Off-Topic ChartStorm: Emerging Markets

This edition looks at: EM equity technicals, strong dollar, EMFX flags, EM bond spreads, fund flows, stress indicators, EM equity valuations, and macro regimes...

Welcome to another edition the “Off-Topic ChartStorm“.

Unlike the usual weekly ChartStorm (which focuses on the S&P500 and related issues), the Off-Topic ChartStorm is basically a semi-regular special focus piece with topics spanning macro, markets, stocks, commodities, regions, and research notes.

This first edition is a good example of the kind of things I’ll be covering in this section. You should expect to see a mix of the timely and front-of-mind issues, as well as some more non-obvious areas under the radar. Should be good.

Hope you enjoy!

NEW: Sign up to the (free) Chart Of The Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you one of the most interesting charts on our radar, along with commentary/context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! > > > Subscribe Now

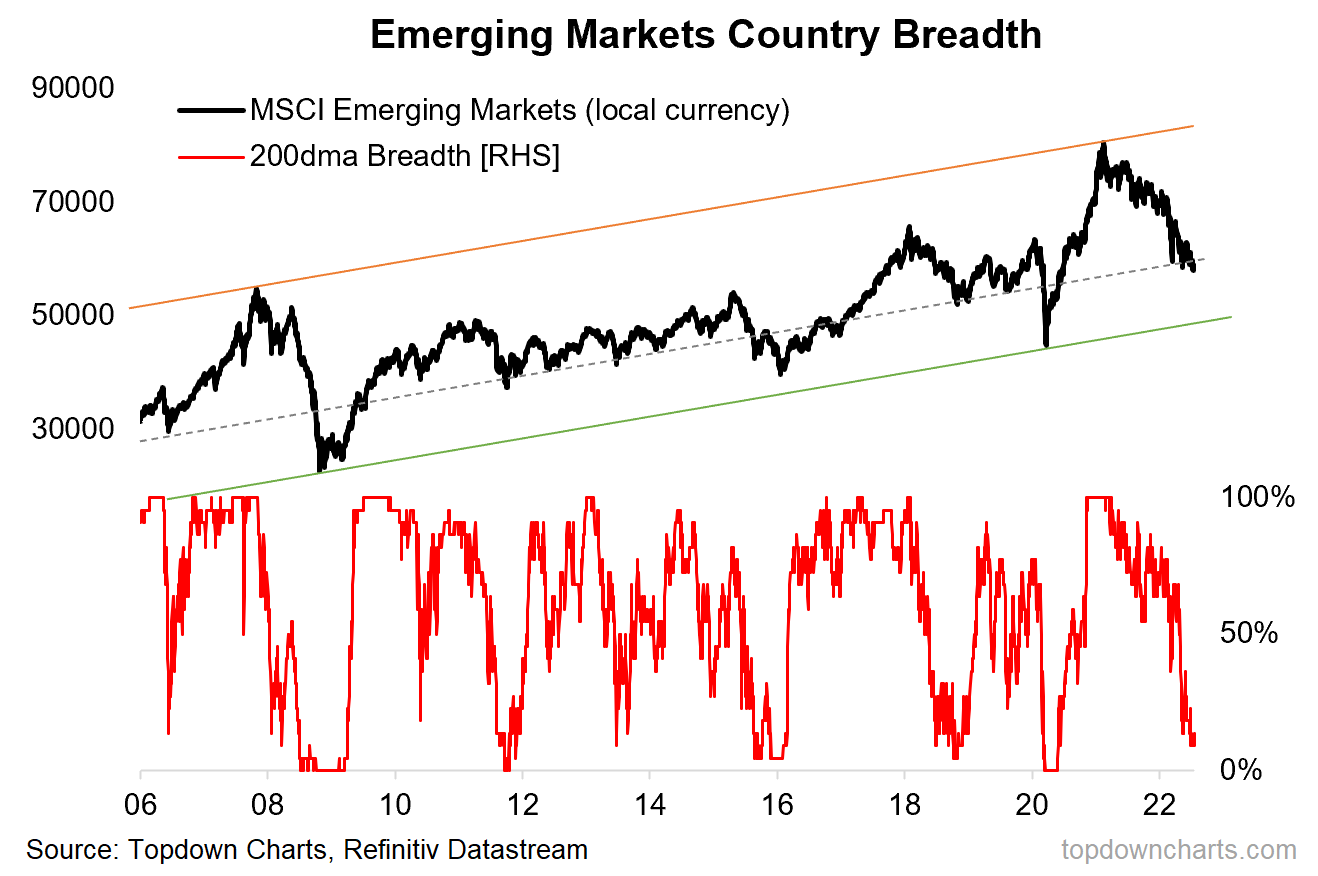

1. EM Equity Technicals: This is a key juncture for Emerging Market Equities — the index is toying with a breakdown of that dotted lower uptrend line, and breadth remains a picture of severe weakness... On first glance the path of least resistance looks to be lower. No need to be a hero and try catch the bottom when things look like this, just be patient and wait for the right signals.

Source: Chart of the Week - Technical Patience in EM Equities

2. EM vs DM Relative Performance in Perspective: Looks like this one wants to go all the way back to the all-time lows/lower support levels! EM had initially (pre-pandemic) looked like it was on a path to shake off it’s long-term relative bear market, but post-pandemic has returned to path… as a wild guess, it may well need a last cathartic push to the lows before it can sustainably turn the corner.

Source: @topdowncharts

3. EM Nemesis = Strong Dollar: A big driver of EM vs DM relative performance (and overall conditions for EM in general) is the US dollar...

