Weekly S&P500 ChartStorm - 10 July 2022

This week: technical tests, flows and positioning, bear market maps, jolting JOLTS, and market pricing of recession risk...

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

BUT FIRST: Can I ask you a favor? if you find these emails at all useful, interesting, maybe even valuable, could you please forward it on to a friend/coworker, or share the link on social media? I don’t ask for much with these because I do it out of enjoyment of the craft more than anything, but it would be much appreciated if you can help spread the word :-)

1. Technical Test: looking at nothing else but this chart, if the market can clear short-term overhead resistance (and the 50-day moving average) it probably has a decent go at putting in at least a multi-week base …and even making a move back above 4000 towards the next major line of resistance around 4200. But we are dealing with “if“ here, and I know this sounds a bit tautological (i.e. “if it goes up, it will go up”), but sometimes we need to just clarify some basic risk-levels to help frame things.

Source: @Callum_Thomas

2. The Small Things: it's the small things in life that matter, and markets are no exception -- keep an eye on Small Caps at this critical junction...

Similar to the previous chart, but zoomed out a bit more and this time the focus is on support vs resistance, ultimately it’s the old question: "spring board or diving board?

Source: @GraysonRoze

3. The arc of ARKK Continued: another technicals chart, because sometimes you just have to listen to what the market is saying...

An attempt is clearly being made here, and similar to the previous two charts the outcome will determine how things playout in H2. ARKK basically represents the new tech bubble burst, so some strength in this corner of the market would set a bullish tone.

Source: @WalterDeemer

4. Positioning: large speculators running large shorts…

(if everyone is prepared for the worst, then it doesn’t take much to surprise)

Source: @RenMacLLC

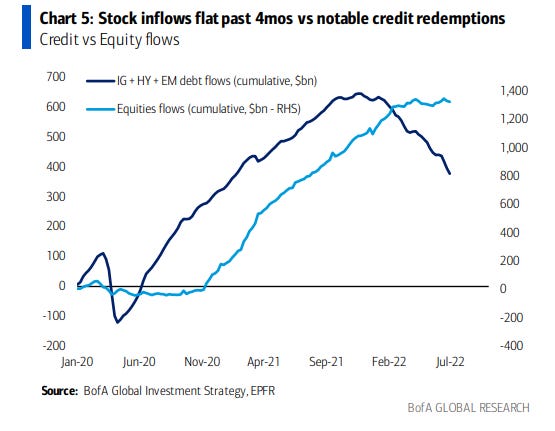

5. Fun with Flows: it looks like the stock market is a few steps behind the bond market... equity flows peaked about 6 months after bond flows did. Key implication or expectation implied is that equity flows are the next shoe to drop in this chart.

Source: @MikeZaccardi

6. The Market Cycle: it's the old textbook market cycle map in progress: first bonds peak, then stocks peak, then commodities peak... at it's simplest, price just reflects the progression of the business cycle (and inflation/monetary policy).

edit: link to “the textbook market cycle map“

Source: @granthawkridge

7. Bear Market Map: again, the market follows the business cycle, and so the playbook for markets comes down to the recession question.

But even then, by this chart -- the typical pattern seems to be that markets are basically a wash over the next few months either way.

Source: @Marlin_Capital

8. Daily Bear: similar to the previous chart, this time daily, same basic message... but a bit more finer detail of the trials and tribulations ahead (zooming out like the last chart is really helpful in setting perspective, but this chart highlights how messy it can be in the day-to-day).

Source: @MarketPictorial

9. With a Jolt: market seems to be saying JOLTS about to jolt!

Source: Boris Kovacevic

10. Energy vs Tech: these two things are not the same. But their drawdowns are!

Source: @bespokeinvest

Thanks for following, I appreciate your interest!

BONUS CHART >> got to include a goody for the goodies who subscribed.

Recession Risk Pricing: from a quick glance at the movement of the stockmarket relative to the path of the PMI, you could argue that the S&P500 is already pricing in the risk of a recession to a certain degree…

Even if we take this assessment or interpretation at face value, the picture is kind of incomplete. And even if the conclusion is true, the case for optimism may be false.

The optimistic case would be something like “good, recession is already priced in, therefore a bottom is close“ ...in other words, because the risk of a recession is already a fairly consensus idea, it is already in the price, and therefore that’s the extent of it, or put simply: sell the rumor, buy the fact.

This does leave out a bunch of other considerations like starting point valuations, and questions around how much the movement in stocks reflects the spike in bond yields, inflation surge, and geopolitical shocks, etc, vs say the likely path of earnings in a recession as such.

But the most important omission is that it does not address the magnitude or duration of recession. In other words, all we can say is that the stockmarket is behaving like the ISM is going to dip down below 50, and that’s all.

So the pessimistic/bearish take would be that the ISM is a (downwards) moving target. And the chart below is one of a few examples of leading indicators that point to a steeper drop than priced (and that still leaves the question of duration open).

All that said, it is true that when you have a situation where the market is ostensibly pricing in recession, and sentiment/positioning are significantly bearish, it doesn’t take much in the way of good news (or simply less-bad news) to trigger a potentially sharp rally.

All of which is to say, basically — big picture: risk of further downside (it’s a bear market after all), small picture: risk of upside (even the biggest baddest bear markets saw some major counter-trend rallies).

…any questions?

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

Relevant Tickers Discussed: SPY 0.00%↑ IVV 0.00%↑ VOO 0.00%↑ SPLG 0.00%↑ IWM 0.00%↑ VB 0.00%↑ ARKK 0.00%↑ AGG 0.00%↑ DBC 0.00%↑ XLE 0.00%↑ XLK 0.00%↑

Great content! As always thanks for sharing. SPY and QQQ important test at 50-day moving average happening per your first chart. Interesting to note though that both small-caps IWM and ARK Innovation ARKK holding above 50-day last week.

Looks like guilty it is...