10 Charts to Watch in 2023 [Q3 Update]

The key macro/market charts for navigating risk vs opportunity this year...

Here’s an update to my 10 Charts to Watch in 2023 article as we head into the final quarter of the year — an opportune time to reflect on the year so far and ruminate on the next steps.

In my original post I shared what I thought would be the 10 most important charts to watch for global multi-asset investors in the year ahead (and beyond). In this article I have updated those 10 charts, and provided some updated comments on the outlook as I see it + reflections on what has/not worked so far this year.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I'm thinking now vs what I said back then!]

1. Global Recession 2023: This one’s interesting — at the start of the year basically every leading indicator was pointing to recession. But it seems a variety of confounding factors ultimately canceled out those signals e.g. drop in commodity prices (cost pressures alleviated), surge in factory building/capex, consumer cash coffers, fixed rates offering insulation from rate hikes, and perhaps some relief effects on economic confidence following post-pandemic normalization and the passing of the shock-effect of the multiple crises of 2022.

So… all-clear then? Well, since the start of the year a few leading indicators have gotten better/less-worse (namely cost-related and short-term demand related), but anything monetary related has gotten much, much worse.

Maybe the whole notion of a recession has been deleted — maybe it is different this time, or maybe the “monetary wall” has been kicked down the road into 2024.

“One of the most interesting pieces of work I undertook in 2022 was to perform a sort of meta-analysis on all the leading indicators I’ve developed over the years. The key takeaway from that is whether you group leading indicators by type/factor, geography, or forecast window — they are all unanimous in pointing to a sharp downturn heading into early-2023. In many ways it’s a coming full circle of the massive stimulus that was unleashed in 2020. Or as I call it: “a strange but familiar cycle”.”

2. Double Trouble: A key reason to push back on the no-landing/soft-landing case would be the double-trouble from surging rates and tightening credit conditions. But again, you might argue that all this does is shift up the hurdle rate for new investment — which may not be an issue in a world of high nominal growth and tight capacity, and may simply not even effect those who already locked-in low rates and shored-up their cash/funding position during the monetary excesses of the 2020/21 period.

Or maybe just the long and variable lags of monetary tightening. Recession 2024?

“I include this one because it goes to show how financing conditions have tightened — banks are becoming more stringent and stingy in their lending decisions, and the interest rate on those loans is now a lot higher. So it's a situation of even if you can get a loan, you might not be able to afford it! If we do get a recession this year it could be the last straw for some of the more unsustainable business models that arose in the world of zero interest rates, and credit stress could become a key issue.”

3. Property At Risk: Even housing has managed to whistle past the graveyard of doomsday calls despite higher cash rates brushing up against record high valuations.

To reflect, maybe it’s a higher incidence of fixed rates (but even in countries with shorter fixed rate periods and more floaters, the initial shock appears to have been absorbed and put behind us). Maybe it’s just that in a world where labor markets are still tight (for now) the high nominal wage growth effect makes people feel ok.

In my mind to really wreck a housing market you need a shock in borrowing costs, a shock to servicing ability (unemployment), or some combination thereof. The fact that rates did at least have an initial peak, and the rise in rates happened over a long enough period to reduce or fade out the shock effect… along with ample availability of jobs and wage hikes, means this one remains a risk rather than a reality for now. But I will say this, if rates really do go higher for longer, those valuations will need to adjust either by rents/incomes surging or price plunging.

“Housing market valuations reached a record high across developed markets last year. That’s going to be a problem if rates stay high or head higher (and if real incomes continue to squeeze). Key risk to monitor.”

4. Unflation: Commodities did most of the heavy lifting on disinflation to date (and that story is now changing — I see a new cyclical bull emerging there), meanwhile on the demand side there was an element of demand dampening, but in lieu of recession — there has been no real large scale demand destruction yet. And hence, capacity utilization (this chart shows the combined view of industrial and labor market capacity) remains fairly tight.

And this is where we get to the tricky bit for no-landers: “congratulations — you avoided recession! Your prize is… more inflation.”

