Subscriber Reviews

If you’re new here (or are considering upgrading to a paid subscription), you might benefit from hearing what subscribers think of the Weekly ChartStorm.

After just over a decade of Weekly ChartStorms (started in 2015), I can share a growing trove of subscriber feedback with you.

This page provides an insight into:

How subscribers rate the service

What they like most about it

Why they signed up

Who typically subscribes

(and reasons people unsubscribe)

This should help you assess if the Weekly ChartStorm is right for you —but also give an insight into how specifically it can be helpful.

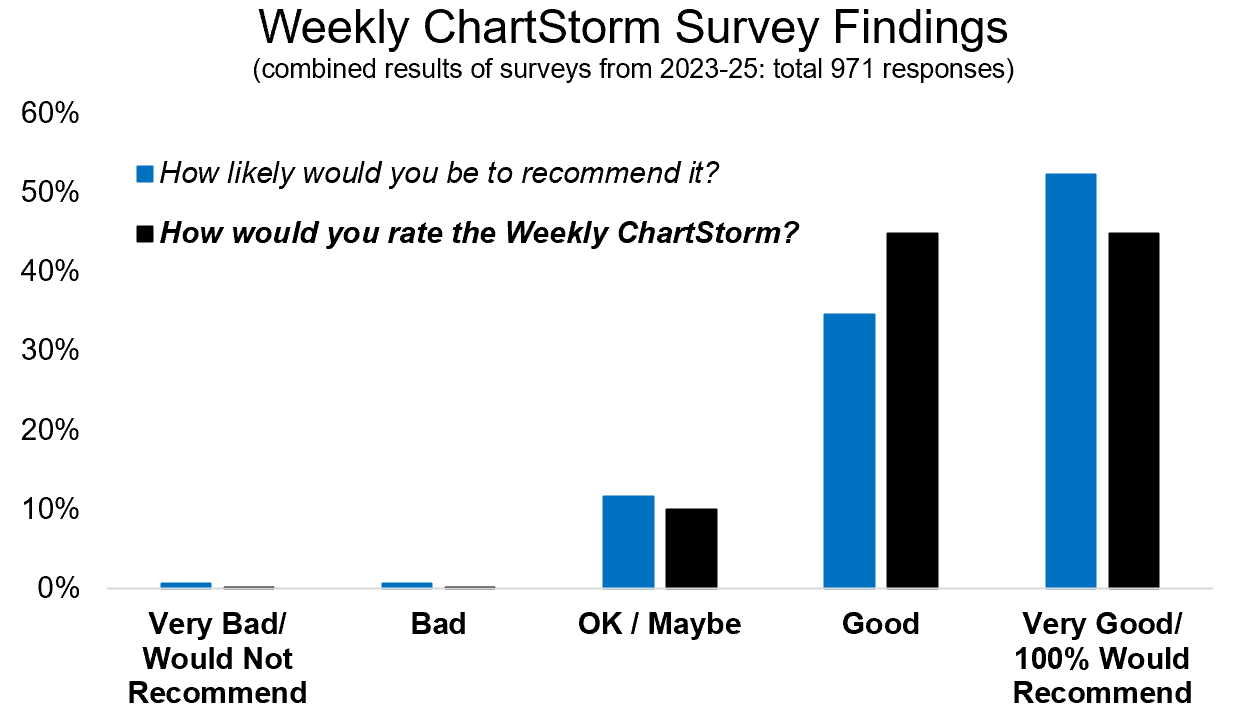

Subscriber Ratings

Based on surveys of readers, 90% of people think it’s Good/Very Good, and would happily recommend it to friends or colleagues (the data includes 971 responses in total across paid subscribers, free subscribers, and those who have unsubscribed).

The weighted average is equivalent to a 4.34 Star Rating (971 reviews) ⭐⭐⭐⭐

What Subscribers like about it

The below table summarizes the key aspects of the service that paid subscribers say they appreciate (this is based on surveyed + unsolicited feedback and is exclusively the opinions of paid subscribers).

The other thing I’d highlight is how many people also mention the personal impact it has had — i.e. how it has become a key part of their weekly routine and genuinely helped them get ahead.

n.b. The above is a summary — please see down the end below for a complete listing of feedback and testimonials (last section).

