Weekly S&P500 ChartStorm - 25 September 2022

This week: sentiment, positioning, selling, election cycles, earnings/macro outlook, monetary valuations, asset class valuations, venture investing thematics, tech sector trouble...

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

In case you missed it: The 12 Charts to Watch in 2022 [Q4 Update]

A lot has happened in macro and markets this year, and the outlook remains uncertain. So I have updated my post from the start of the year on what I thought would be the 12 most important charts to watch in 2022 and beyond…

1. AAII Bears: Most bearish reading since 2009. According to SentimenTrader “This week joins just 4 others in 35 years with more than 60% of respondents being despondent in the AAII survey. One year returns after the others: +22.4%, +31.5%, +7.4%, +56.9%”.

So bearish that it’s bullish?

Source: @sentimentrader

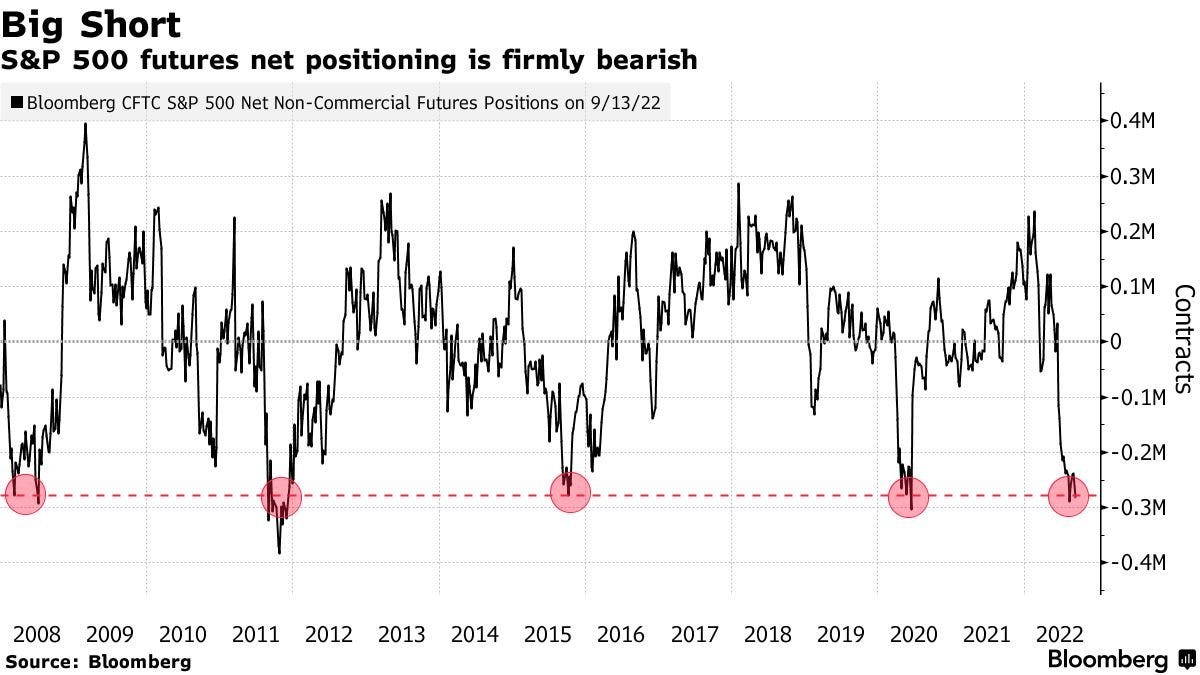

2. Big Shorts: Speculative futures positioning is heavily net-short.

Albeit, n.b. this group were crowded short and right in 2008.