Until the black line in that chart drops, and especially with the resurgence in commodities, inflation is going to be an issue. Hence, again, watch out for the monetary wall — it’s still there, and will get worse if/when inflation resurges. In other words, you can win for a while, but if you win too much, you lose.

“The downward drift in commodity prices is already going to dampen headline inflation, but a recession will seal the deal (the fastest way to free up tight capacity is demand destruction: central banks understand this).”

5. Bond Yield Go Down: Well, no — at least not yet. Higher for longer appears to be in play, and will be the reality if inflation resurgence risk rings true.

That said, I would note that while I have some models pointing to higher yields (e.g. cash rates, inflation), others are pointing to (significant) downside for yields (PMIs, growth risks). I think that will be resolved in a matter of timing.

“Weaker growth, credit stress, housing market issues, lower inflation… it’s all a recipe for lower bond yields. If we take my macro models literally then US 10-year bond yields could head back below 2.0% (even as low as 1%?!) by the middle of this year. Sure, there’s a lot of if’s and but’s around that, but an interesting forecast being suggested by the data, and it fits with the macro (and valuations).”

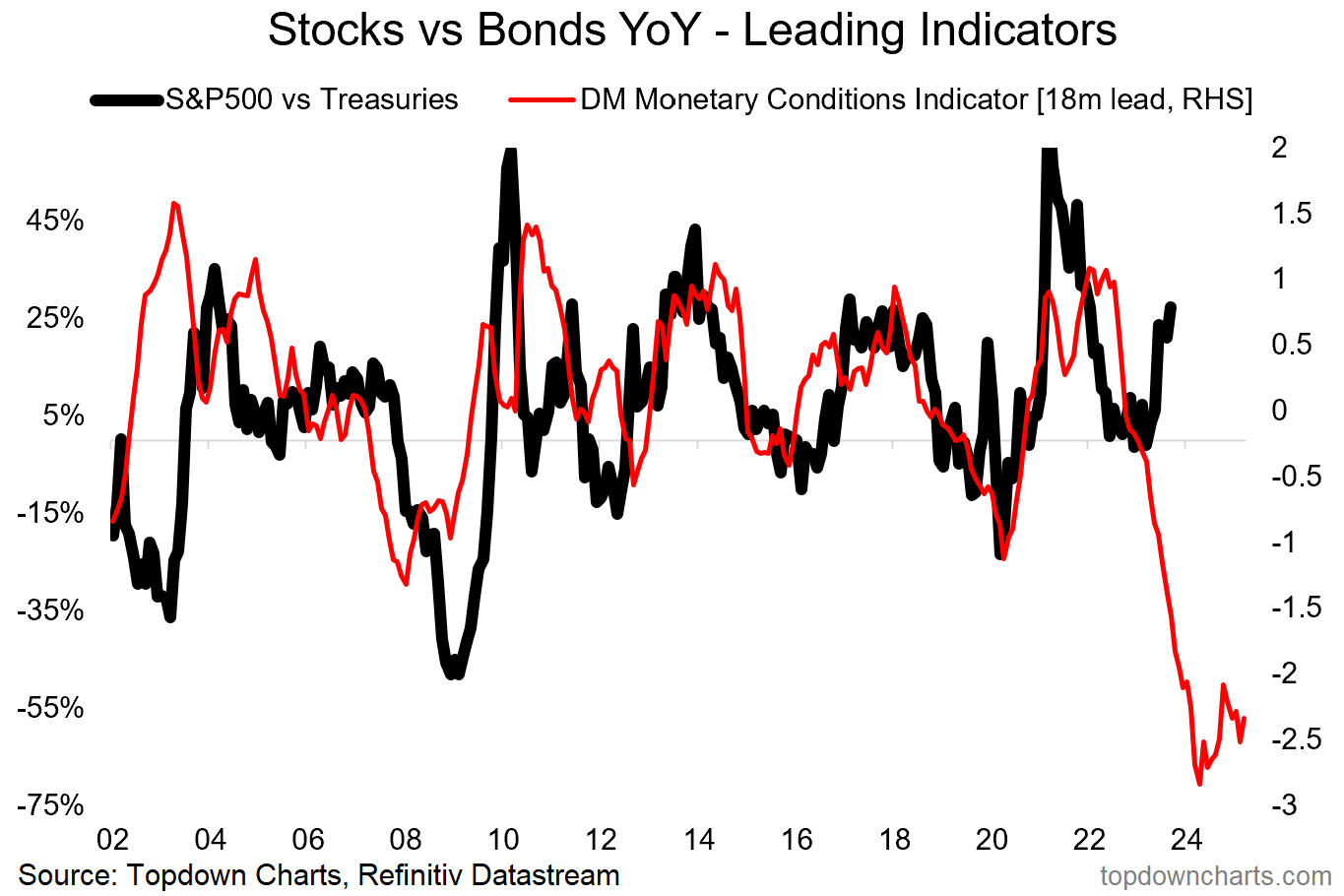

6. Bonds Beat Stocks: Lower inflation, recession avoided, AI dreams, FOMO, goldilocks and the crowded bears — all helped stocks power ahead this year and leave bonds behind. But in terms of the outlook from here, this is probably the best illustration of the so-called “monetary wall” I keep going on about.

And at this point it’s time for an inspirational quote: "Just because something hasn't happened yet, doesn't mean it won't"

As things stand now, bonds are cheap, stocks are expensive, relative value is very stretched for stocks vs bonds. Sentiment and positioning are overcooked on stocks, undercooked on bonds. Macro remains a mystery for now, but the leading indicators are still sounding the alarm. Evidence based investment thinkers will recognize the risks vs opportunities here…

“On valuations, treasuries are cheap, and stocks are not. By itself that means bonds have the advantage, but bonds also disproportionately benefit in the event that global recession does indeed set in. The leading indicator affirms this notion in the chart below.”