Why did people subscribe?

I surveyed paid subscribers on this very question and it’s probably mostly what you would expect (+ from my point of view, basically an endorsement of what I aim to achieve with the service).

Most people said they subscribed for the charts, naturally, but subscribers also appreciate the commentary around the charts, and how it helps make them think, identify ideas, and expand their knowledge base. Which I’d say is probably important for all of us, and quite valuable.

But really it’s about: efficiently getting effective information, to help level-up your thinking/understanding + market-situational awareness — so you can become a better investor and achieve your goals.

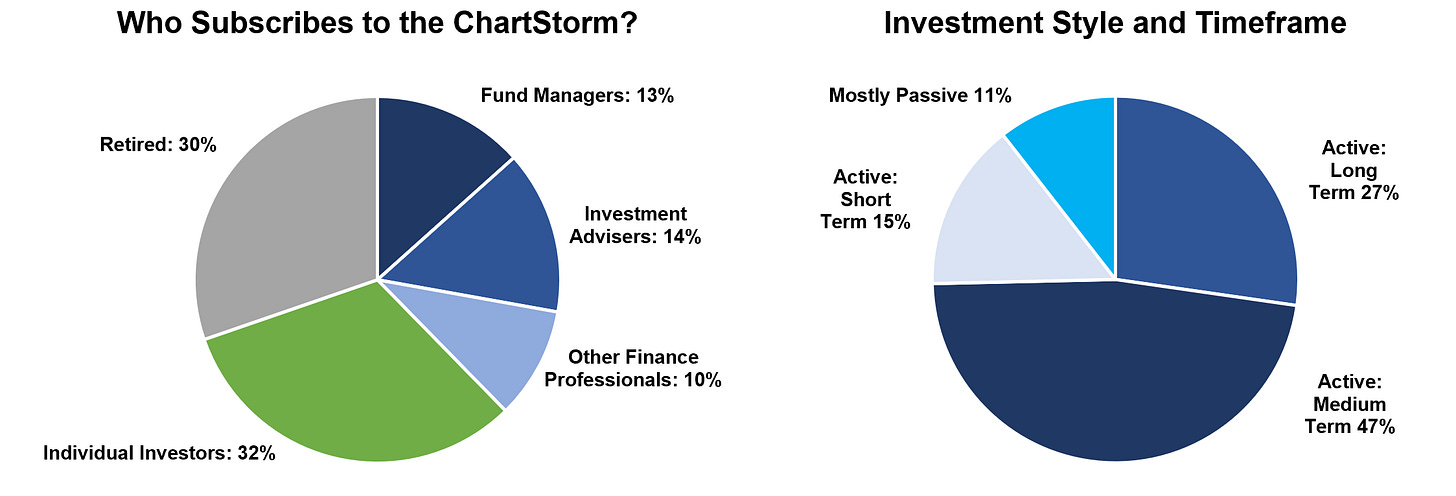

Who subscribes?

The Split across subscriber type is basically 40% finance professionals (e.g. fund managers, analysts, investment officers, financial advisors), 30% retirees, and 30% individual investors. About 90% of subscribers are active investors, and the majority have more of a medium-to-longer term focus in their investments.

I would say this is consistent with the type and level of material I cover (big picture overview, highlighting key trends, emerging risks/opportunities, insights on sectors and regions). It’s not daily trading advice, but at times it does feature very actionable tactical insights (depending on what stage we’re at in the cycle and what’s going on in the world). And while it’s not aimed at beginners, it is also a great resource for building your knowledge base.

So basically it’s a mix of:

Finance Professionals looking to outperform peers, grow in their careers, and most importantly —help their own clients;

Retirees looking to protect and grow their nest egg; and

Individual Investors seeking to build wealth and achieve financial freedom.

Again, I would say this service will be less useful for those who are just focused on nitty-gritty bottom-up stock-picking, or those who are hyperactive day-traders, or those who just set-and-forget. Yet there are probably still going to be occasional snippets that will also be of interest and value to those cohorts — as a top-down complement and perspective-builder.

