Weekly S&P500 ChartStorm - 24 August 2025

This week: market breadth, earnings momentum, bullish rotations, seasonality snippets, tech sector risk flags, credit spreads...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

We’re seeing bullish broadening as breadth trends higher.

Also seeing improved earnings breadth and bullish rotation signs.

(but) there are ample seasonal risk flags waving heading into Sep.

Tech sector early-warning indicators are also starting to light up.

Credit spreads at 25-year lows indicate a mix of confidence & complacency.

Overall, there’s probably 3 key themes this week; the building bullish evidence (technicals, rotation, breadth), the bigger picture risk pressures building (expensive valuations, AI hype, all-in positioning), and the short-term seasonal risk flags waving. The way to reconcile this is the way you always reconcile this sort of thing: through portfolio strategy (diversification), risk management (contingencies to address downside risk), and paying attention to what price is telling you…

n.b. see “Getting Started” for how to get the most out of your subscription to the Weekly ChartStorm + FAQ and troubleshooting.

1. Breadth Broadening: Here’s something interesting; after the last 2 minor sell-offs breadth has come back stronger both times, and just as the index is making higher highs and higher lows the 200-day average breadth indicator is making higher highs and higher lows — and is now sitting at the strongest level since late last year. Bullish stuff.

Source: MarketCharts

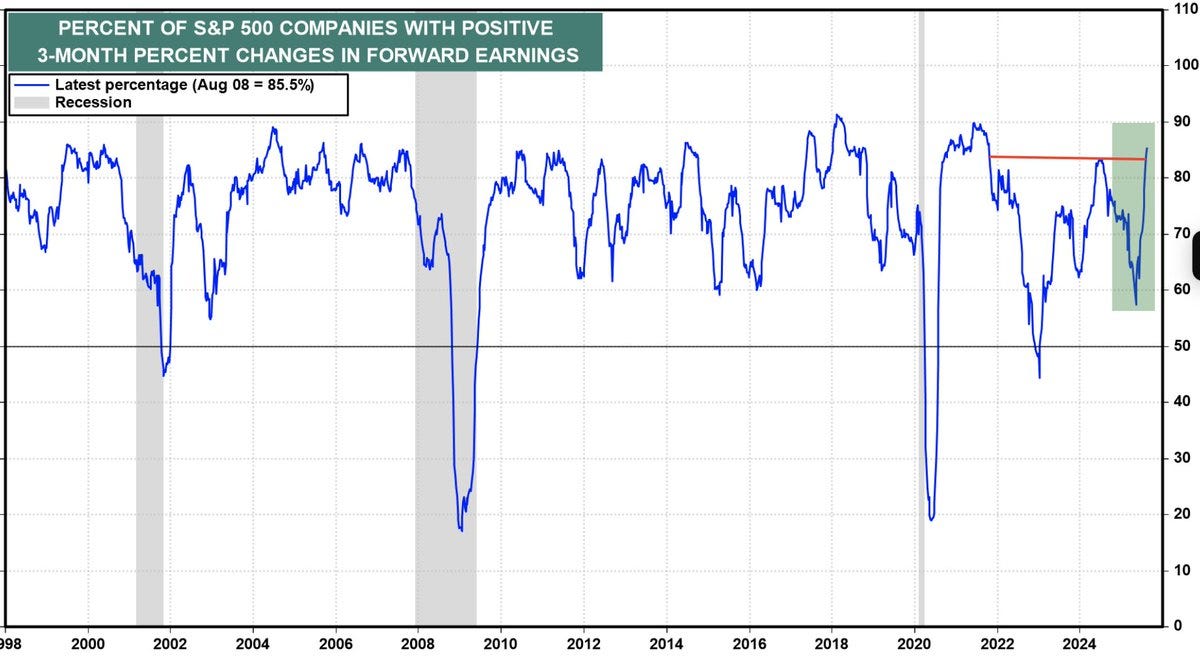

2. Earnings Momentum: On a similar note, the breadth of earnings revisions momentum is expanding (over 80% of companies are seeing positive 3-month revisions in forward EPS). In practice this is sort of a sentiment indicator, but one thing to note is the pattern of movement here (i.e. a big washout and rebound) is consistent with the early stages of cyclical bull markets.

