Weekly S&P500 #ChartStorm - 4 April 2021

Your weekly selection of charts...

Welcome to the Weekly S&P500 #ChartStorm (by email!)

Just to be clear, the chart storm will continue as always on Twitter, the Substack post is just a means by which to make access more convenient and consistent for those who happen to miss it on Twitter for whatever reason.

1. Happy New Month!

(and happy new ATH)

Markets largely marched on in March.

ALSO

Here’s the log version of that chart

(for those who were wondering)

2. The most wonderful time of the year?

Typical seasonal pattern round this time of the year is for stocks up and volatility down. (n.b. seasonality doesn’t always work …it’s more of a thing you look at last —i.e. after you have an existing sound thesis)

3. Bears gone into hibernation...

h/t @ceteraIM

4. AAII surveyed equity allocations getting high

(but have been higher in the past)

(…so you’re saying there’s a chance?)

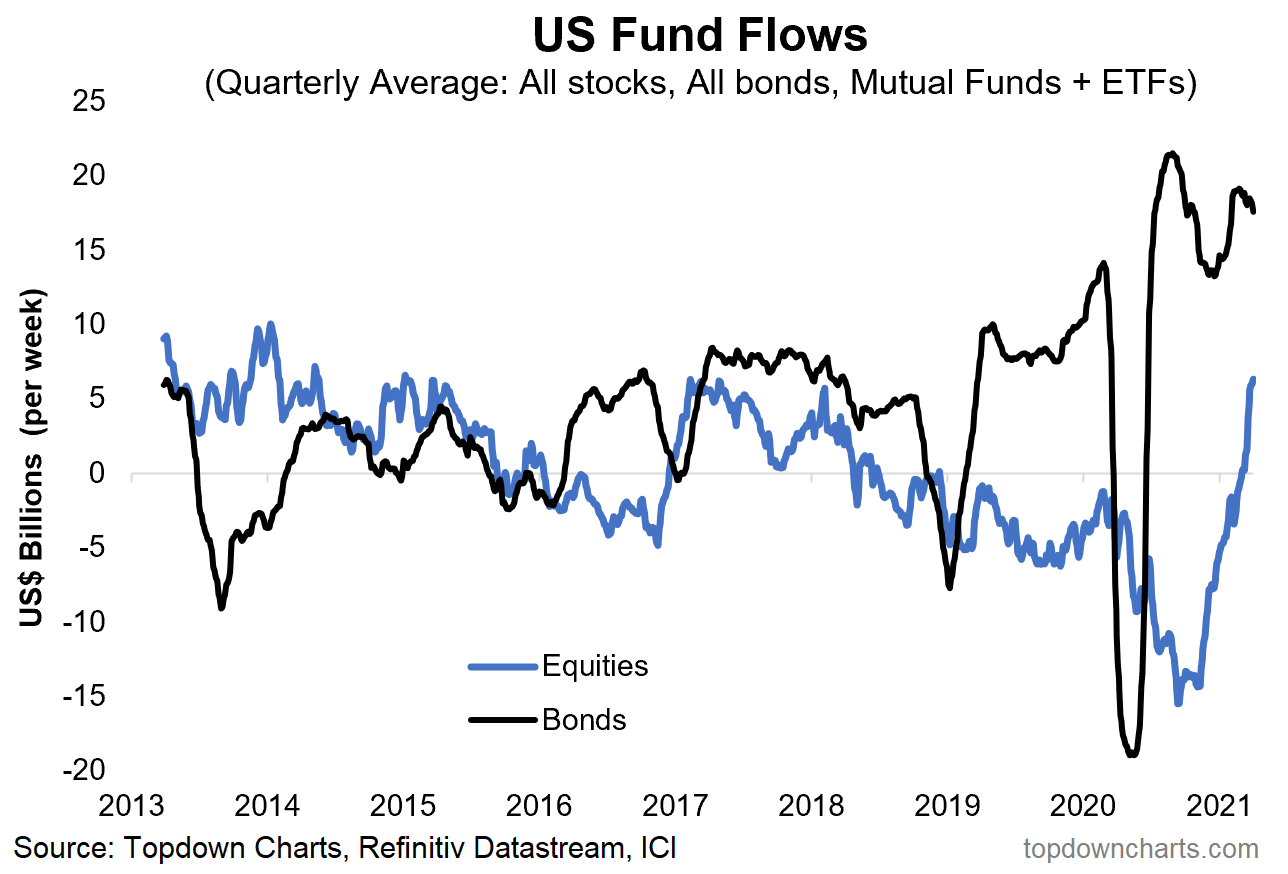

5. Fund Flows Update:

-Bond flows rolling over

-Equities going vertical

6. S&P500 vs ISM manufacturing PMI

(easy for both of these to be reaching such levels given the low bar, but then again, things could have easily gone the other way if policy makers didn’t step up)

