Weekly S&P500 ChartStorm - 25 July 2021

Your weekly selection of charts...

Welcome to the Weekly S&P500 #ChartStorm WriteUp

The Chart Storm is a weekly selection of 10 charts which I hand pick from around the web (+some of my own charts), and then post on Twitter.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

1. S&P500 - The Bounce: As noted earlier in the week, the S&P500 dropped all the way down to touch the 50-day moving average and the intermediate support level at 2050. Then came “turnaround Tuesday“ and as noted in the next chart; traders successfully engaged the BTFD strategy…

Source: @Callum_Thomas

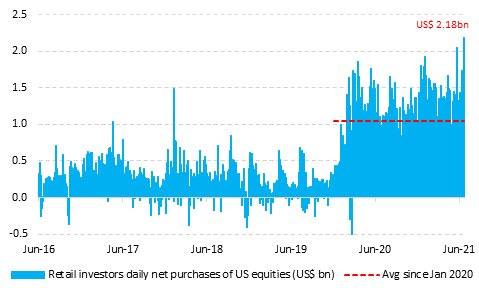

2. Retail Investor Flows: Two things stand out in this chart; firstly net-purchases by retail investors spiked into the selloff. Second, perhaps more notable is how stark the regime shift has been with the rise of retail. Retail investors are an undeniable force to be reckoned with in these unprecedented times.

Source: @Theimmigrant84

3. Tech Flows: Back into the pool for investors as a brief period of outflows gives way to renewed inflows into tech funds. The demand for tech stocks has been relentless as tech stock euphoria pushes market valuations ever higher. Time will tell if this rebound in tech flows turns out to be a dead cat bounce (a last throe of activity) or the start of the next wave.

Source: @ISABELNET_SA

4. Buybacks Back: Another force to be reckoned with in the markets is buybacks - and it looks like buybacks are back and are set to accelerate in coming months. Corporates sit on record cash balances, but also record low corporate bond yields make it easy for companies to borrow and buyback.

Source: @PriapusIQ

5. Global vs US Equities - BREAKDOWN: As we might then guess, with rabid retail, bouncing buybacks, and thirsty tech flows, US equities remain firmly in the lead. Indeed, global equities have broken down vs US in relative terms (after making an initial push higher late last year). Rotation is alive and well, but not in the direction we had anticipated.

Source: Global vs US Equities - Breakout to Breakdown

6. S&P500 Dividend Yield: Just as bond yields have pushed lower, dividend yields are approaching the previous record lows set around the turn of the millennium. Of course I should note that this is only part of the equation - buybacks are effectively a dividend, so adding buybacks in the yield would look less miserly.

Source: @macro_daily

7. Dividend Yield vs Bond Yield: One consolation of low dividend yields is the point that bond yields have dropped again - resulting in a positive yield spread. To be fair the two are not really “fungible“ at all given the different risk profiles, but an interesting development nonetheless.

Source: @StuartLWallace @johnauthers

8. S&P 500 Earnings Yield vs CPI Inflation: Another interesting yield chart - this one shows the earnings yield for the S&P 500 vs the annual CPI inflation rate. Basically the implication is that the earnings yield might be in for a rebound. There are two ways this could happen (or a combination): the index drops, and/or earnings surge. One possible causal linkage would be if higher inflation spurred monetary tightening; imposing a headwind on stocks. Or alternatively, if burgeoning inflation gave earnings a boost e.g. if corporates can push higher prices through to consumers.

Source: @crescatkevin

9. M&A Activity: Another sign of the times - Mergers & Acquisitions activity has reached a record high for the YTD period. Although there might be an element of delayed transactions going ahead, the bigger drivers are: SPACs, record cash holdings, cheap WACC (high equity valuations + low interest rates), easy funding conditions, and of course - we have to say it (CEOs are people too!) euphoria/hubris. So this could just be the start…

Source: @Saburgs

10. Long Term Earnings Growth Forecasts: Exponential Age? Or Stimulus Age? Longer term earnings growth estimates have reached a new higher plateau... This is a strong sentiment signal, and another sign of excess as we progress later in the market cycle.

Source: Chart of the Week - Long Term Earnings Growth

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

US Margin Debt: the June data on margin lending activity was just released by FINRA, and wouldn’t you know it, we’ve reached another new all time high!

Clearly, the market itself moving to new all time highs has helped do a lot of the heavy lifting, and there’s also the point that some people anecdotally use margin lending to finance property purchases because the interest rate is cheaper. But even factoring in the various if’s & but’s, this is a remarkable chart.

But rather than looking at the nominal levels, or even the margin debt vs market cap metric, I like to look at the annual rate of change… but with market movements subtracted: this way we get a normalized view of margin debt acceleration (i.e. waves of speculation).

The key point is margin debt has accelerated sharply.

It does tempt one to draw comparisons to the last two major market peaks, although this time around it hasn’t reached the same heights, and it comes after a period of very sharp deleveraging (so base-effects are a factor).

I think what we can say is that margin debt is definitely elevated, we have seen significant re-leveraging, and just in general we know from other metrics and data that a speculative fervor has swept across the market.

Add it to the risk indicator list, and the growing number of late-cycle signals.

—

Best regards,

Callum Thomas

>> SPONSOR: ( …he’s me!) My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the key ideas and themes from the institutional/fund manager service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think

Thanks for your support!