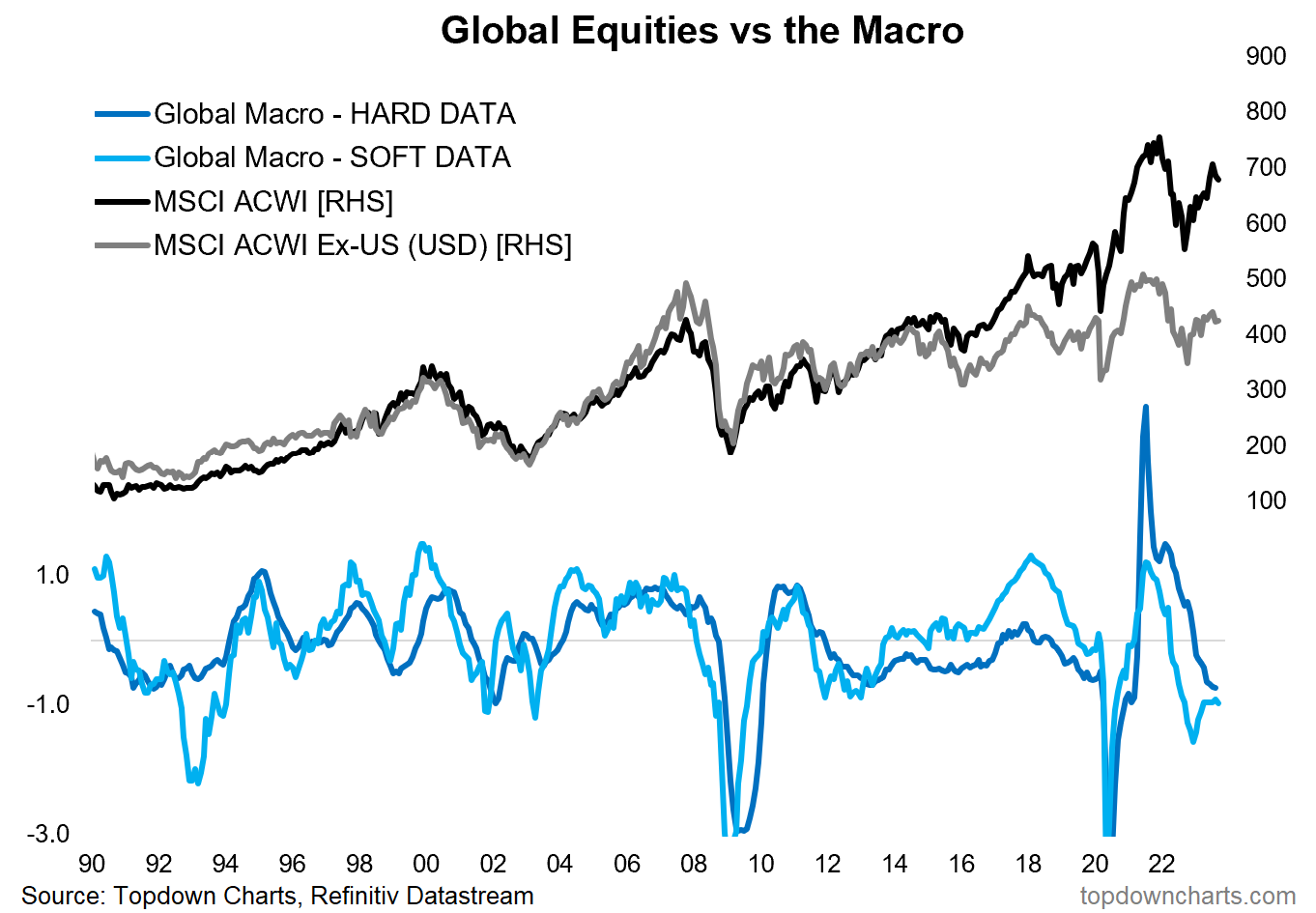

7. Monetary Risk to Macro Risk: So about that recession-avoided thing… the soft data globally remains weak (PMIs, business confidence, consumer confidence), and hard data growth rates continue to lose momentum (retail sales, exports, industrial production, jobs growth). If I didn’t know any better I would have looked at this chart and told you a global recession was on the cards.

My baseline mental model on this is that for the stock market, recessionary conditions don’t matter if valuations get cheap, sentiment gets washed out, the data gets so bad its good, and monetary policy turns to stimulus… the issue we face is stocks are not cheap, sentiment is back to bull, macro data is mixed, and central bankers are still aggressively tightening. Maybe YTD 2023 was all just one big bull relief rally before the next phase.

“Arguably much of the pain in equities last year was down to the rates/inflation/monetary shock. Recession risk means slowing growth is set to become the bigger concern this year.”

8. Tech Unwind: So we have definitely seen a reset here. But I will note on the valuation side of things, the unwinding has been fully unwound, and tech stocks are now back to expensive again (extreme expensive — vs history, vs the rest of the market, vs global tech stocks, and vs bonds). A mix of recession-avoided and AI hype along with the relentless flows from passive and global investors has helped big tech reclaim the highs and end the bear market. Not dot com. Something else…

