Weekly S&P500 ChartStorm - 4 December 2022

This week: update on "that trendline", bullish technicals, global equities, election cycle map, bear market vs bull Santa, peak inflation vs stocks, recession outlook, ESG small caps, leveraged ETFs..

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

This week’s edition is sponsored by Stratosphere.io

Stratosphere.io have just launched a new research platform with global coverage and financial data that goes back over 35 years covering 40,000+ stocks and funds.

1. Who's Line is it Anyway? (bulls or bears?) Bulls have an opportunity to take control and change the narrative here: the index closed above its 200dma, and is very close to breaking that much-watched "arbitrary line"... I’m reminded at this point of the truism that price moves faster than fundamentals, and a corollary: the reason for a certain market move is almost always obvious in hindsight (things to keep in mind when looking(out) for a turning point).

That said, personally I don’t want to be flip-flopping and chasing price when the macro hasn’t really moved in favor of the bull case yet. And just to make it completely ambiguous, I’m also reminded of the market aphorism that the market will tend to move in a way so as to inflict the maximum amount of pain and confusion for the maximum amount of participants — in this case that could for example come in the form of a breakout that amounts to nothing more than a riling range-trade: ruining things for both bulls and bears!

Source: @Callum_Thomas

2. Back Above (and beyond?): Recapturing the 200-day moving average (after a material (6-month) period below) is usually a good thing... (reminds me of another market aphorism — "nothing good happens below the 200dma").

Of course, we do need to be mindful of and highlight the (single) false positive in the early 2000's. So, feeling lucky?

Source: @RyanDetrick

3. USD Delight: Down is up when it comes to the US dollar and global equities — a stronger dollar generally means a tightening of financial conditions, and so we shouldn't be surprised to see some pockets of strength as the USD (+yields) goes down and eases financial conditions…

Source: @WillieDelwiche

4. Global Equity Technicals: Similar chart, but broader coverage of countries in this one — and a similar stark surge in breadth (albeit this particular index still has some work to do with that key overhead resistance line). Also of note: Divergence Noticers will notice the bullish divergence (higher low in the breadth indicator vs lower low in the index), looks like a/the bottom is in for now.

Source: @topdowncharts

5. Election Cycle Map: All is as it should be?

Source: @allstarcharts

6. Bull vs Bear Seasonality: Historically, Santa only comes during Bull Markets...

Source: Chart of the Week - Bear Market Seasonality

7. Peak Inflation and Stock Prospects: Seems like peak inflation is good for equities — unless it is followed by recession... (e.g. such as the recession currently being engineered by central banks in order to destroy demand and restore price stability.....)

