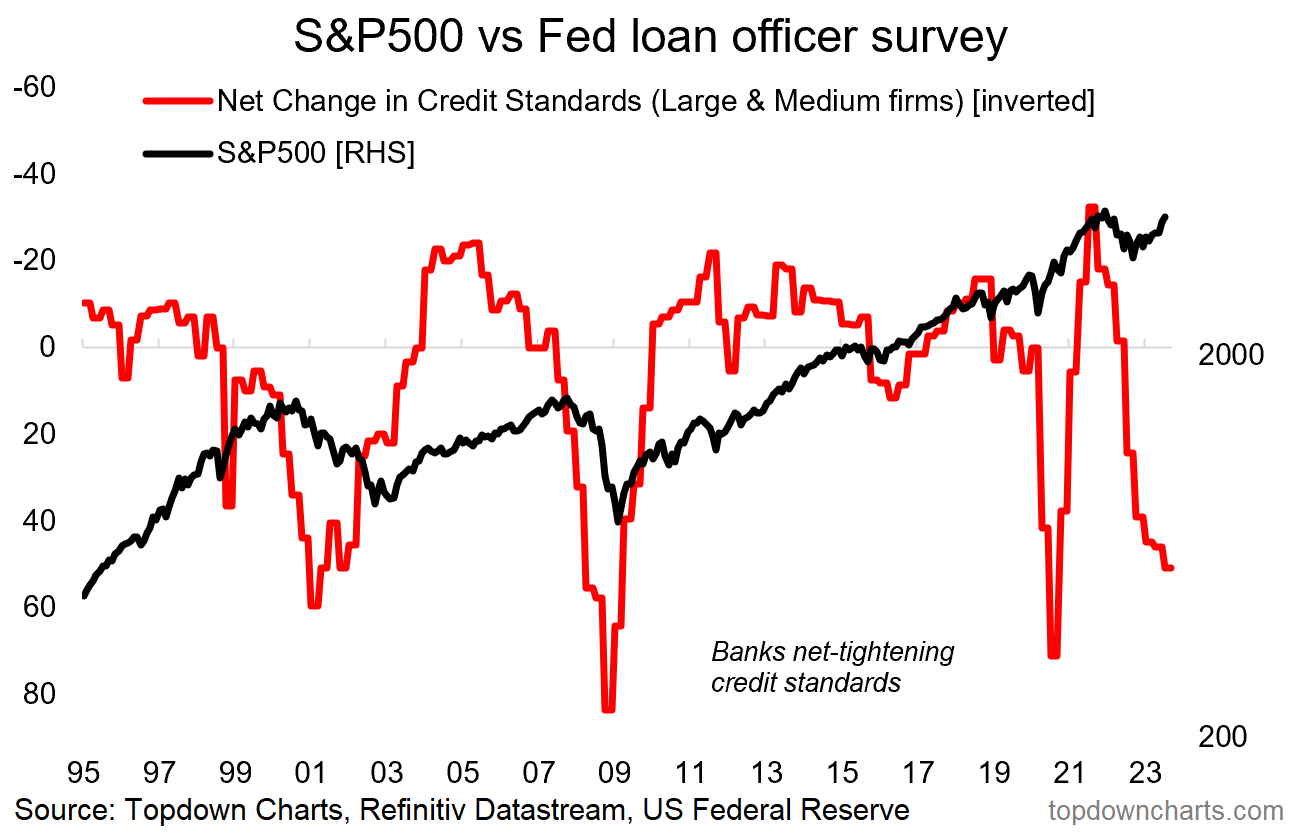

A bear market warning indicator from the banks...

Bank Loan Officers say NO: The Q3 “Senior Loan Officer Opinion Survey on Bank Lending Practices” showed banks further tightening lending standards for Commercial & Industrial loans — and marks the 5th quarter in a row where survey respondents reported a net-tightening of the standards and criteria by which they make lending decisions.

The last time we saw such a significant tightening of lending standards was in 2020, but it’s important to note during that time interest rates were falling, fiscal stimulus was pumping, and the world was awash with liquidity.

Outside of 2020, the other 2 key examples in recent history were the lead-up to the bear market and recession of the early 2000’s, and then again in the lead-up to the financial crisis in 2008.

It is somewhat different this time in that a lot of firms (and households for that matter) locked-in low rates during 2020/21 (as noted in chart 10 last week). But with ongoing monetary tightening, signs of strain in the global economy, and multiple leading indicators pointing to recession, it’s well worth pondering this bear market warning indicator.

SUBSCRIBE —> Important Note: if you would like to subscribe to receive the Chart of the Day series straight to your inbox;

1. first subscribe to the Weekly ChartStorm as either a paid or free user;

2. navigate to Account Settings, and turn on emails for the Chart of the Day section.

(alternatively you can bookmark the Chart of the Day section page and check-in daily for an interesting variety of timely + timeless updates on the market)

Thanks for your interest. Feedback and thoughts welcome.

Sincerely,

Callum Thomas

Founder and Editor at The Weekly ChartStorm

Follow me on Twitter

Connect on LinkedIn

Subscribe to the Weekly ChartStorm for a carefully selected set of charts and expert commentary to help you stay on top of the evolving market outlook