Weekly S&P500 ChartStorm - 4 January 2026

This week: state of the markets -- an update on where things sit closing-out 2025 and heading into 2026...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

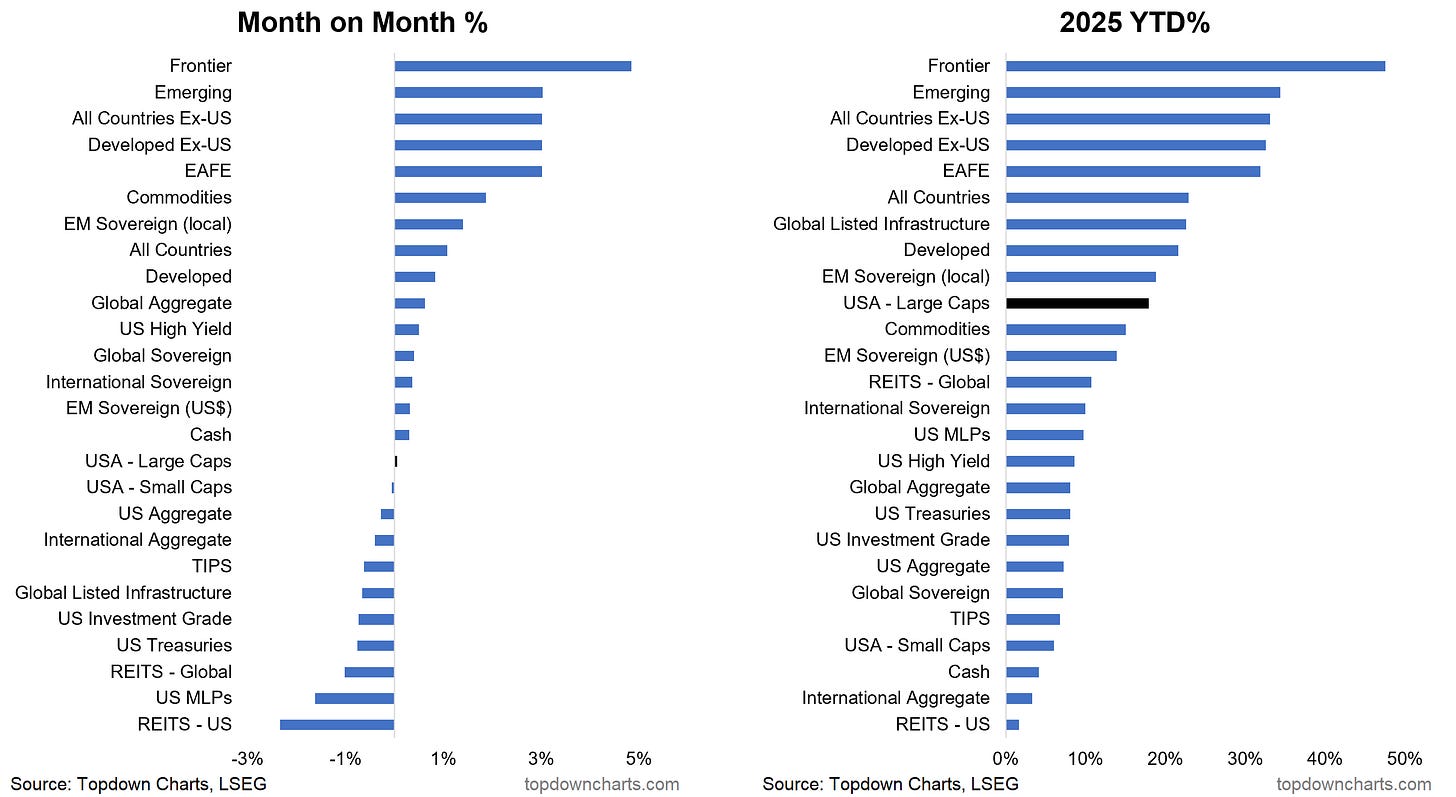

The S&P500 gained +16.4% in 2025 (+17.9% including dividends).

(yet it lagged behind global stocks, which saw 30%+ returns).

Investor sentiment is booming (yet economic confidence is glooming).

Tech sector earnings are going vertical, non-tech is going sideways.

Tech/mega cap valuations extreme expensive, non-tech/SMID cap cheap.