Source: @patrick_saner

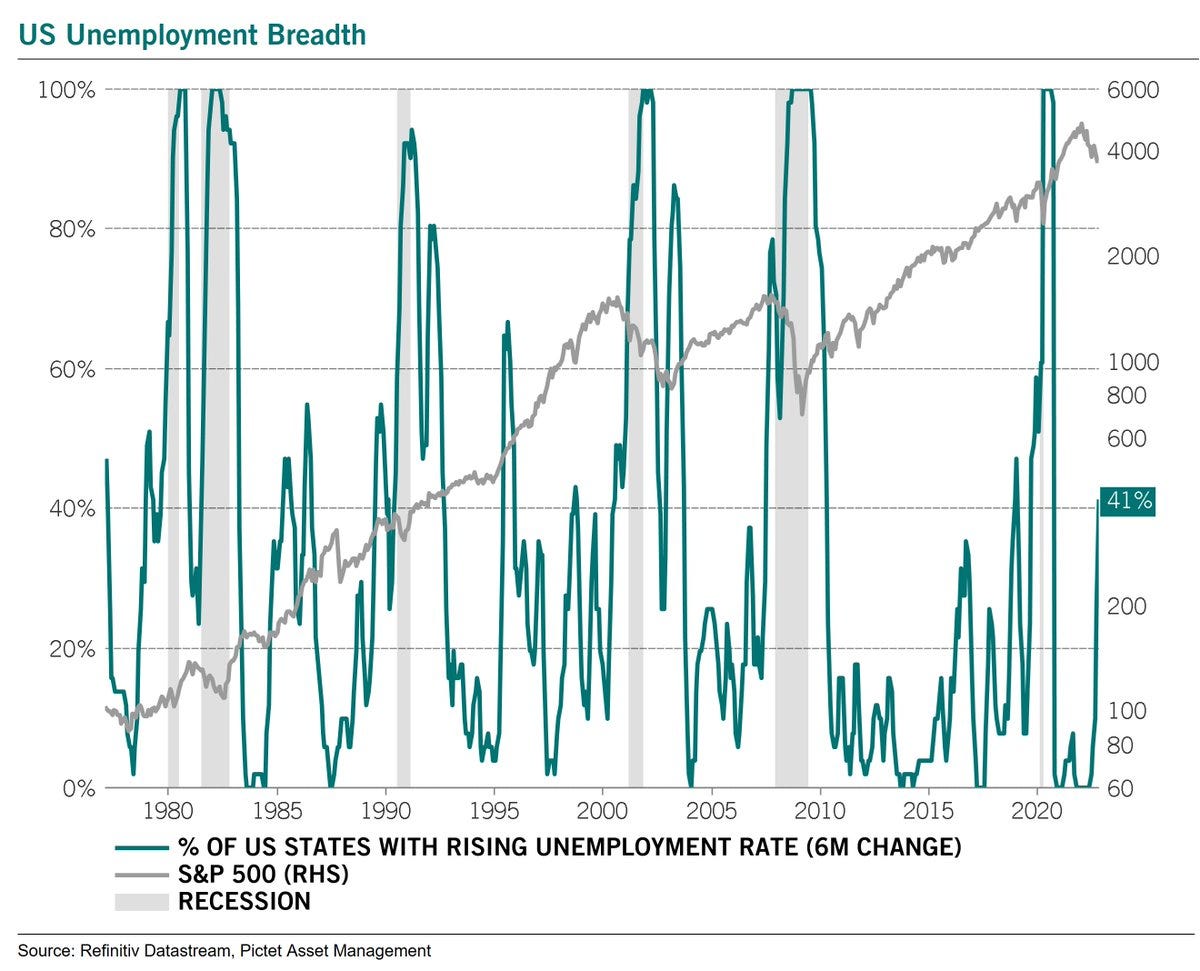

8. Earnings Recession: And it seems recession is precisely what appears to be in the pipeline based on this +dozens of other indicators.

We could well see an air pocket of falling earnings and tight/tightening Fed policy between now and an eventual trough and pivot to easing. But that is a few steps ahead. The technicals might be looking up, but the macro is still mucky.

Source: @MikaelSarwe via @saxena_puru

9. Recession Risk: Take a closer look and you will see all the signs. The economy is rolling over into recession, and the Fed is determined to get inflation well and truly under control. This is not over yet.

It should be said, looking at this chart, recession does not necessarily mean doom for equities, but it typically is not helpful (and can trigger off hidden risks/loops).

Source: @steve_donze

10. Small Cap ESG Penalty: This is an intriguing chart, turns out Small Cap Stocks have materially worse ESG ratings than large companies...

(...basically because small companies don't have the budget to boost their ratings with extensive reporting, PR, and disclosures like large firms do!)

Source: @DuncanLamont2 (The small cap sustainability opportunity)

Thanks to this week’s sponsor: Stratosphere.io

Take your Stock Research into the Stratosphere with this NEW tool!

Gathering KPIs and segment data is a time sink for investors.

Stratosphere.io makes the process easy, clean, and clear with their brand new platform and you can give it a try completely for free.

It gives you the ability to:

Quickly navigate through the company’s financials on their beautiful interface

See every metric visually

Go back up to 35 years on 40,000 stocks globally (!)

Compare and contrast different businesses and their KPIs

Build your own custom views for tracking your portfolio

Stratosphere.io has just relaunched their platform, so go give it a try now for free!

BONUS CHART >> got to include a goody for the goodies who subscribed.

The Long and Short of Leveraged ETFs: I was digging around my excel files looking for an interesting chart for this week’s bonus chart section, and this one stood out due to an interesting pattern popping up (or down as the case may be…)

It shows aggregated leveraged long and short US equity ETF Assets Under Management vs the S&P 500. The level is interesting, but the movement and pattern of moves is especially intriguing.

Now, yes the green line is interesting in that we’ve seen a plunge in leveraged long ETF assets (and subsequent initial rebound). But it’s the red line that looks most interesting to me.

After a surge in assets in leveraged short US equity ETFs, we’ve seen a clear peak. This is something we saw when the market bottomed in 2020, and perhaps to a less obvious degree also in 2009 (and much more subtly in 2016/17).

It’s another one for the technical bulls, and in some respects a sign or symptom of shorts giving up in the face of adversity as the market pushes higher, and the narrative slowly shifts progressively bullisher and tropes of year-end seasonal Santa rallies are wheeled out.

Sadly, we don’t have this data for the early-2000’s, as it could be quite informative…(leveraged long/short ETFs only launched around 2006, and even then only really flourished post-08). So we’re left waiting and watching on this one to see if history repeats (or if history gets made!)

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a NEW entry-level service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service; and most importantly: What our clients say about it…

Be sure to subscribe and watch out for an "Off-Topic ChartStorm" later this week....... *intrigue*

See previous editions: https://chartstorm.substack.com/s/offtopic-chartstorms

great coverage as always, thank you!