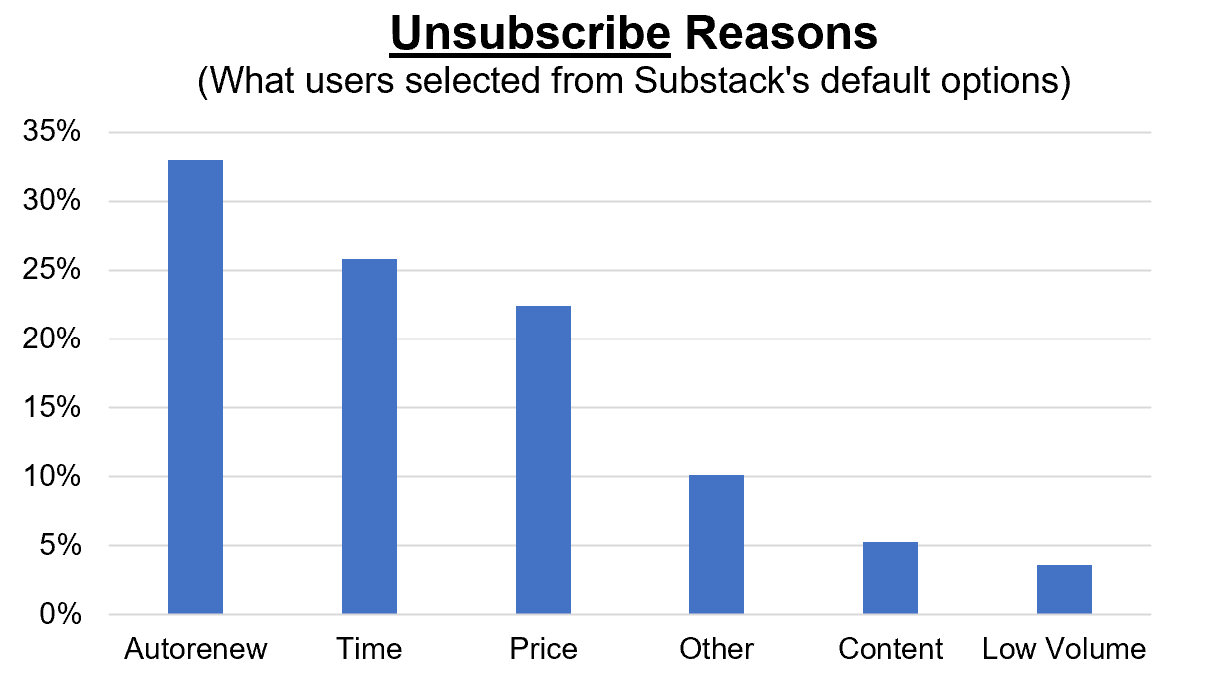

Why People Unsubscribe

It would be incomplete without looking at what paid subscribers said on their way out the door — I think this is helpful to make sure that you’re not going to sign up for something that’s going to miss the mark for your situation and what you’re trying to do… but also as another angle on what it is and who it’s for vs what it’s not (because you can’t try to be all things for all people).

The chart below shows what people selected as the reason for unsubscribing. Note, this is from Substack’s default/generic set of options — so some of it is a bit cryptic and I will add some interpretation along with context from comments left by those who have unsubscribed.

Here’s some context, explanation + perspective on these reasons:

Auto-renew: this is by far the biggest reason, I find there are many people who simply do not like autorenewals in general (often due to bad experience with bad operators, or lack of notice and flexibility, or just desire for more control).

Personally I have mixed feelings on this; subscription revenue is my main source of income, and I am trying to build a business so I rely on people renewing their subscriptions (and most people value not having to worry about making payments manually each year). But equally, I get it — and I try to make sure people have plenty of notice and I would never want to force someone to stick around if they no longer want the service or have experienced a change in circumstances.

Time: this one anecdotally involves 3 different aspects; changes in circumstance that mean they no longer have time to enjoy the content, information overload as they deal with competing sources of content, or finding they are just too busy in general to engage with the content.

I deeply understand the time constraints aspect, and I am constantly looking at how to make the reports easier and more efficient to read, while also making sure not to lose any depth or quality of insight. But in the end, you do have to make the investment of time to read it and apply it.

