Weekly S&P500 ChartStorm - 25 August 2024

This week: tech stock technical check, global stocks, USD, Fed pivot and macro trends, recession risk, valuations, weight lifting, and Fed sweet/sour spot...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

Tech stocks face a key technical test this week.

Global stocks are breaking out (thanks weak US$).

Fed pivot is underway (pivot on interest rates and pivot in focus from inflation risk to unemployment risk).

It’s still the season for higher volatility.

Weight lifting is good for portfolio health.

Overall, it’s going to be a very telling week ahead as to whether the Fed pivot confirmation at Jackson Hole will be the excuse markets needed to kick-up back to new all-time-highs… or not. Failure to do so will confirm some of the trends and themes noted in this week’s session, and will be very informative for rotation and risk management strategy.

REMINDER: the new Weekly ChartStorm Chat-Room is now up and running — I will host a live Q&A session on Sunday evening about 7pm EST.

1. Tech Top Check: I know this is supposed to be the *S&P500* ChartStorm, but I keep featuring this chart because it has been tech stocks in the driver’s seat, and so when it comes to the risk outlook we need to be across this. As things stand the Nasdaq 100 has made a solid recovery from a key support level and broken its way back above a couple of key resistance areas… but we’re still not out of the woods on this one yet, and the week ahead will be key. If the NDX can’t break through that upper overhead resistance level and revisit the highs with the Jackson Hole rate cut confirmation, that will be a bad sign for the AI/Tech bull run.

Source: Callum Thomas using MarketCharts.com Charting Tools

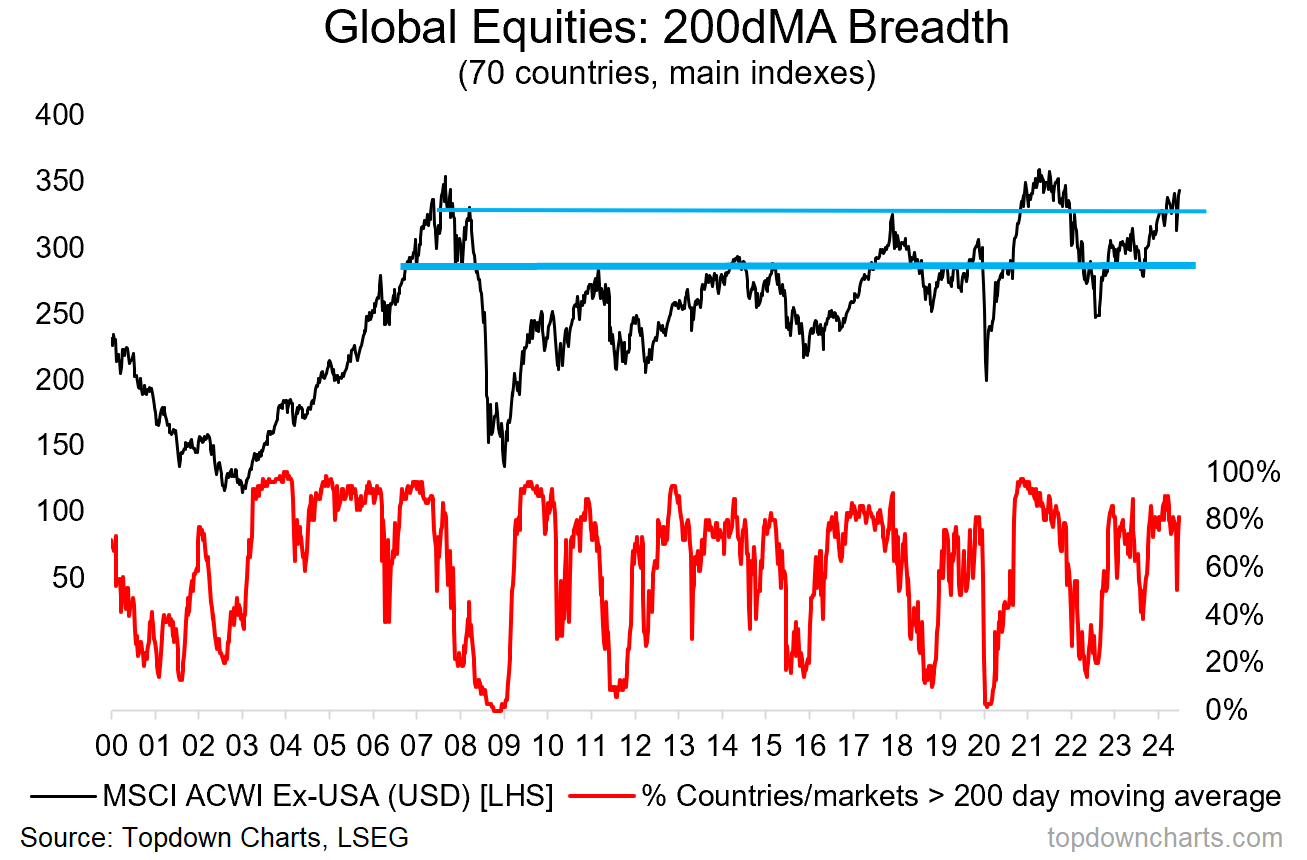

2. Glowing Global: Meanwhile, checking in on global equities (excluding US) things are looking decidedly desirable. The global market correction saw a brief dip back below that major resistance line before going on to notch-up new post-2022 highs this past week. Breadth across countries is also going strong (the strength is widespread, broad-based).

And by the way, remember a few weeks ago we were talking rotation? Well, one key potential avenue for rotation is global vs US. Global stocks are reasonably cheap by themselves and very cheap vs US, but there’s one key ingredient it needs…

Source: Topdown Charts Professional