Weekly S&P500 #ChartStorm - 28 March 2021

Your weekly selection of charts...

Welcome to the Weekly S&P500 #ChartStorm (by email!)

Just to be clear, the chart storm will continue as always on Twitter, this is just a means by which to make access more convenient and consistent for those who happen to miss it on Twitter for whatever reason.

1. April begins this week... you know what that means

(historically the best month in terms of average return and percentage of instances positive m/m)

2. Wow! New ATH for S&P500 annual price return!!

(albeit, n.b. base effects)

3. Sell the last hour

"past 3 months, a net 29 days have seen stocks fall during the last hour of trading"

Used to be a market rule of thumb that the last hour is when the smart money trades...

h/t @sentimentrader

4. Corporate treasurers yolo-ing their corporate stimmy into their own stock at a record pace

h/t @MikeZaccardi

5. Valmentum?

(rising number of stocks screening positive for value + momentum)

h/t @MrBlonde_macro

6. Big turnaround in valuations since this time last year.

Progress check: https://www.linkedin.com/pulse/global-equities-progress-check-generational-buying-callum-thomas/

7. Fun fact: 44% of all companies ever in the Russell 3000 experienced a catastrophic loss at some point during the past 40yrs.

(which is defined by JPM as 70% decline in stock price from peak levels which is not recovered)

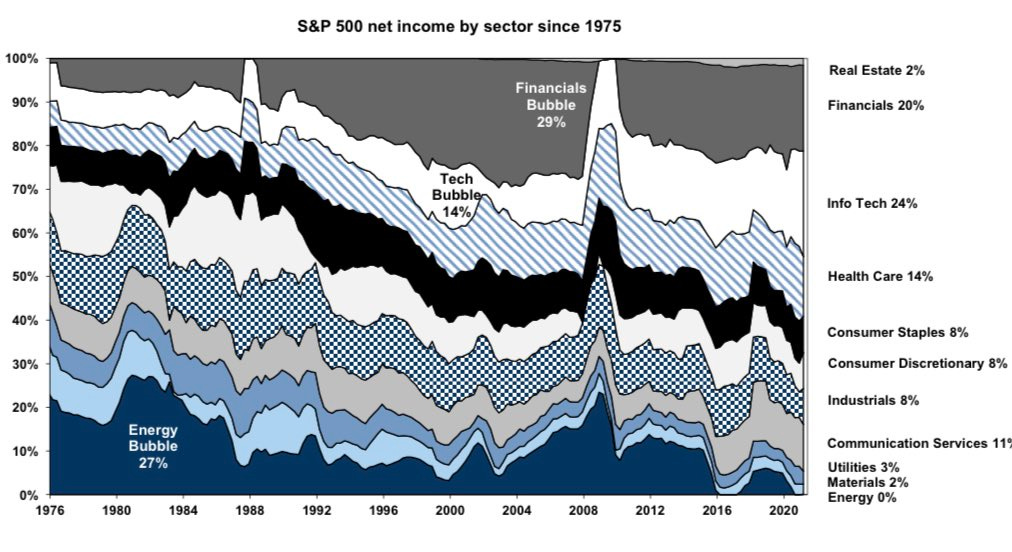

8. Energy contributes nothing to SPX earnings

h/t @DavidSchawel

9. Wait... what? S&P500 is in a bubble??

(also, BTC got nothing on Mississippi Co.)

h/t @tracyalloway

10. Founder-led companies have historically outperformed the rest

h/t @_inpractise

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

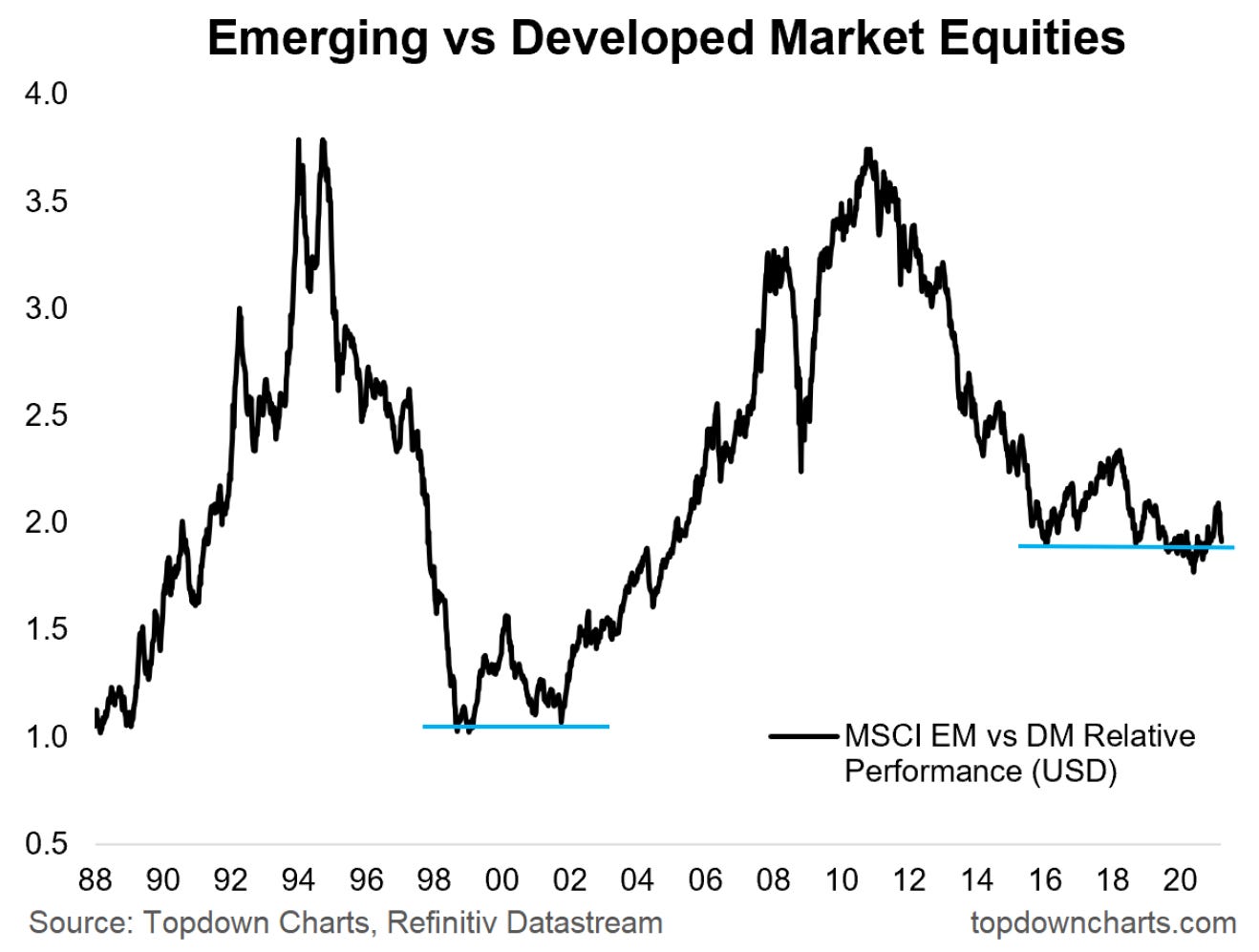

EM vs DM: After another promising attempt at finally well and truly shaking off the relative bear market of the past decade, emerging markets have lost ground again in relative terms vs developed markets. Seems like this bottoming process is indeed more of a process, and for now very much a work in progress.