Price: this one involves a few factors e.g. change in circumstances that means budget constraints and cost cutting, but also trade-offs around e.g. just doing the work yourself and using free sources (a key benefit of the ChartStorm is I do the work for you), and probably some aspect of mis-match e.g. a short-term day trader will not get short-term trade ideas from this service so the price will be too high for them but may be very attractive for someone where the service hits the mark (such as a busy longer-term focused investor who wants occasional actionable ideas, and big picture perspectives + efficient updates on the market).

In the end, you get what you pay for, and I want to also note that I am 100% happy with having the ChartStorm as a paid service rather than being monetized with ads — because it provides the best alignment. If you make money from ads, the subscriber is the product and the advertiser is the customer… but if you make money with subscriptions your output has to be valuable and useful for your paying subscribers (so there’s much closer alignment of interest and proper incentives).

“Other” — while a small portion, a lot of the comments on this one highlighted changes in circumstance (e.g. retiring from the industry, or a change in focus in their investments, or financial changes making for a more constrained budget), but folk also mentioned information overload from competing sources (e.g. having too many subscriptions and just blanket canceling everything), or a mismatch with their goals and objectives or style/approach.

So there’s an element of natural attrition here (eventually you will lose subscribers just to the sands of time as people move on in their lives), but also the time and fitness for purpose aspect comes up (the service is best for active medium-longer term investors, who value having an expert opinion and having someone else do the heavy lifting for them to help save time on research).

Content: there’s a small featuring of people wanting broader coverage of other asset classes and markets (and I do this selectively in the Off-Topic ChartStorms section + feature global/international content from time-to-time in the regular weekend updates), but there’s also people in this category where it simply wasn’t a fit with them in the first place.

As far as I can tell there are no quality issues with the content, but at the same time I am 100% committed to constant and never ending improvement, so I will always be aiming to maintain very high standards and raise quality over time.

Volume: again I would say this is more of the short-term crew, but I’d also say that low volume is actually a strength of this service — I am acutely aware that whenever I send a report out, I am creating work for my subscribers… so it better damn-well be worth it for them! :-)

Indeed, a lot of feedback highlights how one of the key benefits of the service is it means they can get all they need to know in one weekly download vs watching every tick or listening to all the talking heads.

Topdown Charts: I also see a number of unsubscribes with the comments noting they are graduating or upgrading to the Topdown Charts service instead (my main business, which is focused on global macro and multi-asset research).

So from my point of view I wouldn’t say there are any particular red flags or big issues that I need to work on here, but as noted I am always looking at how to improve the service + onboarding and communications to help provide the best experience for paid subscribers. I’d also take the opportunity to highlight that I am happy to hear from subscribers so if you ever experience any issues or have any concerns just reply to any mails from me or get in touch via the website.