“Definitely different from the dot com bubble, but definitely also some excesses that needed to be unwound. My sense is we are still just over midway through this process, and ultimately: growth stocks can’t outgrow the macro.”

9. EM Stocks & Bonds: Remain cheap. The puzzle pieces seem to be falling into place here... EM central banks were first to pivot to tightening, and as a group are now pivoting to easing, that’s going to help things along for EM stocks — and especially EM bonds. There are still some risks e.g. if US dollar and/or treasury yields push materially higher. But one other aspect to this space is that sentiment has flipped quite materially… bullish EM was very consensus at the start of the year, and now few if any are bullish, and indeed most have gone full-doom on China.

“When it comes to emerging markets, the equities are looking somewhat cheap, but what’s really interesting is where the bonds got to. There is what appears to be a major once-in-a-decade value setup for emerging market sovereign bonds (I am talking at the asset class level, equal-weighted). I think this could be one of those moments in time for asset allocation, but a few things do need to go right for this one to work.”

10. China Policy Map: Key to EM, and well — just about all of global macro/markets, is China.. and specifically China stimulus (or lack thereof). To take stock on China macro: the covid reopening bounce has been and *gone*, the property market remains mired in a deep downturn, inflation has turned to deflation, and add on a troubled labor market and recessionary conditions in global trade… basically you get the classic case for monetary easing and any other central bank around the world would be slashing rates.

