Weekly S&P500 ChartStorm - 31 December 2023

This week: the yearly chart, year-end performance stats, monthly charts, real returns, sentiment splits and shifts, valuations, defensive stocks, and wine vs stocks...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

The S&P500 closed up +4.42% on the month, and +24.2% for the year (or 26.3% including dividends).

The annual close was up slightly on the 2021 high (albeit not quite beating the all-time high on the daily chart).

Despite a brief flare-up, the VIX was lower than average in 2023.

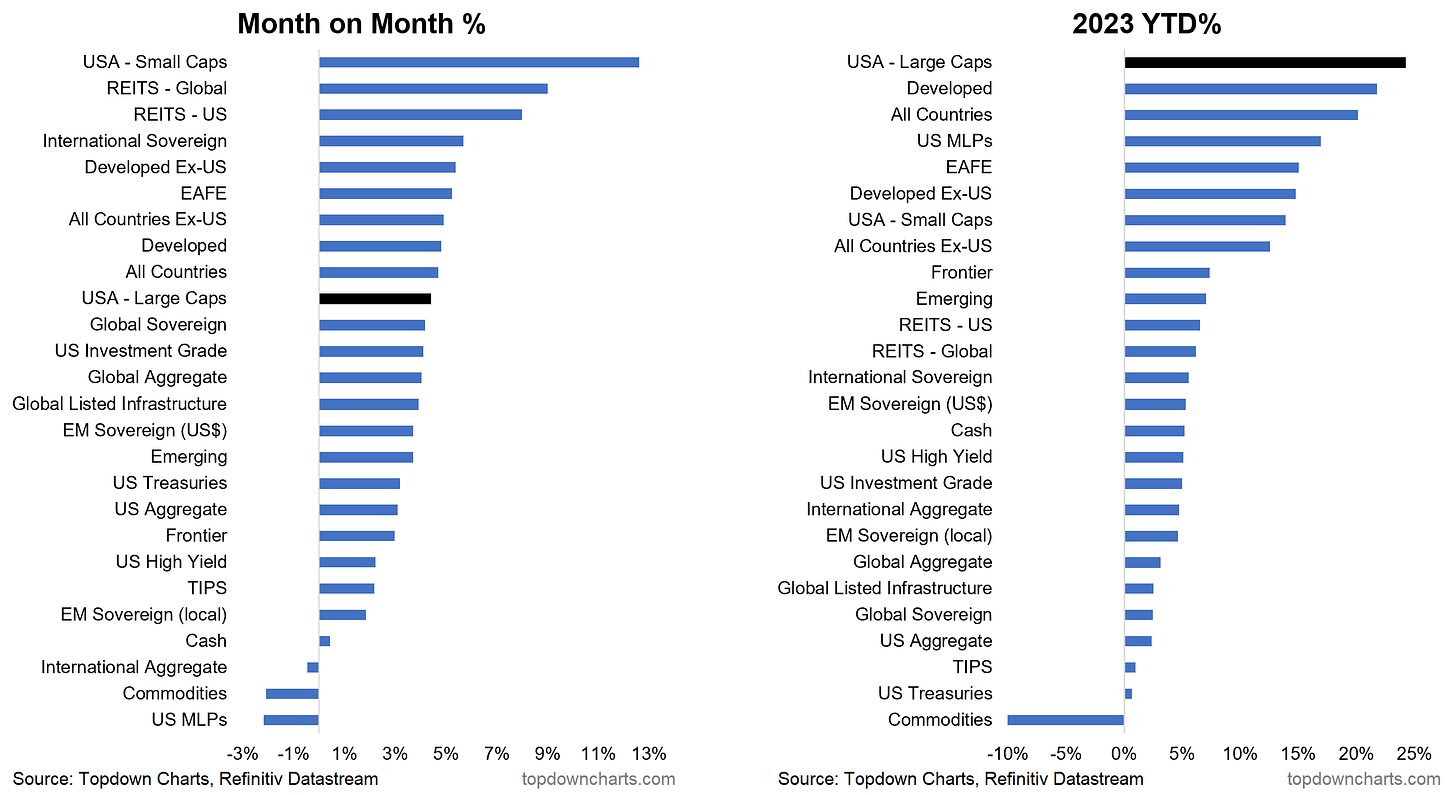

US Equities topped the return tables, beating bonds, cash, and global equities.

Heading into 2024, valuations are expensive and sentiment is bullish.

Overall, it was a solid finish to what turned out to be a solid year for stocks. Technically the market is on a fairly strong footing heading into 2024, but we still need to clear the all-time highs, and there is that background issue of expensive valuations, ebullient sentiment, and the seemingly soft landing…

Hope you enjoy this final edition of the year, thank you for your support and attention this year, and I wish you all the very best for a healthy, happy, and profitable 2024!

1. Yearly Chart: My favorite thing about 31 December? Getting a new update to the yearly chart of the S&P500! Taking stock, we got a higher close, a higher low, but a slightly lower high. The 2023 close also just slightly eclipsed the 2021 close — funnily enough for a buy-and-holder who only checked their account every 2 years… these last 2 years may have seemed quite dull!

