Weekly S&P500 ChartStorm - 21 September 2025

This week: technical check, global equities, policy moves, animal spirits, sentiment, murky macro divergences, wealth allocations, IPO market activity...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

The S&P500 remains in a strong uptrend.

Rate cut resumption has helped unlock further new highs.

Global equities are also going strong (thanks also to policy stimulus).

Wealth effects are speaking louder than soft jobs data.

There has been a frenzied surge in ETF launches recently.

Overall, while there are some concerning signs and signals, the trend is still up and the path of least resistance looks to be higher for longer for stocks. And as we look at in this week’s session; changing dynamics in the US economy mean macro soft spots may well get painted over by wealth effects (and bad macro might even have the opposite effect than you think).

n.b. check out the “Getting Started” section for tips (+ reading list) to help you make the most of your subscription to the Weekly ChartStorm.

1. Technical Check: After a brief period of consolidation, the S&P500 has pushed on to new highs, with a healthy looking trend (price above upward sloping 50 and 200-day moving averages). The only quibble might be that a 3rd of stocks are still tracking below their 200-day average, but you might argue that represents room to move to the upside via eventual bullish rotation.

Source: MarketCharts

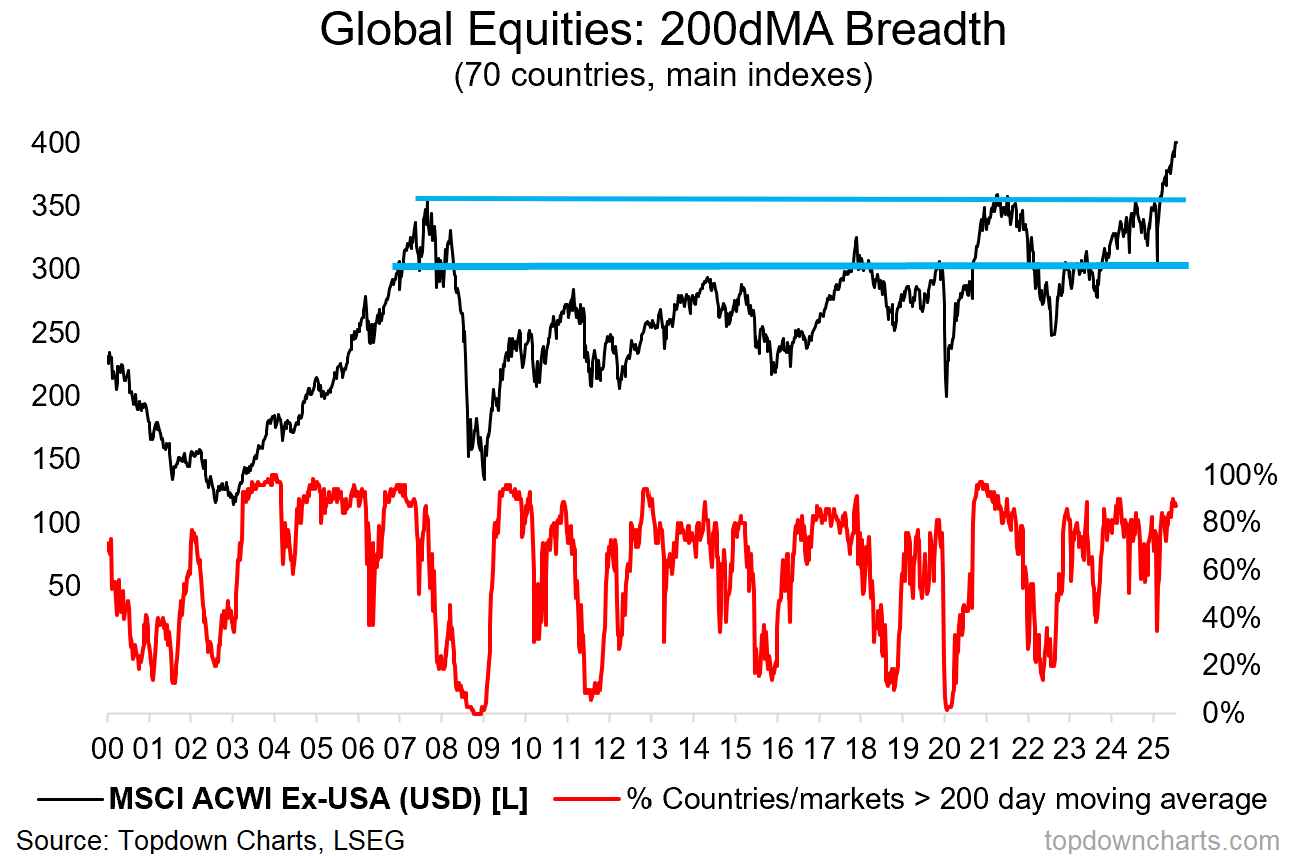

2. Global Equities: I’ve updated this chart as it was a key feature in the “2022 Top charts” edition from last week — as things stand there are currently *no* warning signs here, and if anything it is a picture of strength on the global front (and a vote in favor of bullish rotation in global equities).

Source: Topdown Charts

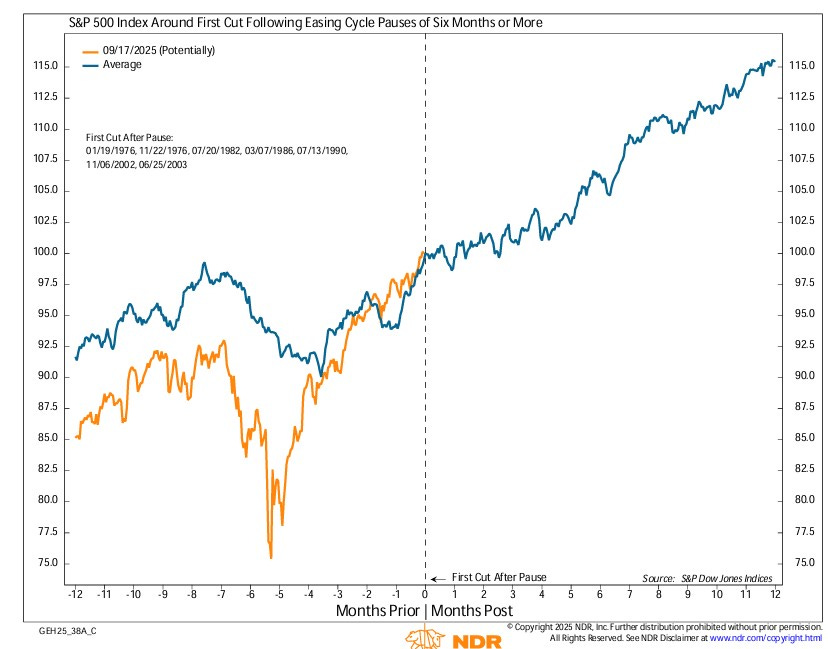

3. Fed Cut: Back on the USA, with the Fed resuming rate cuts last week — this now puts in play the pattern below of the market tending to keep on keeping on following a pause and return to rate cuts.

