Weekly S&P500 ChartStorm - 1 June 2025

This week: monthly data and rankings, sentiment snippets, corporate uncertainty and disruption, Japanese yields, healthcare, working vs retirement...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

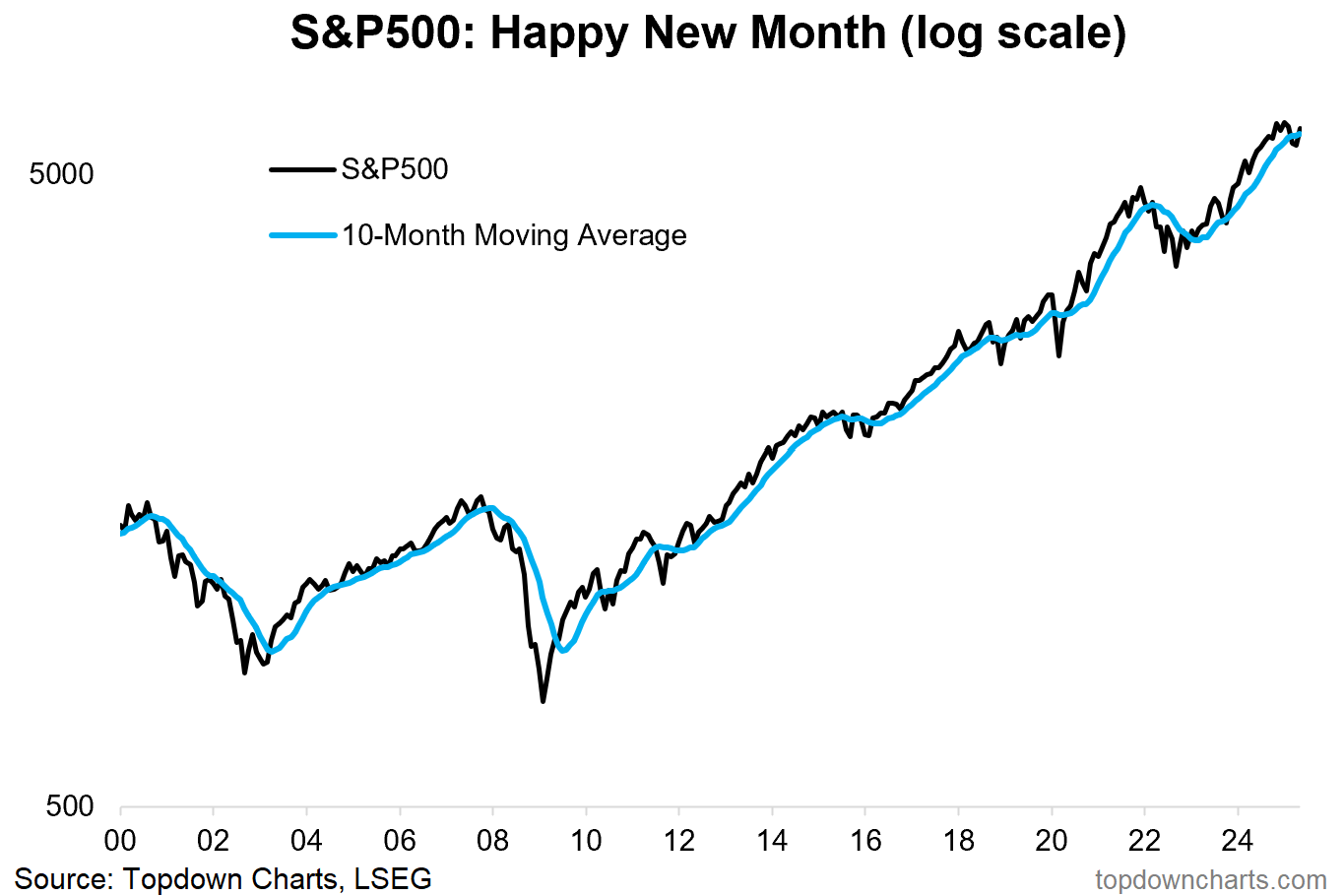

The S&P500 closed up +6.2% in May (+0.5% YTD).