Source: @SethCL

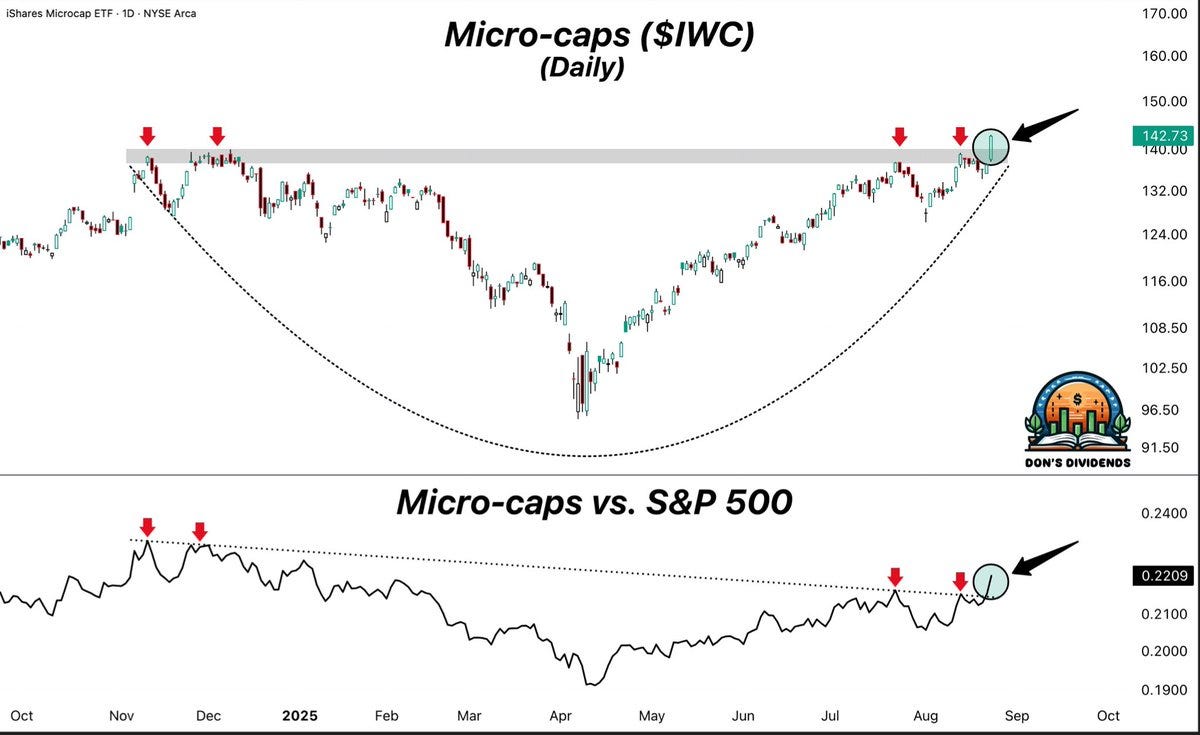

3. Big Things in Micro-caps: Another bullish broadening/rotation theme is the emerging strength in micro-cap stocks. It’s always interesting to see the fringe/riskier stuff doing well (n.b. also note that frontier markets and EM stocks have also been going strong recently; indicative of the broadening bullish price action sweeping global markets at the moment).

Source: @TheDonInvesting

4. Bullish Rotation? Indeed, while there are risks and pressures building in certain pockets of the market, there’s also bullish possibilities hiding in plain sight. A big potential one is the relative value trinity that I’ve been going on about (global vs US, small vs large, value vs growth). I think there is a real chance we do get a bullish resolution of this in the form of bullish rotation and catch-up by past laggards. A big part of that story is going to be global growth reacceleration theme (explained here).

Source: Chart of the Week - The Best vs Worst

5. VIX Seasonality Tracker: But just to keep things grounded, here’s an update to the VIX seasonality tracker — because even if we bull-forward through to 2026, rule one of markets is things don’t go up in a straight line. We’re almost certain to see a flare-up in volatility some time in the coming weeks…

Source: Topdown Charts

6. Seasonally September Sucks: And September could be a candidate for that. Seasonally September is typically one of the worst months of the year, and as I’ve previously belabored valuations are elevated, positioning is fairly all-in, and September brings a busy macro calendar.