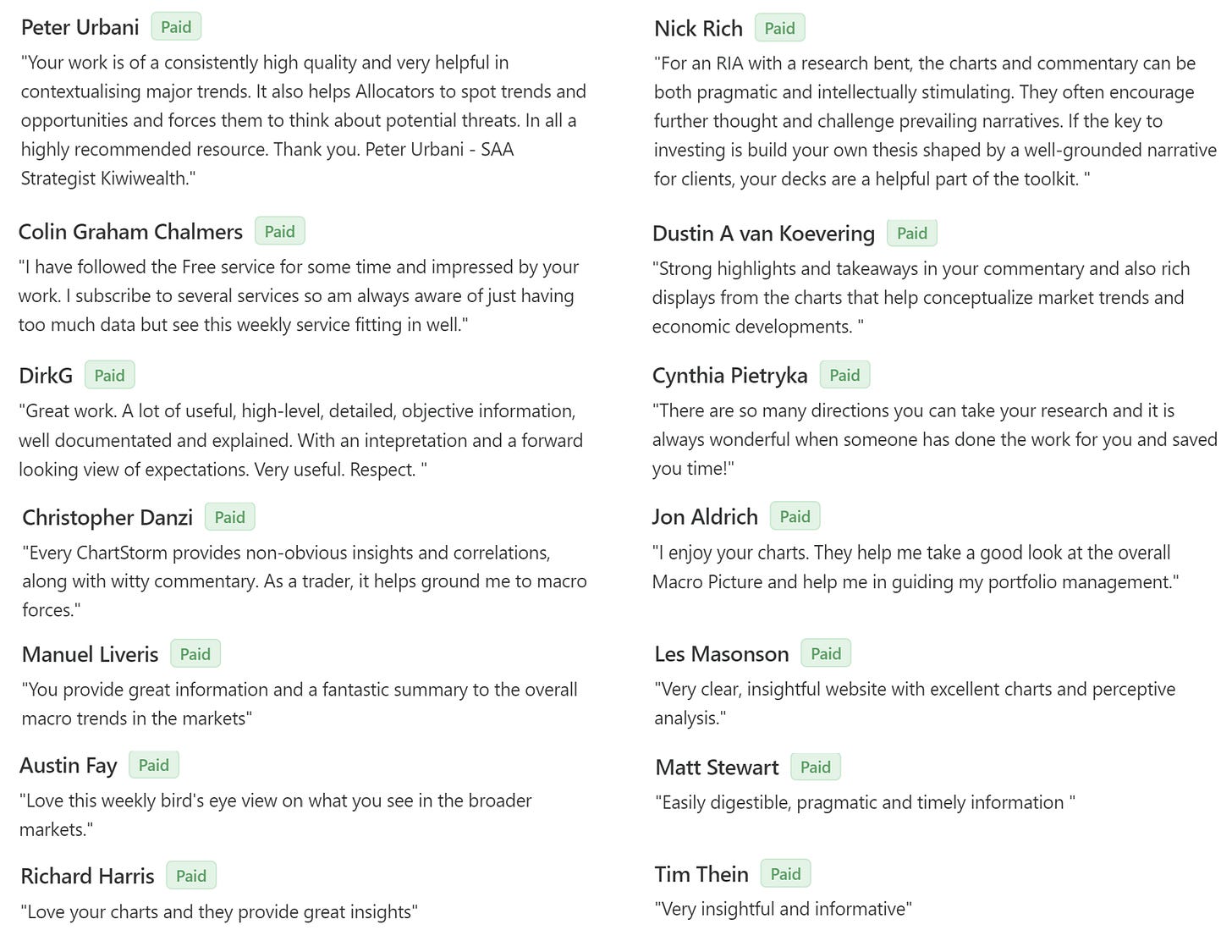

Testimonials & Survey Feedback

Here’s a full listing of feedback from surveys and paid subscriber notes. And p.s. please let me know if you yourself have any feedback (good or bad) as I am always keen to hear from subscribers. In addition, I strongly welcome questions and thoughts by email or in the comments section.

Paid Subscriber notes

The below feedback comes from comments people have made as they upgraded (or renewed) to a paid subscription to The Weekly ChartStorm.

2025 Surveys of Paid Subscribers

The below comes from a series of reader-surveys I conducted in 2025 (as part of semi-regular efforts to look for opportunities to improve the service).

“Good overview of markets, delivers some data and analysis I don’t get elsewhere. Balanced perspective. Good combination of technical, fundamental, and money flow and sentiment assessment. With succinctness.”

“I’m a charts kinda guy, and the weekly ChartStorm not only shows me things that I would never think of, but even if I did, I can use my time doing other things!!”

“It’s a quick efficient way to get the zoomed out view of the market to inform positioning from a source which is less likely to be biased. Someone else does the work to help me know what are some important things I should be paying attention to.”

“It is a wonderful tool to get a read on the market. I recently have returned to work and have not been as active and your service allows me to quickly assess the market which is critical for making my now weekly decisions.”

“I love how clear and straightforward the language is.”

“I look forward to receiving your ChartStorm every weekend. It helps me keep my perspective on the markets.”

“I really appreciate your chart-driven approach to macro analysis. Your charts present market patterns and structures with concise, illuminating clarity. I’ve learned so much from your work.”

“Your mix of technical and fundamental analysis beats any reports I have seen, all in an easily digestible form that comes at a comfortable cadence.”

“I like your practical common sense in application”

“I think that this is a very relevant, timely and most importantly money making product, Thank you”

“Your analysis helps me understand where we are in the market cycle, while highlighting the risks and opportunities. I rely on your newsletter for anticipating peaks and troughs in the market.”