Basically Strong Dollar ~= Weak Emerging Markets

(a few reasons for this: firstly just the translation effects, i.e. the below chart is using US$ denominated indexes, so all else equal a big move in the US dollar will be reflected in this chart just by virtue of math. Also though, flowing on from that, investors chase/flee performance — strong dollar means lower returns for a USD denominated investor in EM equities, and hence it triggers outflows from EM - which can be self-reinforcing. Also, strong dollar can effect funding conditions for EM, and have a general tightening effect on EM financial conditions… and then ultimately if you get stress in EM then it triggers safe-haven demand for USD {feedback loop})

Source: @beursanalist

4. EM Currencies: Speaking of currencies, EM Commodity Currencies look like they know something treasuries don't know...

(and p.s. if you look at the broader picture for EMFX it even looks much worse than that, especially some of the smaller countries)

Source: @IanCulley

5. EM Bond Market: EM Sovereign spreads are trending wider as a bunch of smaller EM/Frontier countries get squeezed by the commodity shock + USD surge + rising yields + economic headwinds.

There will be defaults (at least on the fringes).

Source: @Schuldensuehner

6. EM Sovereign Stress: Stressful times for EM sovereign borrowers.

(n.b. some of the move in this chart is simply due to the surge in inflation and aggressive central bank response by EM/Developing countries, where rates have been hiked an average ~400bps — and a lot more at the tail of the distribution!)

Source: @MichaelAArouet

7. Gone With the Flows: As such, investors have been abandoning EM bonds at a record pace this year.

(contrarian bullish signal?)

Source: @C_Barraud

8. EM Bond Technicals: Extreme downside volatility in EM Debt ...can they find support soon? (or another wave down before all is said and done?)

Source: @exposurerisk @exporiskprivate

9. "It's In The Price" Emerging Market equity valuations are close to 2009 lows looking at things on a price to book ratio & CAPE (cyclically adjusted PE ratio — i.e. price vs trailing 10-year average earnings) basis. Meanwhile USA remains expensive vs history and others, and interestingly: Germany is now cheaper than EM...

Source: @NorbertKeimling

10. "High and Falling Inflation" regimes: Based on historical patterns (and remember the usual disclaimer that past results =/= guarantee of future results!) perhaps the best way to play a possible peak in inflation and Fed pivot is actually EM equities... (whereas I think consensus would probably say US tech)

Source: @MikeZaccardi

Thanks for following, I appreciate your interest!

Summary and Closing Thoughts

To sum up, it’s basically a picture of clear weakness across EM equities, EM currencies, and EM sovereign bonds. Technical weakness is/has been reinforced by clear and considerable macro headwinds. The risk of further stress across EM assets is not small, and as we saw in a few of these charts, there are a couple of make-or-break setups in the charts — where if the market can’t stabilize or bounce, a breakdown is the logical alternative.

That said, there are some very interesting features if we look close enough e.g. in terms of valuations (chart 9) [and fwiw, my own EMFX and EM debt valuation indicators also look pretty good — will cover those in my next weekly insto report]. Also, if and when we do get a shift in the macro regime (e.g. peak inflation and Fed pivot), it could disproportionately benefit EM. Also, the breadth indicator in the first chart is arguably looking somewhat oversold. So we may well be in the old “darkest before dawn“ phase.

But again, it’s not plain sailing yet — we could still be a few steps and breakdowns away from “dawn”. So I would remain cautious/patient on EM equities for now — at least in the short-run.

Appreciate your ongoing support and interest.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from our institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

Relevant Tickers Discussed: EEM 0.00%↑ VWO 0.00%↑ IEMG 0.00%↑ CEW 0.00%↑ EMB 0.00%↑ EMLC 0.00%↑ TLT 0.00%↑ IEF 0.00%↑ PCY 0.00%↑ EBND 0.00%↑ VWOB 0.00%↑ SCHE 0.00%↑

I couldn't agree with you more on this. One potential positive is if you look at the relative Chinese M2 vs US M2, growth of money and credit in each. This gives some potential reason for optimism. There is a lot of wood to chop though

This bit of FUD, https://www.bloomberg.com/news/articles/2022-07-21/warnings-of-sovereign-defaults-in-asia-frontier-markets-flare-up , had me rechecking VWOB/EMB portfolio assets. VWOB seems pretty conservative about allocating to the "frontier" nation states. Have been dipping in small increments on the hopes the capital-gain returns will be worth waiting for if the price(s) paid must be revisited from below. Using various search strings on Bloomberg for the multitude of Chinese bond and property crises and FUDding results are enough to disturb my sense of calm.

Do like the "relevant tickers discussed" feature. Helpful it is. I couldn't find anything yet that neatly packaged up your "ex-Asia" into a single ticker. Fidelity lets customers create "baskets" ...

China is truly unique. As a Westerner in a nation state that seemed hellbent on becoming a Banana Republic, but, now seems to have changed course yet again and settled on being just a Republic gone Bananas, I can hardly wrap my mind around stories like this by Adam Minter, https://www.bloomberg.com/opinion/articles/2022-07-17/china-is-falling-out-of-love-with-skyscrapers

Implementing even the tiniest fraction of the proposals (or is it really part of the next topdown ;) Government "plan"?) the article reveals would take a CENTURY, at best, to transpire in the US.

So it seems all those commodities wound up creating unlivable concrete-canyon hellscapes no one can really afford the maintenance on as they age (i.e., dissolve in the air pollution ). Well doh! Chinese are human, and humans love their suburbs!