7. Momentum migrating away from quality

Momentum & quality used to be synonymous… but normalization prospects have the market momentum gods smiling on the “lower quality” stocks

h/t @choffstein

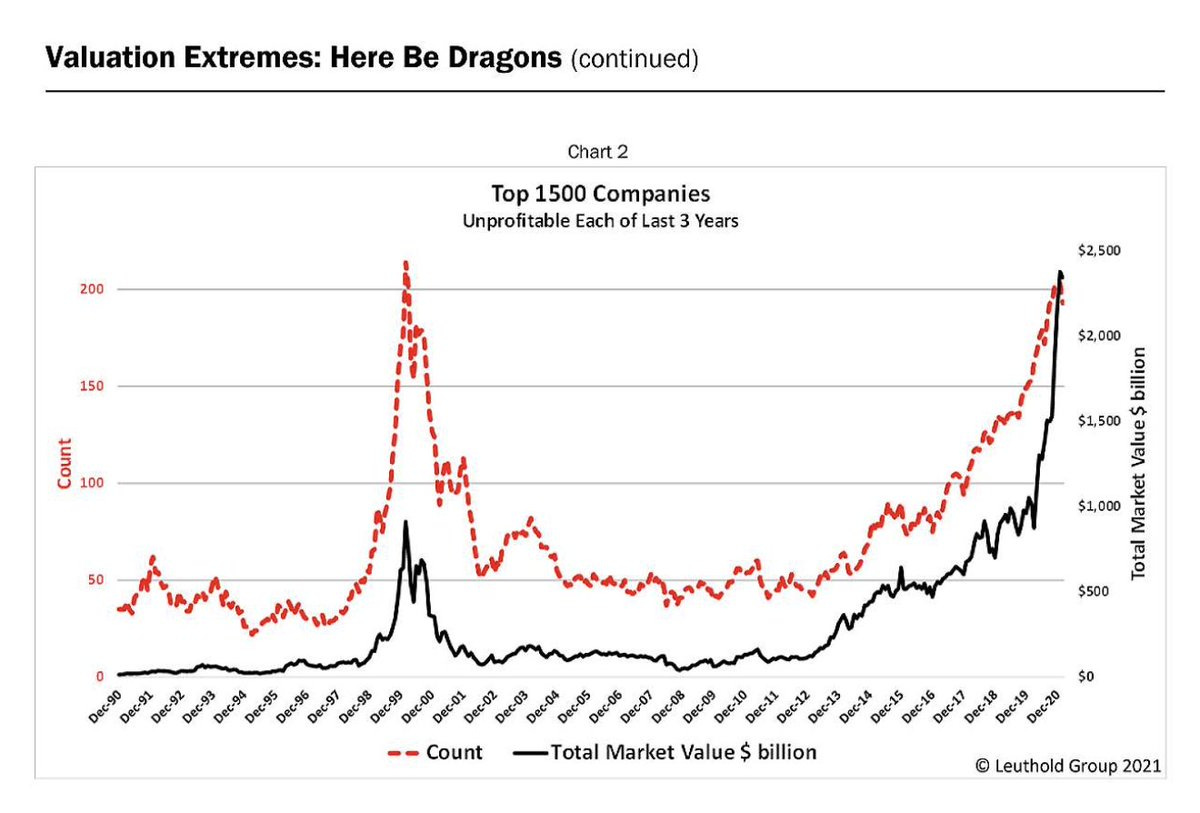

8. Bull market in unprofitable companies

(of course the pandemic didn't help, but there was a trend underway here)

h/t @jessefelder

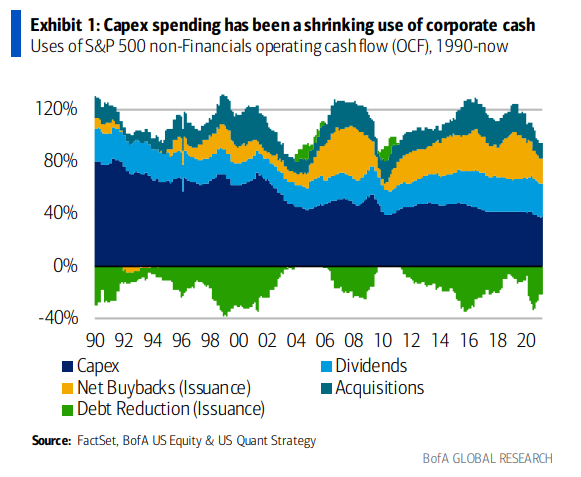

9. Capex a shrinking use of corporate cash

#WeDontMakeThingsAnymore

h/t @MikeZaccardi

10. PE chomping up tech

h/t @TN

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

Bond Market Sentiment: Consensus Inc. bond sentiment has dropped to decade lows. In theory when sentiment gets this lopsided it’s a recipe for a reversal or at least a period of consolidation. But that theory can get complicated during times of change and upheaval. For instance, during a major trend change sentiment can stay lopsided (i.e. when the crowd is right). The other thing is most sentiment indicators only give their true signal when the indicator reaches an extreme and then turns. For what it’s worth, my macro/market indicators still point to around 3% for the US 10-year yield… maybe it doesn’t go all the way, but I guess what I’m saying is: it may not be time to turn contrarian bullish on bonds just yet…

What do you think of the format of this weekly mail out?