Needless to say: it’s complicated. The desire to avoid the perceived mistakes of the past excess stimulus programs, to restructure the economy, to avoid various other aspects like FX weakness, and really who knows what else they are thinking… all raise the odds that what could be a key bullish catalyst (stimulus) becomes a major policy mistake and downside risk (not enough stimulus, and/or too little too late). Add on the murky geopolitical ructions, and China presents 2-sided tail risk to the overall global-macro-market calculus.

Maybe they’re waiting on the Fed to finish hiking, maybe a global downturn will be the trigger to easing. The chart says expect rate cuts, and so I would still say odds are on for more stimulus. Let’s see.

“With China transitioning away from zero covid to zero cares about covid, the door is opening wider and wider for more forceful stimulus. The property market downturn, global growth risks, and clear disinflation trend makes for a classic and compelling case for monetary easing. Amid an otherwise gloomy outlook for 2023, this could be a key bright spot for macro and markets if they do step up stimulus. So keep an eye on China macro.”

Summary and Key Takeaways:

-Despite the twists and turns, so far no recession in 2023 (but still many warning signs)

-The “Monetary Wall” has grown larger and more imposing

-Credit tightening and housing market risks continue to lurk in the background

-Recession 2024? (leading indicators say yes…)

-Inflation has cooled off, but the lack of recession means resurgence risk is real

-Bond yields defied the macro models, but followed the inflation models

-Inflation resurgence risk means higher for longer for bond yields is on the table

-Stocks enjoyed a multi-pronged relief rally

-Yet stocks remain expensive vs bonds cheap, and overcooked on sentiment

-Bonds better placed vs stocks, especially if/when recession eventually comes

-Emerging market stocks and bonds are cheap, set to benefit from EM pivot

-China mystifies against a clear and compelling case for larger stimulus

-Add on geopolitics; China remains an important source of 2-way tail risks

Overall: I would repeat my quip of this being a “strange but familiar cycle”, but perhaps more emphasis on the strange aspect as confounding factors abound. A lot of the usual macro/asset allocation sign posts that we usually follow continue to work (albeit with some nuance, and more variable leads/lags) and are still pointing the way in terms of next steps. From an asset allocation standpoint the evidence tells me to be overweight defense (cash and government bonds… and commodities*) vs underweight growth assets (equities, real estate, credit). After nailing nearly all my calls in 2022 and 2021, so far 2023 has been relatively more humbling, and a prompt to refine and reflect ahead of what may be a very interesting 2024.

—

Thanks for reading! Thoughts & Questions welcome in the comment section ↓

n.b. these charts were first featured in my 2022 End of Year Special Report — click through for the full report (free download)

Best regards,

Callum Thomas

Head of Research and Founder of Topdown Charts

Great charts. From my experience, we need to consider the actual benefit COVID did for the US Economy after COVID. My view is that 90% of economist failed to realize that COVID provided the cleansing of excessive inventory build and expansion as most firms remained cautious. As a result, the benefit COVID gave is that most companies were inadvertently prepared for the Fed tightening except banks and the housing sector. Most banks bought the story from Wall Street economists that it would take 5 years (KKR’s forecast at a conference in 2020) before yields had any material risk to the upside. As a result of this consensus view, most banks extend the durations of their investment portfolios, and at least FRC made many long term fixed rate loans to increase interest margins during ZIRP. This aggressive move has caused FRC and SVB to fail and to cause depositors to move out of many banks to reduce the risk of having an uninsured deposit at a non SIFI bank. The housing sector should be in a typical housing recession but instead it is being propped up artificially by the lack of sellers due to the fact that the ones who don’t want to sell have 3% mortgages that they don’t want to give up. This has had the perverse benefit of propping up housing prices, which has mitigated the normal paper loss of wealth that homeowners are faced with like in 2008 from declining home prices. If you take all of this into account then it explains why we are not in the predicted recession and why we are nit likely to experience one if the Fed only raises one or two more times. This cycle is markedly different from all others that we have been looking at for hints at what is to come.

I have own homes since 1973 and have seen it all.