Source: @Barchart

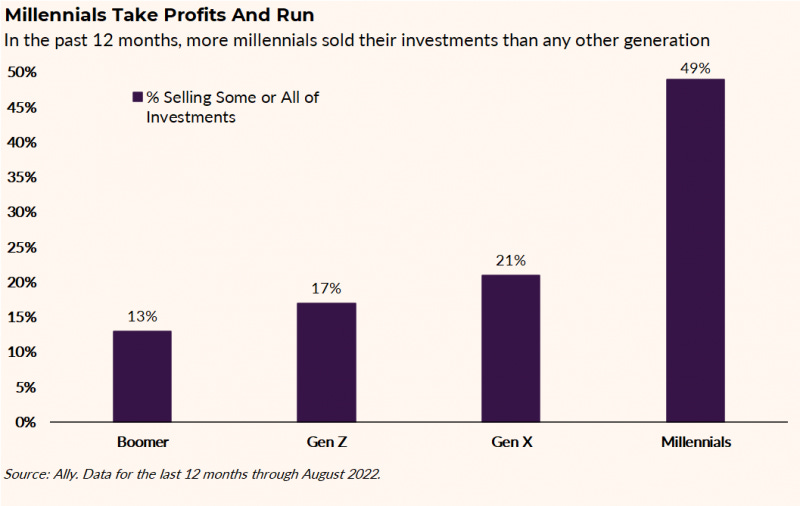

3. Generational Selling Opportunity: Intriguing statistics. Seems just about every millennial sold some or all of their investments. Could have to do with life stages, but hard to guess what is specifically driving this. The other key thing that sticks out in this chart is that aside from millennials, everyone else has held tight. That gels with my previous observations about the difference between very bearish surveys vs relatively minor movement in equity allocations and margin positions.

Source: @justLBell

4. Presidential Election Cycle: Clearly there is a lot going on, and so naturally the instinct when presented with a chart like this can be to dismiss it and say “yeah but this time is different”. And many things are different. But still, it is an interesting observation, and could become more interesting if there happened to be any (perish the thought) positive surprises.

Source: @allstarcharts

5. Friendly Reminder: Strong dollar = tighter financial conditions (= recession = earnings go down). Hard to escape the reality of multiple mounting headwinds, and the inevitable negative impact on earnings.

Source: @IanRHarnett

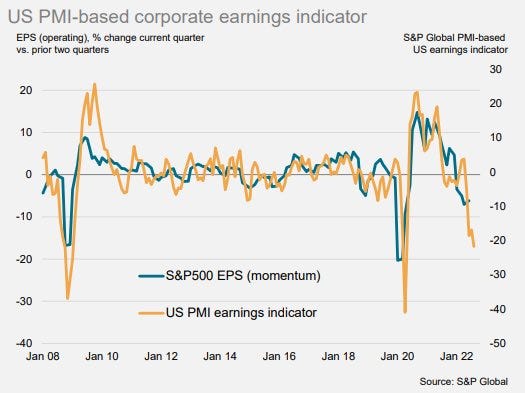

6. Earnings Recession: Judging by the S&P Global PMI indicators, an earnings recession is on its way. Seems like just about every week we see a new chart with a new indicator pointing to recession/earnings collapse!

Source: @MichaelAArouet

7. Stock Price Crash Drivers: Interesting yet somewhat unsurprising chart.

When it comes to individual stocks, bad earnings announcements are the leading cause of stock price crashes. I would guess we can probably extrapolate this out to the macro/aggregate index level...

Source: @Ozard_OfWiz

8. Real High Real Yields = Real Problem: Monetary tides going out. If you take this chart literally, based on the shift in rates, stocks are still overvalued...