“It is great value for money and generally the right pitch of charts to navigate risk management.”

“Appreciate the variety and historical perspective you provide. It has helped shape my thinking and understanding.”

“I almost always get a fresh view of something that was not on my radar. Appreciate the bear/bull indicators and historical valuation measures.”

“I read a number of sources but you might be the most important one. Definitely a key source. I regularly act on what you’ve said about commodities, emerging markets, smallcaps, now Japan, etc.”

“Thanks for the charts and your comments and views on the charts. You do give both views at times that I do appreciate.”

“There is a lot of noise in market commentary. I find your style helps cut through that noise.”

“Enjoy the charts, commentary as it provides an interesting take on the markets and a reminder of where we might be in the cycle”

“It really helps me in my investment decision making process and I appreciate that.”

“I think you do a phenomenal job!”

2023 Surveys of Paid Subscribers

The below points of feedback come from a similar series of reader-surveys I conducted back in 2023. The reasons are largely the same but I think the 2025 feedback reflects improved value and impact, while also continuing many of the good points below.

“The most important reason I subscribe is that you are a great filter. There are so many charts and comments out there and I don’t have enough time to read them all. You are a great filter, filtering out the noisy ones and providing the good ones for us.”

“I feel like your product is in a sweet spot of price and impact, particularly for those of us with an eye towards longer term investing and who want to understand the market better.”

“I think this is a very useful snapshot especially, because I do not follow markets tick for tick, but just trying to concentrate on the big picture. For that purpose a weekly ChartStorm is very useful and the chosen charts are very often spot on in concentrating on the most important topics in the market.”

“Great resource & I can tell it is the product of much thought and experience. Thank you for the terrific newsletter!”

“What I like is that you post charts that are relevant, but with a different angle than most other content. Gives me ideas for new things to consider or look into further.”

“As I said previously; I always look forward to the weekly ChartStorm. For me it’s not just the charts, it’s a thinking piece that helps generate ideas.”

“It’s not just charts, it’s the charts that are selected and the reasons they are selected that brings additional value to this service”

“I like the thought that was put into selecting the charts. It’s concise.”

“I really like the unbiased look at the markets across 10 charts.”

“Keep up the good work, it has been very helpful and useful to my investing strategy development!”

“Saves time, and it provides valuable insight.”

“Love the humor when you use it. Like your tone generally. Like the relative brevity. I don’t have the time or patience to watch endless talking heads videos”

“I value a quick summary showing relevant themes. Saves hours of reading.”

“Good concise market data, whether it be macro or events of the day is hard to find. Your pack does a great job in summarising this and capturing the mood of the market at the time.”

“I love your charts! They are concise and packed with information! Thank you for your work!”

“Really enjoy your work! There are always at least 7 or 8 (relevant to me) thought provoking charts in your weekly round-up.”

“Love your work. I learn a lot and you provide great perspective.”

“Love the charts. I look forward to them every Sunday. Engrained in my routine.”

…who is this again?

Lastly, I realize I have said “I/me/my” a lot on this page — if you want to learn more about who’s behind the Weekly ChartStorm, please see below.

Callum Thomas (Founder and Editor of The Weekly ChartStorm + Head of Research and Founder of Topdown Charts)

Callum has a background on the buyside in global investment strategy, economics, and asset allocation. He now runs an independent research firm which serves fund managers, pension companies, hedge funds, and other institutional investors. As such he brings a well-informed perspective with his weekly selection of charts and commentary — often drawing upon his own extensive and ever-growing library of charts and indicators.

Callum started his weekend habit of Weekly S&P500 “chart-tweet-storms” in 2015, and to date has not missed a single week (even while on holiday!). And as a result has attracted a keen following and reputation as an astute observer with integrity and insight — not willing to trade sensibility for profitability; eschewing sensationalism and fear-mongering, and instead sticking to charts, data, and down-to-earth balanced views and coverage. He believes in keeping an even keel and maintaining a long-term perspective. The Newsletter version of The Weekly ChartStorm was launched in early 2021, and went paid in 2023.

Connect with Callum on social media:

Twitter/X: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

And then of course, finally, if you’d like to join the many happy subscribers to the Weekly ChartStorm please go ahead and sign up!