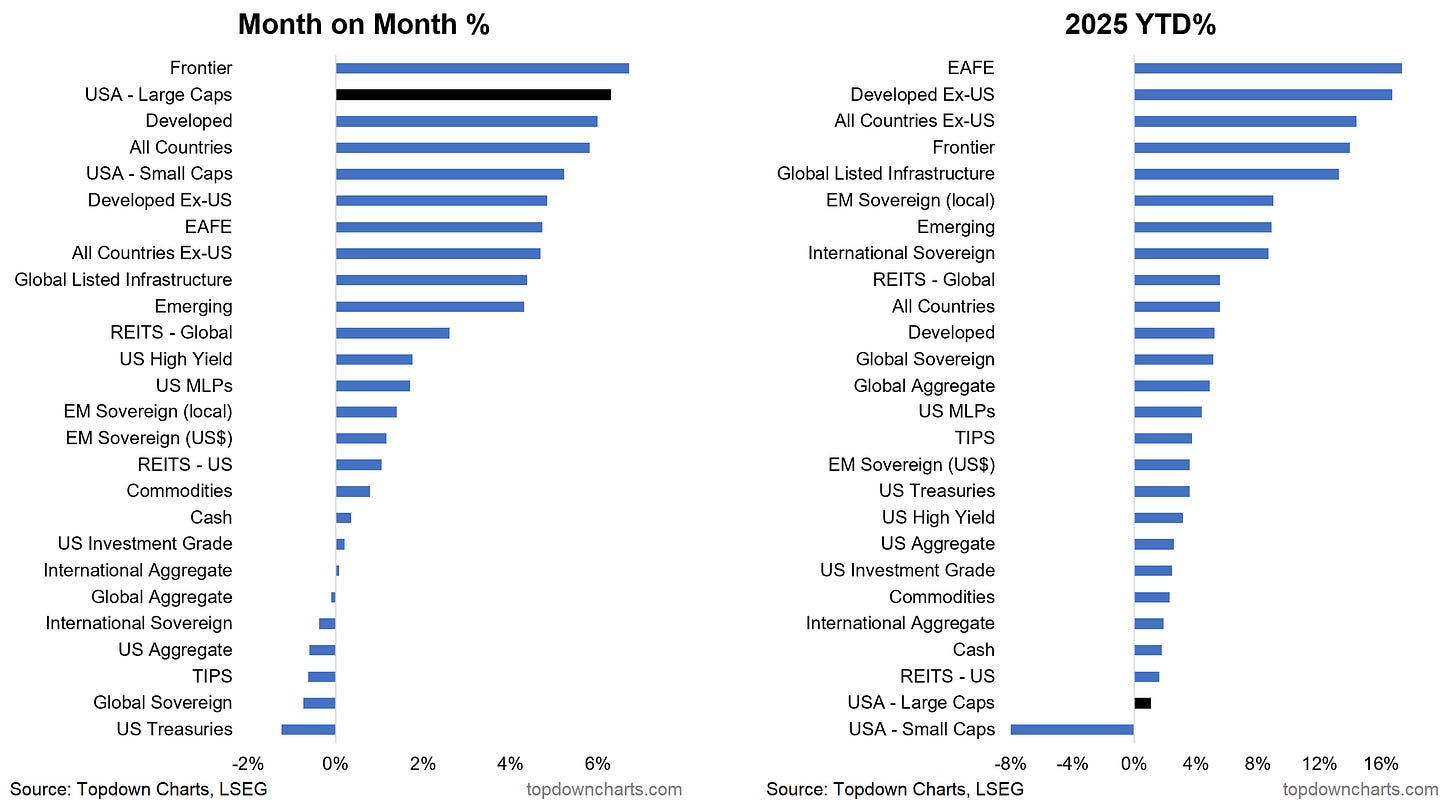

YTD, US equities rank the lowest, global ex-US the highest.