Source: @edclissold

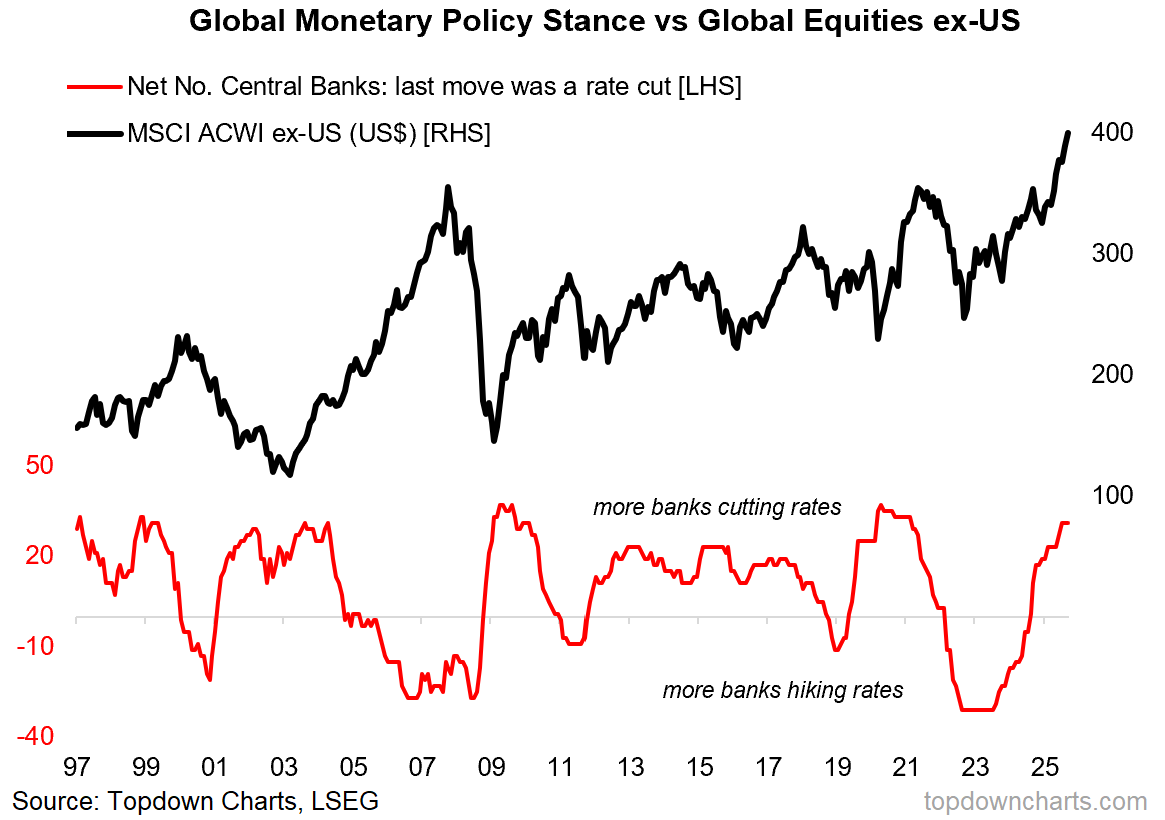

4. Global Cuts: But this is old news on the global front as there has already been a stampede toward rate cuts globally, which has been a key force behind the new bull market in global stocks.

