Weekly S&P500 ChartStorm - 27 February 2022

This week: a check on technicals, Russian market mayhem, bearish sentiment, valuations, IPO stats, Nasdaq short interest, Biotech stocks, and automation

Welcome to the Weekly S&P500 #ChartStorm (by email!)

The Chart Storm is a weekly selection of 10 charts which I hand pick from around the web (+some of my own charts), and then post on Twitter.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

! NEW ! Sign up to the (free) Chart of the Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you a chart along with some commentary + context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! The focus is on illuminating the ever-changing macro-market outlook to help identify incoming risks and opportunities. > > > Subscribe Now

1. S&P500 defending support for now…

Major drivers of weakness:

-RSX = Russian stocks (geopolitics)

-LQD = credit/duration (rising yields/Fed)

-ARKK = ... (tech bubble burst)

Somehow I don't think any of these resolve quickly, but this chart at least presents some barometers or indicators to track for signs of further strength/weakness.

Source: @Callum_Thomas

2. Strategic Mistake: Russian assets are imploding.

Source: @topdowncharts

3. Boom in Bears: Since 1998, whenever investors got this bearish 1yr forward returns were positive 69% of the time, with a median gain of +21.6% (albeit for the 31% of cases where returns were negative, the average loss was -24%, and worst was -39%).

Source: @granthawkridge

4. Sentiment basically as bad as the covid crash.

(but then again, you have to ask: is this 2020, or is it 2008? i.e. sentiment goes like this in a short/sharp dump, but also goes like this during transition to bear market)

Source: @topdowncharts

5. Bargain Hunting?? For some context, the US CAPE valuation ratio is down -9.5% from the peak in Oct, but is still 112% higher than its long-term average…

Source: @topdowncharts

6. IPO Boom & Bust: This chart gives a sense for the magnitude and scale of the US IPO boom (and bust). Notably, IPO filings increased exponentially through the second half of 2020 into 2021. More recently though, IPO filings have plunged back to “normal“ levels.

Source: Chart of the Week - IPO Boom & Bust

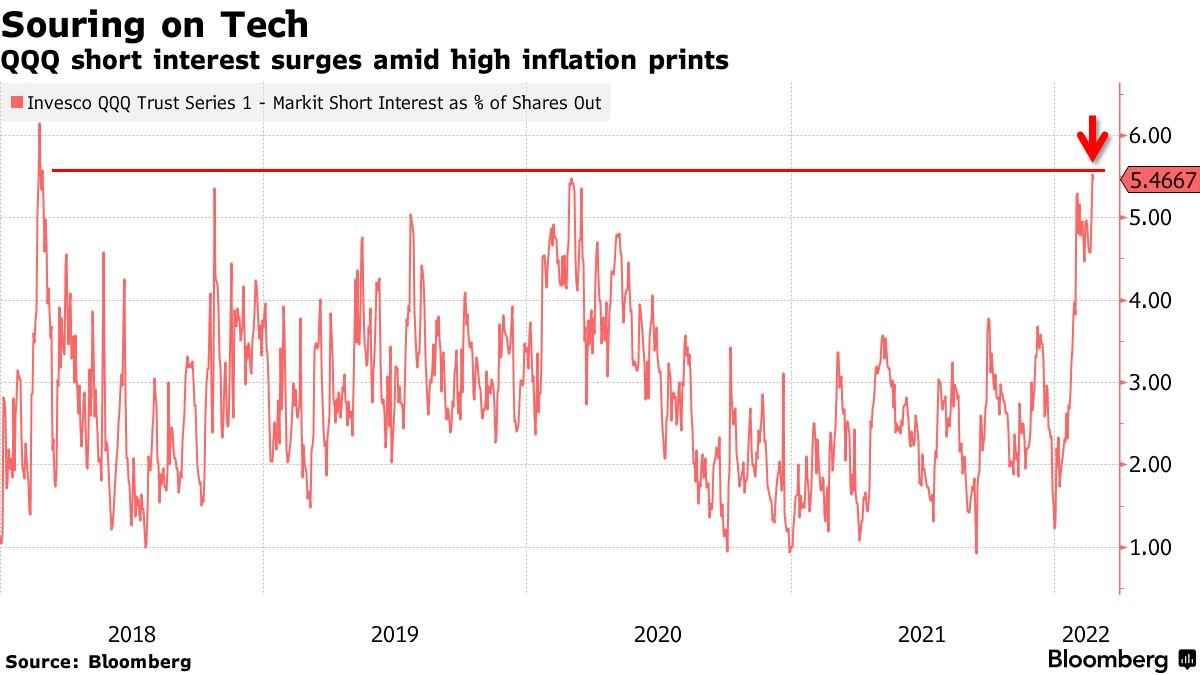

7. Get Shorty: Nasdaq (QQQ) short interest surging.

Bear markets are known for sometimes having a series of short, sharp, face-ripping rallies... and this is exactly the type of precondition that fuels them.

Source: @MacroCharts

8. Biotech Stocks: Amid a major global health crisis, Biotech Stocks...

*checks notes*

...are performing the worst since 2001.

Source: @sentimentrader

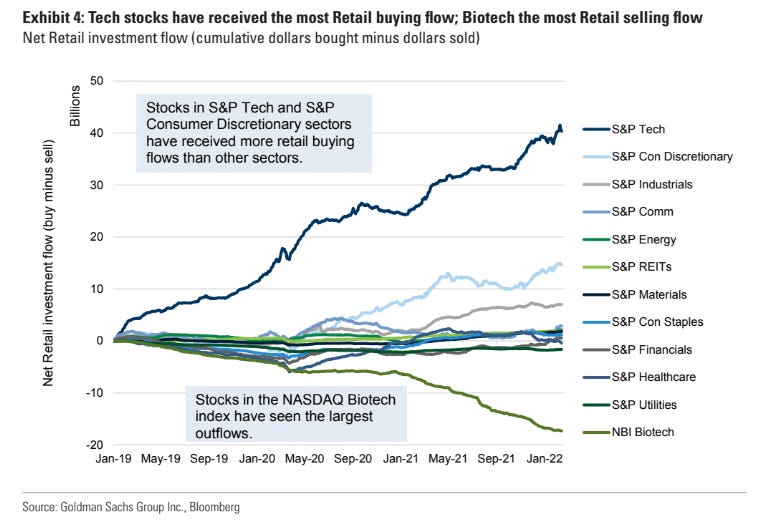

9. Fund Flows: As such, investors are dumping biotech and pumping ...abio-tech.

Source: @WallStJesus

10. Automatability: the robots are coming...

Source: Automation and Reshoring

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

The Stockmarket vs The Economy: seems like investor sentiment has completely disconnected from economic sentiment.

This chart tracks investor bullishness from a composite of surveys and economic sentiment, likewise from a composite of surveys. The intent is to overweight signal vs noise, and what a signal…

It’s not unusual for the two to disconnect, and indeed, investor sentiment — fueled by movements in the market, often move faster and more erratically than the economic cycle. But investors have been “right“ in the past in terms of guessing the direction (if not the magnitude) of the twists and turns of the economic cycle.

For now though, we can objectively say that investor sentiment is wildly disconnected from economic sentiment.

—

Best regards,

Callum Thomas

SPONSOR: ( …he’s me!)

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the key ideas and themes from the institutional fund manager service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think

Thank you, Callum. Always & especially after this week!