Again though, this is not necessarily a reason for pessimism or bearish abandon, but certainly a prompt to think about risk management and portfolio strategy.

Source: Citadel via @neilksethi

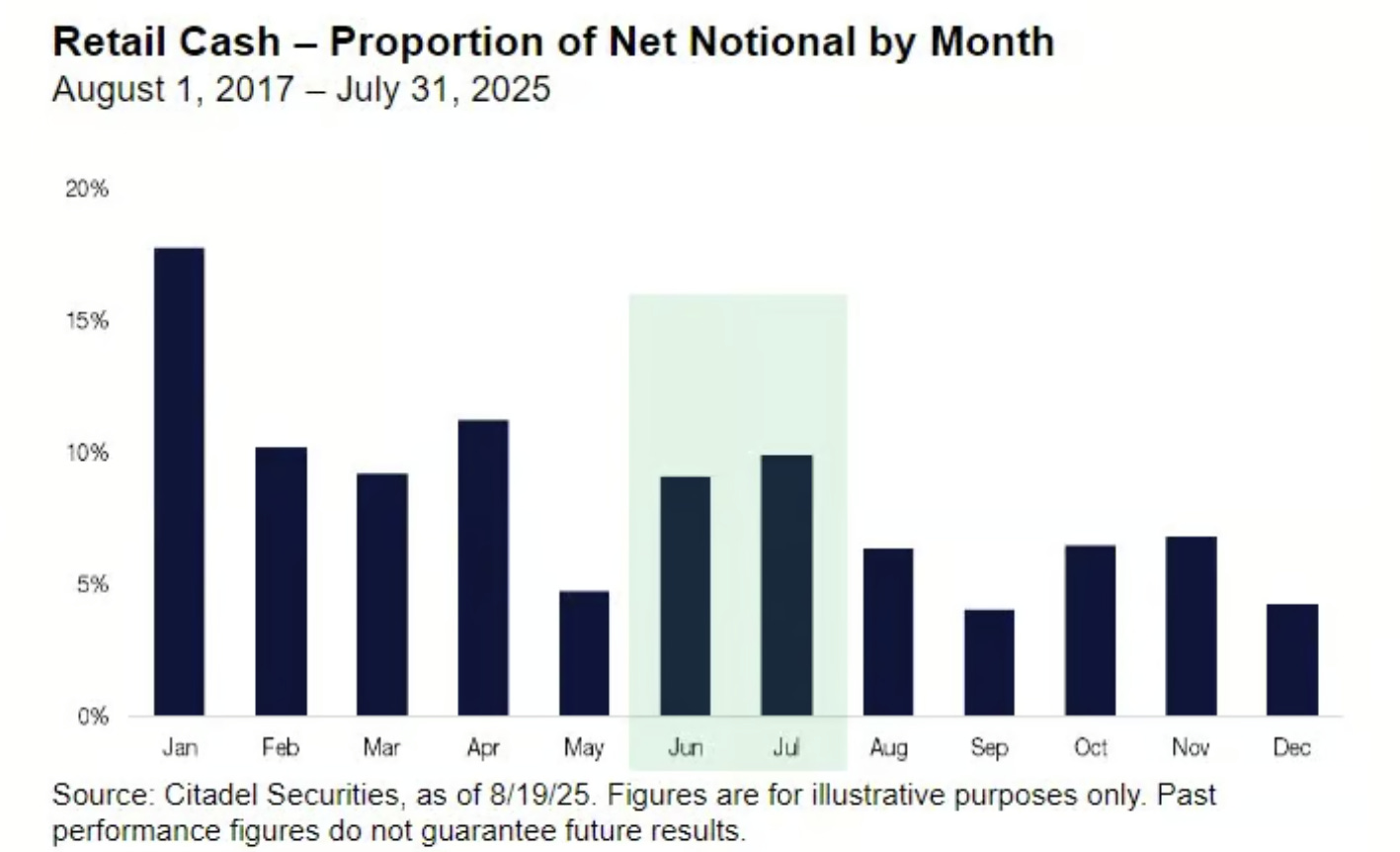

7. Seasonal Buyers’ Strike: This is an interesting one, and it stacks on last week’s chart (no. 4) that showed corporate buybacks seasonally slump this time of year — it also turns out retail buying sees a seasonal slump too: “retail buying activity starts to slacken in August, while September typically marks the year’s low point for retail participation.”