Overall, it turned out to be a good year for US stocks and a great year for global stocks. As such, sentiment is riding high as most everyone is patting themselves on the back following the gains of 2025. Keeping and building on those gains in 2026 is going to take a balance of optimism and trend following, as well as realism around some of the risks building up as the Stockmarket cycle progresses…

ICYMI: Weekly S&P500 ChartStorm - Best-of 2025 Special Edition

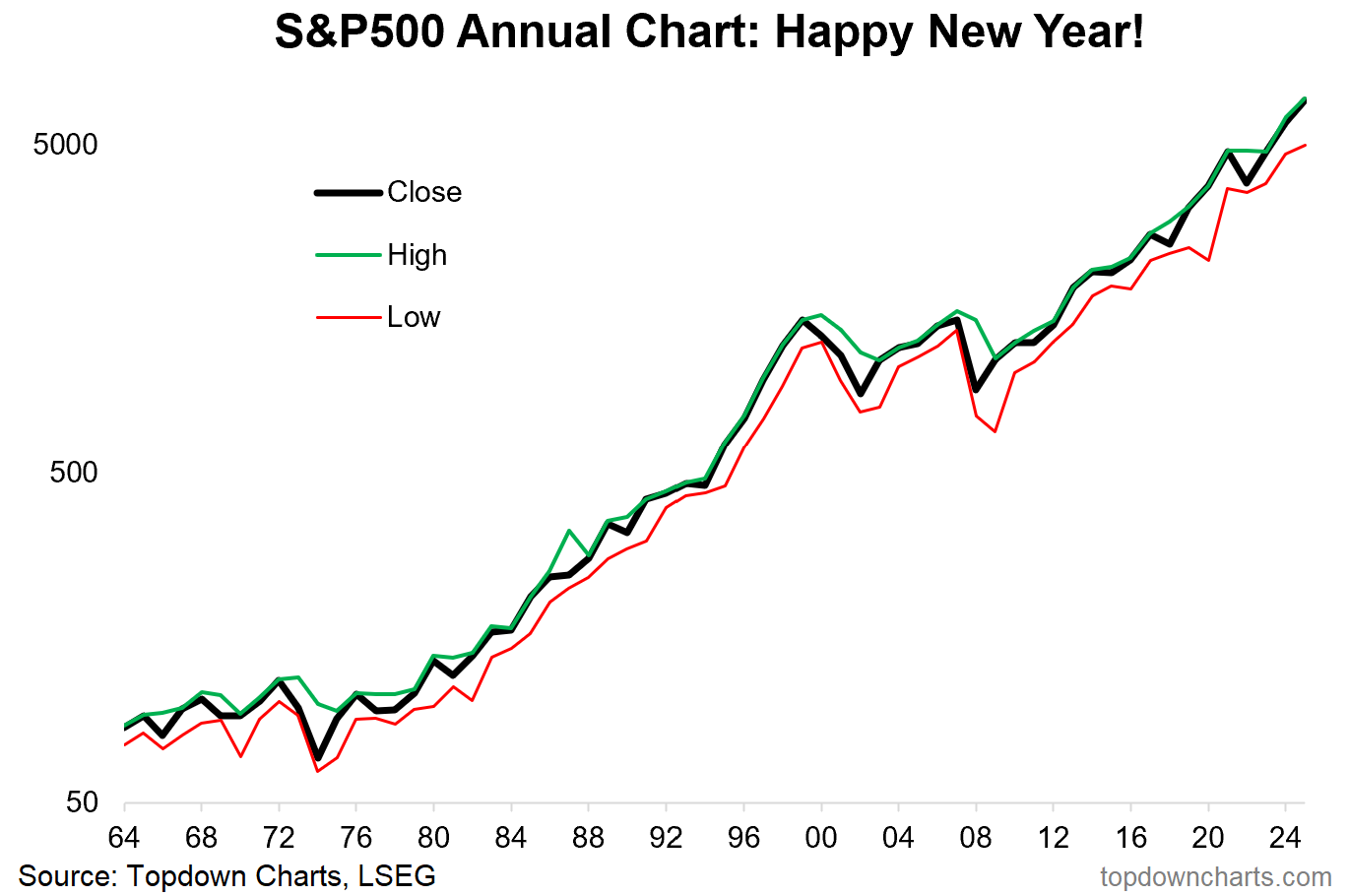

1. Annual Charts — The Trend is Your Friend: The S&P 500 closed 2025 up a respectable +16.4% on the year (or +17.9% including dividends). The Gap between the daily closing high vs low for the year was larger than normal, thanks to the April tariff tantrum and subsequent recovery.

