Weekly S&P500 ChartStorm - 25 Feb 2024

This week: market euphoria, hedge fund momentum, foreign stock holdings, global stocks, new tech paradigms, mixed up macro, VIX, and China...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

Euphoria is the dominant market mood.

Hedge funds are all-in on growth and momentum.

Global stocks are looking much improved.

The AI new paradigm is following a similar path to the dot com new paradigm (something to keep in mind for bulls AND bears).

China is stepping up stimulus (important for global macro and markets).

Overall, the things that stand out to me are the increasing parallels to the dot-com bubble — which is not necessarily a bearish comment. You may be wary of high valuations, euphoric sentiment, and mixed macro… but in the face of new highs, new paradigms, and the unpredictability of bubbles when they get going: the path of least regret is running with the herd and path of least resistance is up.

1. Investor Euphoria: The Euphoriameter is something I put together about a decade ago, designed to capture market sentiment from multiple sources (forward PE — higher valuations imply higher confidence, VIX — lower volatility is seen at times of maximum complacency, and surveyed bullishness — people feel bullish when prices go up). But you probably didn’t even need to see this chart to know that Euphoria is the dominant market mood right now!

Source: The Euphoriameter Topdown Charts

2. Hedge Fund Euphoria: Hedge fund traders have one job: generate a positive monthly PnL. There’s no room for academic big-brain discussions about valuations and long-term expected returns. Just make money. And so, as a group, they’re all-aboard the growth/momentum train (“just buy Mag7”). That’s what works right now, it’s obvious. And if it’s obviously right…

Source: @modestproposal1

3. Foreigner US Asset Allocation: Foreign holdings of US financial assets are heavily concentrated in equities. Brings to mind the Swiss National Bank, which invests a heavy component of its USD reserves in tech stocks.

But also — compare and contrast the heights of 2000 vs the depths of 2009 — what do you think this indicator is telling us?

Source: Topdown Charts Topdown Charts Professional

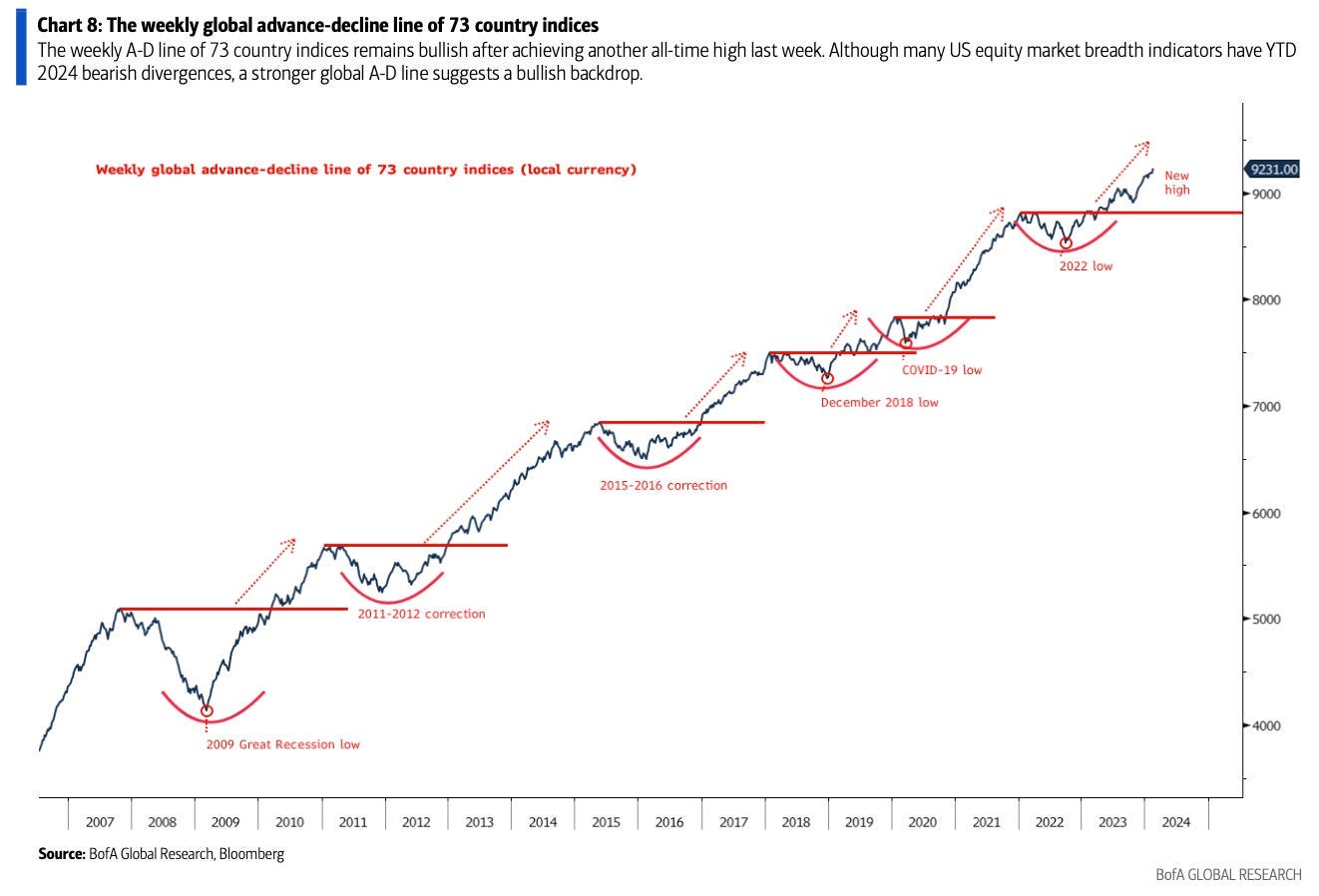

4. Go Global: Global equities breadth is looking very good. Indeed, you might have missed it, but Japanese stocks have made new all-time highs, and Europe has notched up 20yr+ highs, and lately even EM are starting to look better. So while in the US, market leadership has been quite narrow, when it comes to global equity country breadth things are looking good.

Source: Daily Chartbook

5. New Paradigm: This is a neat chart, shows the path of the Nasdaq following major technology releases. If you consider the ChatGPT tipping point as equivalent to the launch of the first web browser, things are basically on track and following the same script as investors attempt to factor in the new economic paradigm that may come.