Source: Scott Rubner of Citadel via Daily Chartbook

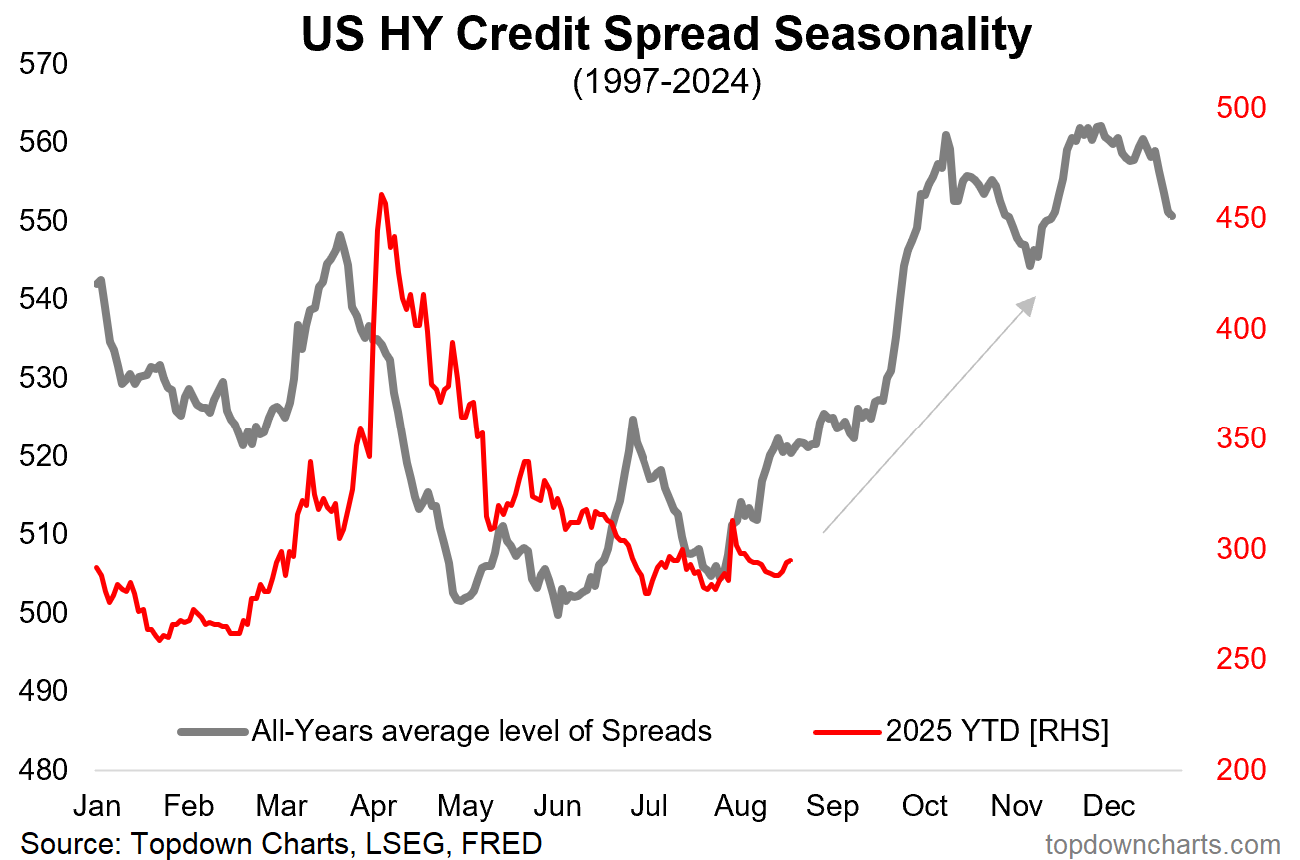

8. Credit Spread Seasonality: Credit markets also have historically seen a tendency for spread widening around this time of the year. So again it’s all enough to make you at least keep a closer eye on risk in the coming weeks/months.