Source: Topdown Charts

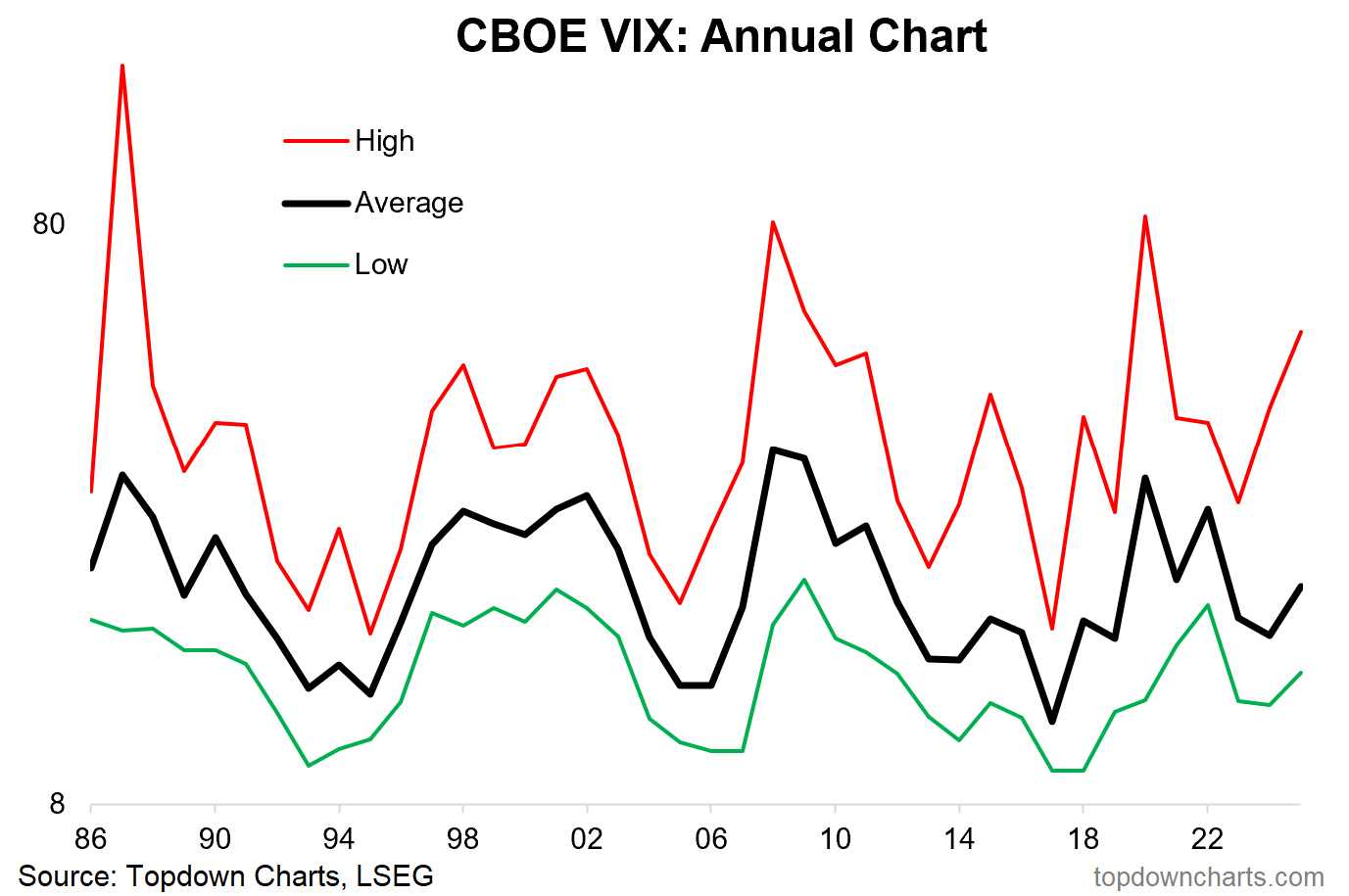

2. Annual Charts — Volatility Cycles: Indeed, the average VIX reading for 2025 was notably higher than 2024 and the daily closing high of the year was at the top end of the historical range. On first glance it looks like 2024 was the low point in what appear to be repeating multi-year cycles in volatility.

Source: Topdown Charts Professional

3. Major Asset Class Returns in 2025: The total return for the S&P500 of +17.9% placed US large caps in the upper half of the asset class return tables, but materially lower vs global equities (with frontier markets boasting the best returns, and oddly enough even EM local currency government bonds outperforming vs US large caps).

Source: Asset Class Returns

4. Investor Euphoria: Moving on to the current state of play, the composite view of investor sentiment is lower now than it was this time last year… That said, it’s still around the upper end of the historical range.