Source: Topdown Charts

2. Low Volatility: The average reading of the VIX in 2023 was materially lower than that of 2022 and notably below long-term average. The daily closing-high of the VIX in 2023 (March 13th: 26.52) was also lower… and may have been even lower were it not for that brief moment of sheer panic in the US regional bank sector. One interesting thought that comes to mind on this chart is that typically after a flare-up in the VIX and subsequent turn down in volatility… it usually stays/goes lower. It’s more unusual for the VIX to spike after a spike vs after a period of calm. So maybe lower for longer vol? (emphasis on the “maybe”)

Source: Topdown Charts Professional

3. Monthly Chart: It’s also a good chance to check out the monthly chart, and after rising +4.42% on the month, and +24.2% for the year (or 26.3% including dividends), the S&P500 managed again a slightly higher close vs the Dec 2021 close, and a second month back above its 200-day moving average. Decent way to close out the year.

Source: Topdown Charts

4. Let’s be Real: Real talk — in CPI inflation-adjusted terms, we are still quite a way off the high. And this is not just some goofy economic technicality, this is real… despite the rebound in (some) asset prices, when you factor in inflation (and taxes, fees, etc) — most people are not actually getting ahead. This is a key reason for that “vibecession” concept (and see chart 9 below for more on that issue) — of course people are going to feel glum despite the GDP figures going up if they are not themselves getting and feeling richer in real terms.

Source: Topdown Charts

5. Asset Class Returns: While mid on the month in Dec, the S&P500 (US large caps) finished top of the table for the year in 2023, with rest-of-world all positive on the year but notably trailing vs US. Interestingly cash pretty strongly outperformed most flavors of fixed income. Commodities were the worst. Does make you think… it’s not at all uncommon for the winners and losers on these tables to flip from year-to-year!

Source: Asset Class Returns

6. Daily + Technical Check: Back down to earth, the daily chart shows us how despite the strong end-of-year close, the market actually ticked slightly down off the high for the year, and still actually hasn’t reclaimed the all-time closing high. That being the case, we still have that big round-number to get through (4800), and the short-term issues of breadth appearing to peak out at 80%. That said, with the index above its upward-sloping 200-day average, and breadth still otherwise solid, it is a picture of strength for now.

Source: @Callum_Thomas using Market Charts

7. Valuation Breakout: While valuations matter immensely for long-term investors (easier to buy low sell high when prices are low to begin with), the truth is, in the short-term it’s almost more of a momentum/confidence indicator… and in that respect the short-term bull story on this chart would be that it’s broken out: be bull. Longer-term investors meanwhile will still be at least one-foot-out-the-door!

Source: Topdown Charts Professional

8. Soothing Sentiment: After a swift and short-lived shakeout, climaxing in October, sentiment is back to effervescent levels. Important to remember these background conditions heading into 2024 — valuations are expensive and sentiment is full bull.

Source: Topdown Charts

9. Sentiment Schism: Very interesting split in sentiment between Wall Street vs Main Street… investors are as bullish as ever, but economic sentiment (average of consumer, business, services, manufacturing, housing) remains recessionary. The last time we saw this type of disconnect it actually turned out that investors were right, so that perhaps is cause for optimism (if economic sentiment plays catch *up* vs investor sentiment down). The other aspect is that we can kind of reconcile this with the inflation-adjusted S&P500 chart… stocks are going up, but people are still not getting ahead. And then also the other thing to keep in mind is while it looks like for now we are in a “soft landing” …it’s still a landing.

Source: Topdown Charts Professional

10. Don’t Discount the Defensive Discount: Last one for this session is from my “Best Charts of 2023” — defensive stocks are back to trading at a decent relative valuation discount vs the rest of the market. From a risk management perspective, you should pay very close attention when defensives start looking attractive (because that in and of itself is basically indirectly a bearish warning signal, but also something to think about on the diversification/hedging front).

Source: My Best Charts of 2023

Thanks for reading, I appreciate your support! Please feel welcome to share this with friends and colleagues — referrals are most welcome :-)

BONUS CHART >> got to include a goody for the goodies who subscribed.

Hangover for Wine Investing: with New Year’s festivities just hours away, it’s timely to check-in on wine prices… albeit the chart below focuses more on investment vs consumption!

After a bubbly run in 2022, fine wine investments soured in 2023 — with the LivEx Fine Wine Index down a musty -14.2% on the year.

This saw fine wine investments significantly underperforming vs the S&P500 and offering negative diversification… in contrast to 2022, where fine wine turned out to be an unexpected hedge (or positive diversifier) in a year where few other assets served that purpose.

Going forward, your guess is as good as mine in terms of wine prices, and we probably need to do some more “research” on the wine front. But meantime, it is an interesting alternative asset and a reminder that sometimes diversification comes from unexpected places (as well as the point that winners and losers across asset markets often end up switching places!)

—

Best regards,

Callum Thomas

Follow me on Twitter(/X)

Connect on LinkedIn

Looking for further insights? Check out my work at Topdown Charts

Great chart report!

Love those yearly charts of the S&P 500. Helps remind you to look past the noise of the daily squiggles...

GM Callum...regarding chart #9...I am curious about when was the last time that retail investors were proven right to be more bullish then Wall Street? Sorry, I could not decipher that from the chart. I want to go back and read up on that time period for more clues that might relate to the current state of affairs. Thanks and Happy New Year!