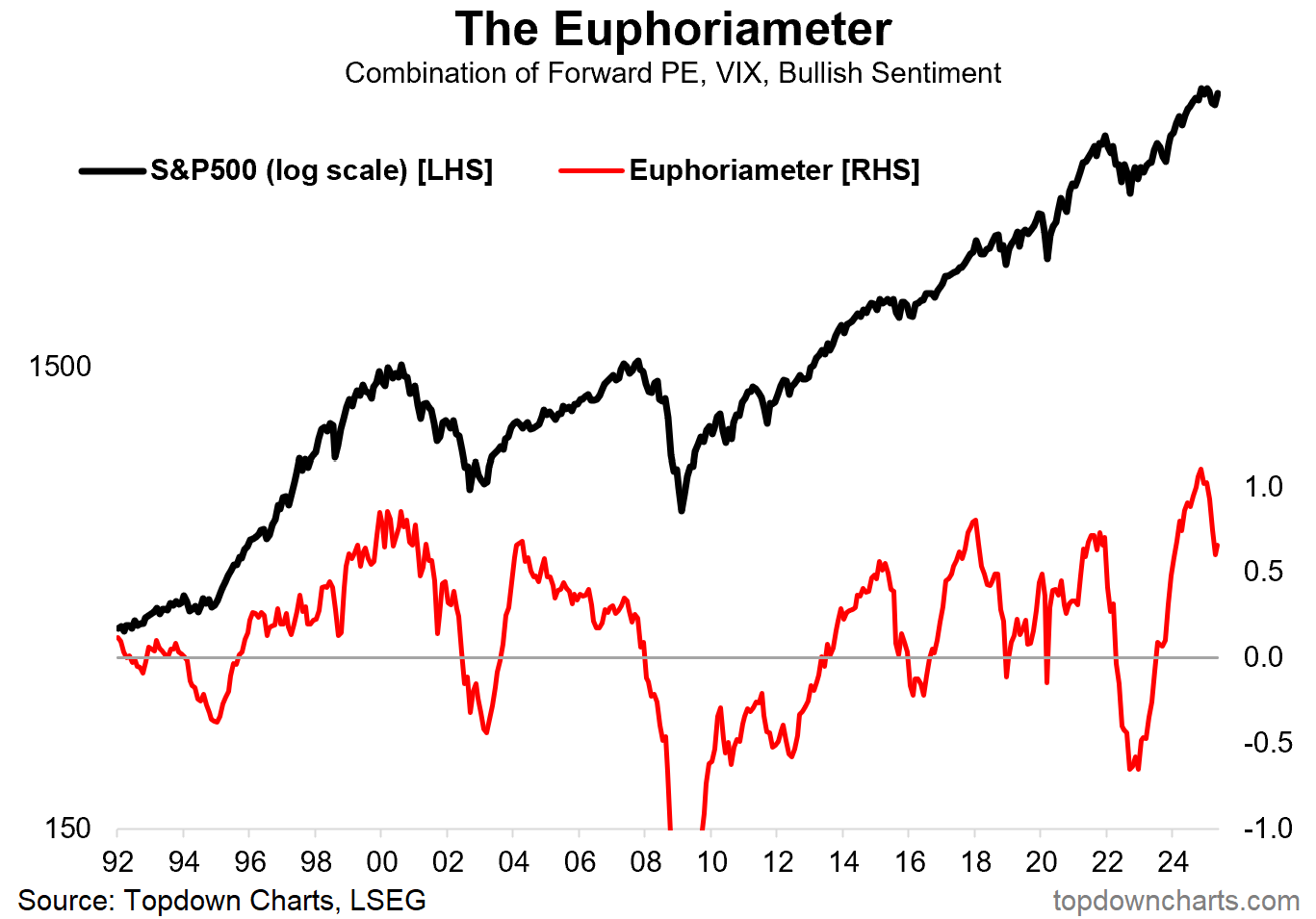

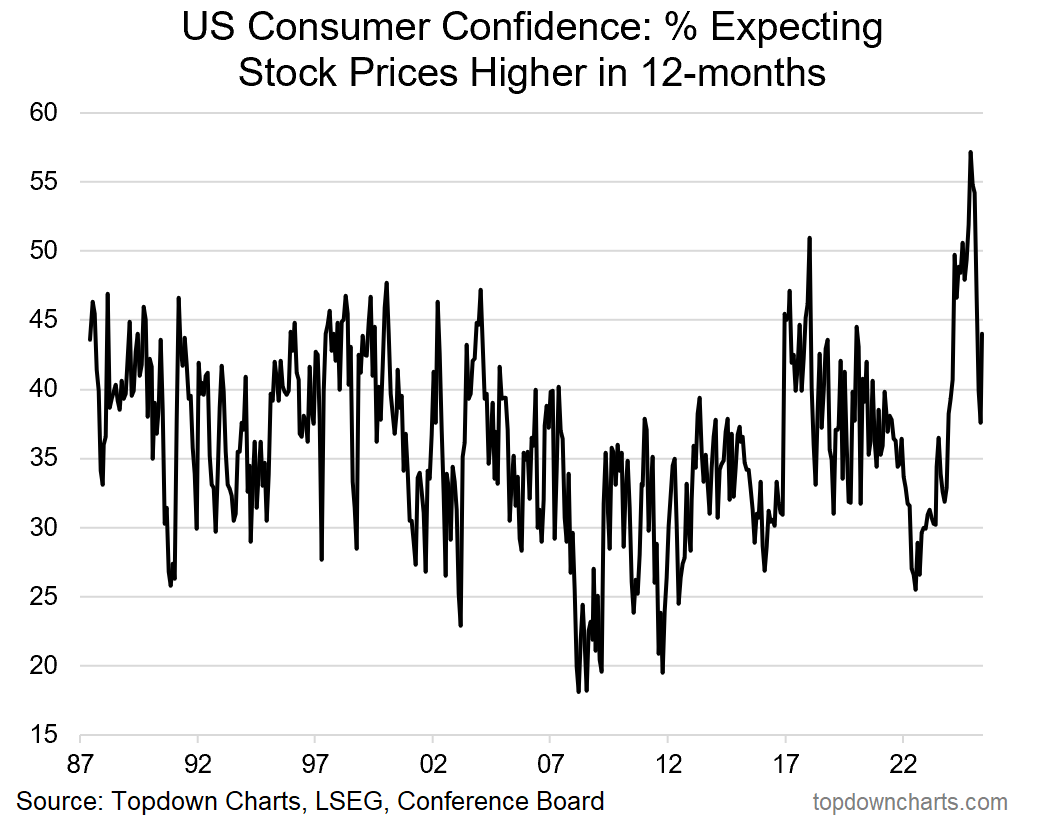

After a big reset, sentiment rebounded in May (and remains historically high).

Big Tech is seeing very Small jobs growth (+M&A activity has plunged).

As Life Expectancy rises, people are Working For Longer.

Overall, as it turned out, a big reset paved the way for a big rebound. The trouble is when looking at analogs of the past we’re presented with the bull case being a late-cycle reset (e.g. late-90’s) and the bear case being a big bad bull-trap (e.g. as happened just prior to the 08 shocker for stocks). As for which one and what to do, let’s take a look…

n.b. check out the new “Getting Started” section (how to make the most of your subscription to the Weekly ChartStorm) + Reviews & Testimonials page.

1. Happy New Month! The S&P500 closed up +6.2% on the month in May, placing the monthly close back above its 10-month moving average and bringing the YTD [Year To Date] return back into positive territory (+0.5% YTD or +1.1% including dividends).

Source: Topdown Charts

2. Asset Class Returns Leaderboard: While the YTD figure is back in the positives (albeit not so for small caps), US large cap equities are still bottom of the table so far this year; despite the strong comeback in May. Global ex-US equities (particularly developed markets) have fared the best so far, and interestingly Frontier Market equities have also had a very strong showing (and just after the only Frontier equities ETF in the US was closed and liquidated back in Jan… funny how the timing of those things works!).

Source: Asset Class Returns — May 2025

3. Euphoria Revival: Everyone’s favorite “Euphoriameter” ticked back up slightly in May following a significant reset over the previous months… that said, it’s still at the upper end of the historical range — the overarching mood is still bullish, the cycle stage is still late (but maybe the cycle gets extended from this late-cycle reset?).

Source: Euphoriameter

4. Consumer Stockmarket Expectations: On a similar note, consumer surveyed expectations about stockmarket returns likewise saw a major reset from previous record highs, and likewise bounced back in May to find its place still around the upper end of the historical range. The open question is whether these bounces in sentiment are sustainable bounces in a renewed cyclical bull, or just a dead-cat bounce on the path over the hill.

Source: Topdown Charts Professional

5. Bit Sentiment: I found this one very interesting — I often talk of Bitcoin/crypto as a gauge of risk appetite and liquidity conditions, so if this really turns out to be a false breakout and an unsustainable rebound for Bitcoin, then that’s likely to mean bearish implication for other risk assets like stocks. Keep an eye on this one!

Keep reading with a 7-day free trial

Subscribe to The Weekly ChartStorm to keep reading this post and get 7 days of free access to the full post archives.