Source: Topdown Charts Professional

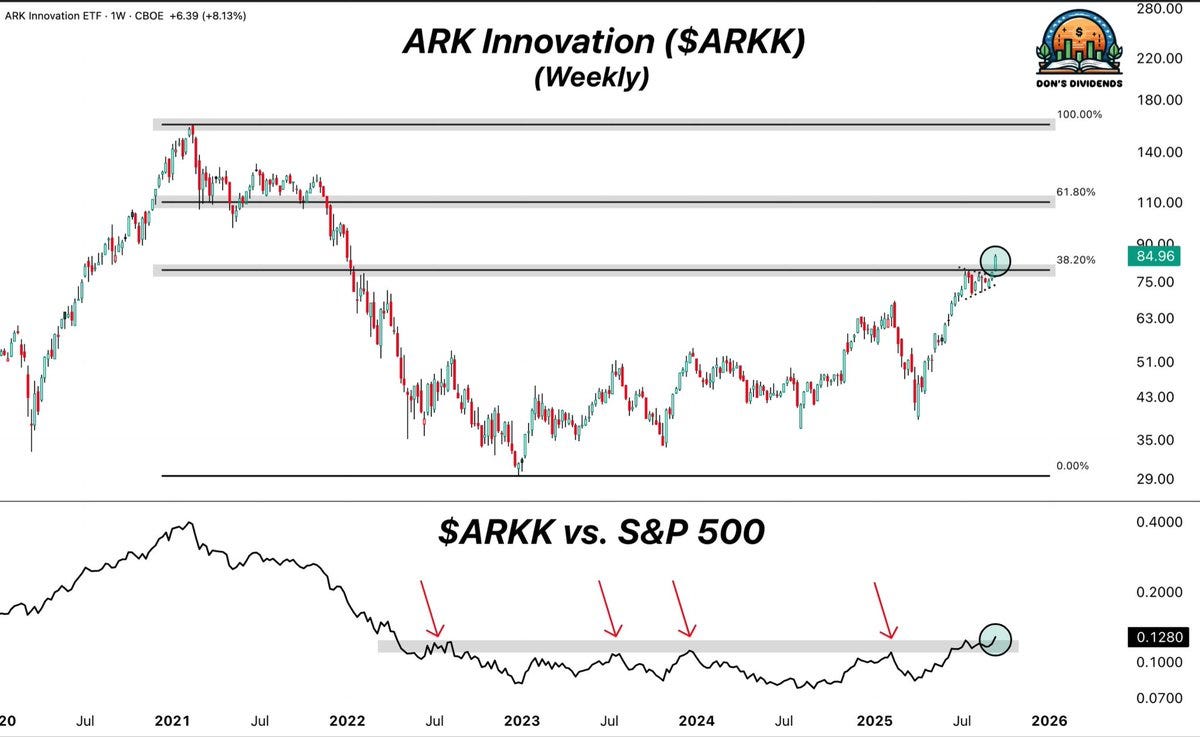

5. ARK floating higher: Another harbinger of upside and a sign of animal spirits reigniting is the breakout in ARKK in both absolute and relative terms. Seeing renewed strength in what has historically been a relatively more speculative part of the market is an interesting sign indeed.

Source: @TheDonInvesting

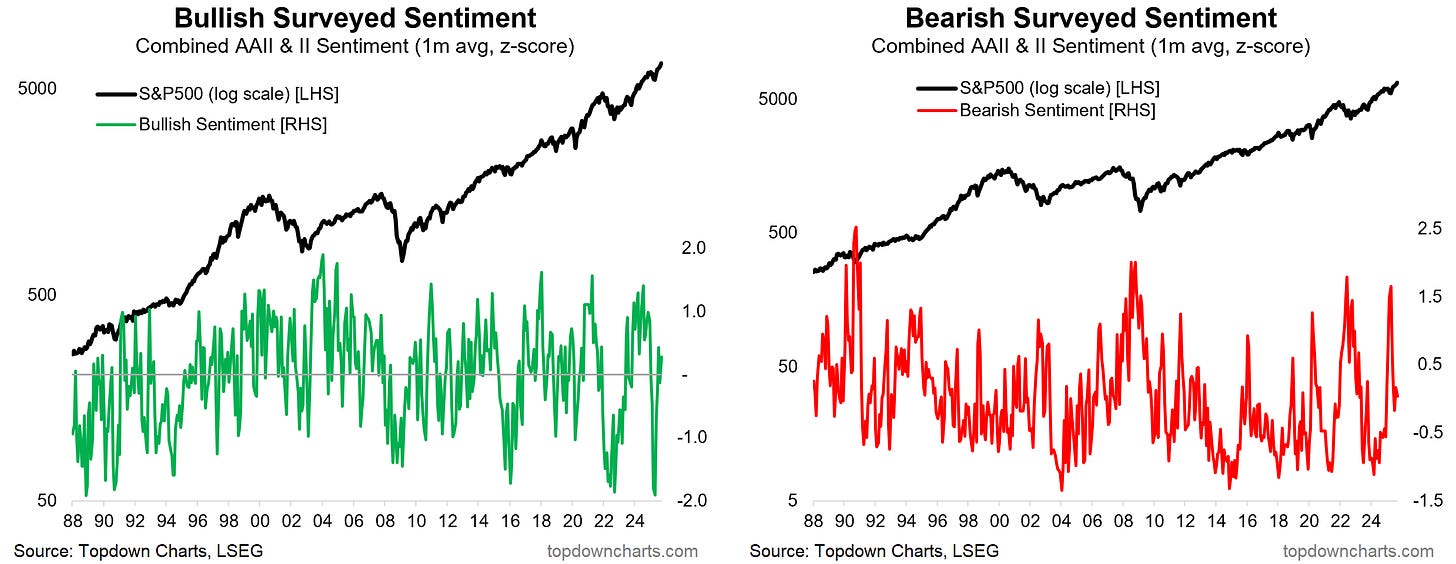

6. Simmering Sentiment: Meanwhile surveyed sentiment is still kind of indecisive — it is still mostly bullish, but we’ve yet to seen bullish readings return to the top end of the range nor bearish readings revisit the lows. This means there is room to move, but it is also symptomatic of the still murky backdrop (people are wary for a reason).

Source: Topdown Charts Research Services

7. Divergence Opening: One such example is the divergence opening up between the S&P500 and job openings. And there are signs things could be about to get worse for the yellow line (but there is some nuance and interesting issues to consider here…)