Source: @TimmerFidelity

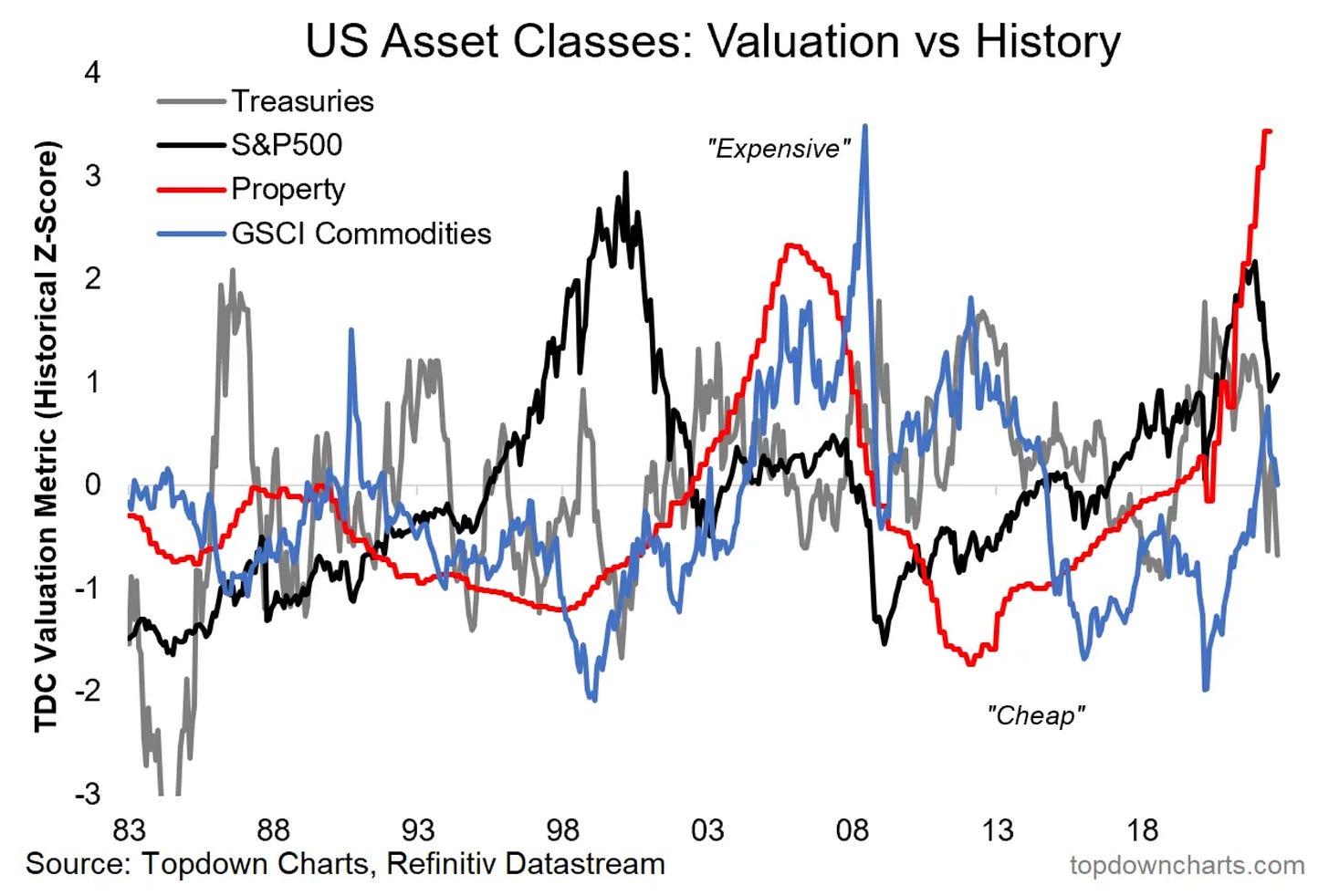

9. Valuations In Perspective: In absolute terms, US equity valuations are still elevated vs history; expensive. If it’s any consolation, property is wildly more expensive — most extreme reading on record(!). Commodities meanwhile are about neutral, and bonds by now are starting to look cheap.

Source: The 12 Charts to Watch in 2022 [Q4 Update]

10. Adventures in Venture Investing: It's a race between AI/Blockchain/Climate.

Source: @SnippetFinance

Thanks for following, I appreciate your interest!

BONUS CHART >> got to include a goody for the goodies who subscribed.

Trouble With Tech: something strange is going on with US Tech sector CDS (Credit Default Swaps), something that we haven’t seen since the global financial crisis.

CDS are basically the cost of insuring against default/”restructure” of corporate bonds. They move and behave in a similar fashion to credit spreads.

It should be noted that the sharp move in the chart above could be simply a result of a routine order in a relatively illiquid market, but at the same time it is not something to necessarily dismiss in the face of increasingly tight financial conditions.

Not to mention the downdrafts in the economy… and p.s. it is mostly myth that tech stocks are immune to the economic cycle. Sure some companies will look cycle-agnostic when they are going through the rapid adoption and market share eating phase, but it doesn’t take long for something that looks structural to become quintessentially cyclical. A key example would be digital ads. Online ads are practically the norm now, so aside from market share eating, it’s all down to what’s happening with the economy, business confidence, and budgets.

In that sense, we should expect changes in market opinion on credit risk premia for tech companies as the economic cycle sours. Particularly so for all those loss-making tech stocks we heard so much about, and that people happily piled into during the monetary miracle of 2020.

These issues are echoed in corporate bonds. Much like tech stocks, IG credit got slammed by duration risk in the (ongoing) interest rate shock of 2022. But so far the pain in corporate bonds has been just that: duration risk vs credit risk.

But credit risk is the archetypal sleeping giant when it comes to bear markets: awoken when monetary policy tightens, financial conditions seize up, and the economy gets crunched into recession.

And that proverbial sleeping giant looks to be stirring. Keep an eye on credit.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a NEW entry-level Substack service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service; and importantly: What our clients say about it…

"bonds by now are starting to look cheap"

and just look how cheap they got in 1983-86! Aka, you ain't seen nothin' yet.