Source: Topdown Charts Professional

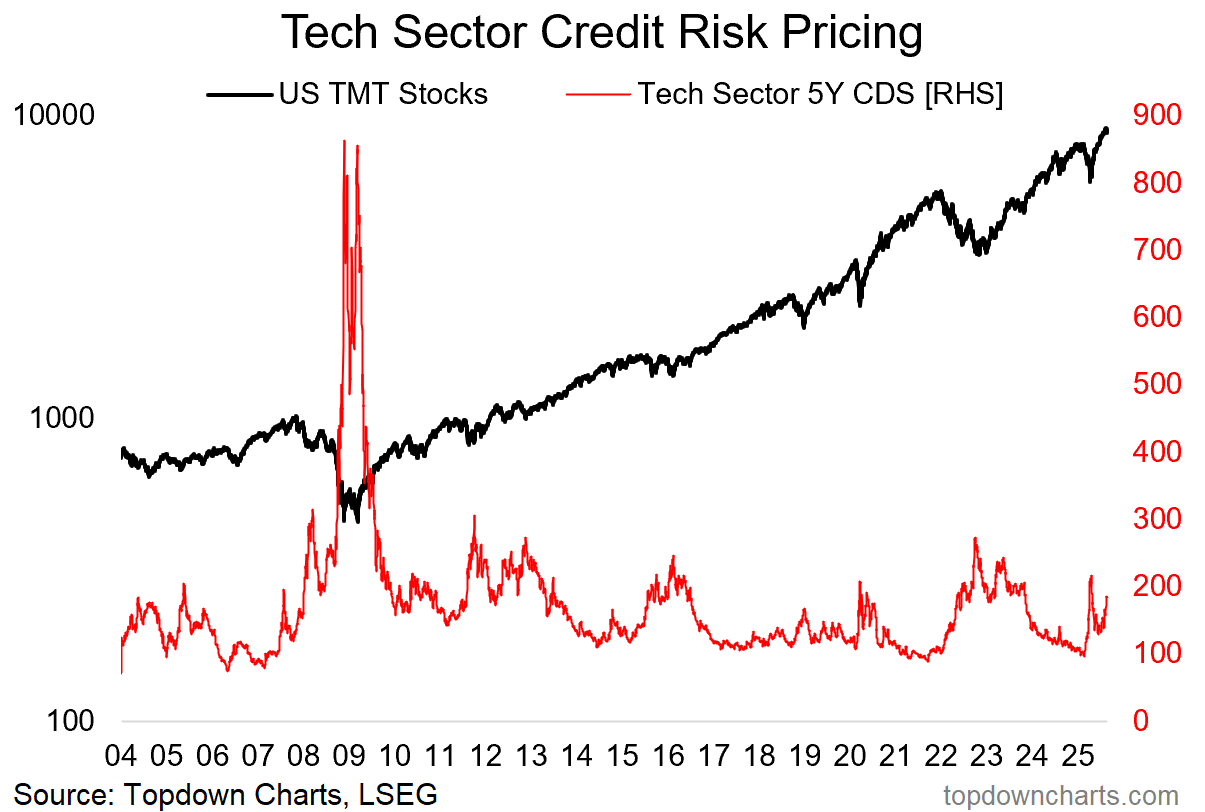

9. Tech Sector CDS: Speaking of credit markets, I thought this one was interesting — it seems tech sector CDS (the cost to insure against credit default) have been ticking higher in recent weeks… what do credit markets know?

Source: Topdown Charts

10. Tech Winners & Losers: Which is interesting when you also notice the tech sector High-Low Logic Index surging, which indicates a “significant number of stocks making new highs while others are making new lows” which Dean Christians described as “underscoring how AI is creating winners and losers within the sector.”

As I commented on twitter the other day, it does appear as though there are some cracks starting to appear in the AI Hype narrative (and specifically the hype cycle).

Source: @DeanChristians

Thanks for reading, I appreciate your support! Please feel welcome to share this with friends and colleagues — referrals are most welcome :-)

BONUS CHART >> got to include a goody for the goodies who subscribed.

Credit Spreads: US investment grade credit spreads reached a 25-year low last week.