Weekly S&P500 ChartStorm - 24 July 2022

This week: short-term technicals, sentiment, cash allocations, earnings revisions, historical market patterns, seasonality, ESG flows, software investment

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

NEW: Sign up to the (free) Chart Of The Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you one of the most interesting charts on our radar, along with commentary/context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! > > > Subscribe Now

1. Support & Resistance: The S&P 500 has managed to breakout vs initial short-term overhead resistance around 3900 AND its 50-day moving average, but has subsequently found another ceiling at 4000 (and arguably now features an overbought RSI).

Key thing for the bulls is that the 3900 level holds -- a successful test of what is now short-term support would be bullish, while a break lower would likely be the first step in another wave lower. Open minded, and listening to what price is saying…

Source: @Callum_Thomas

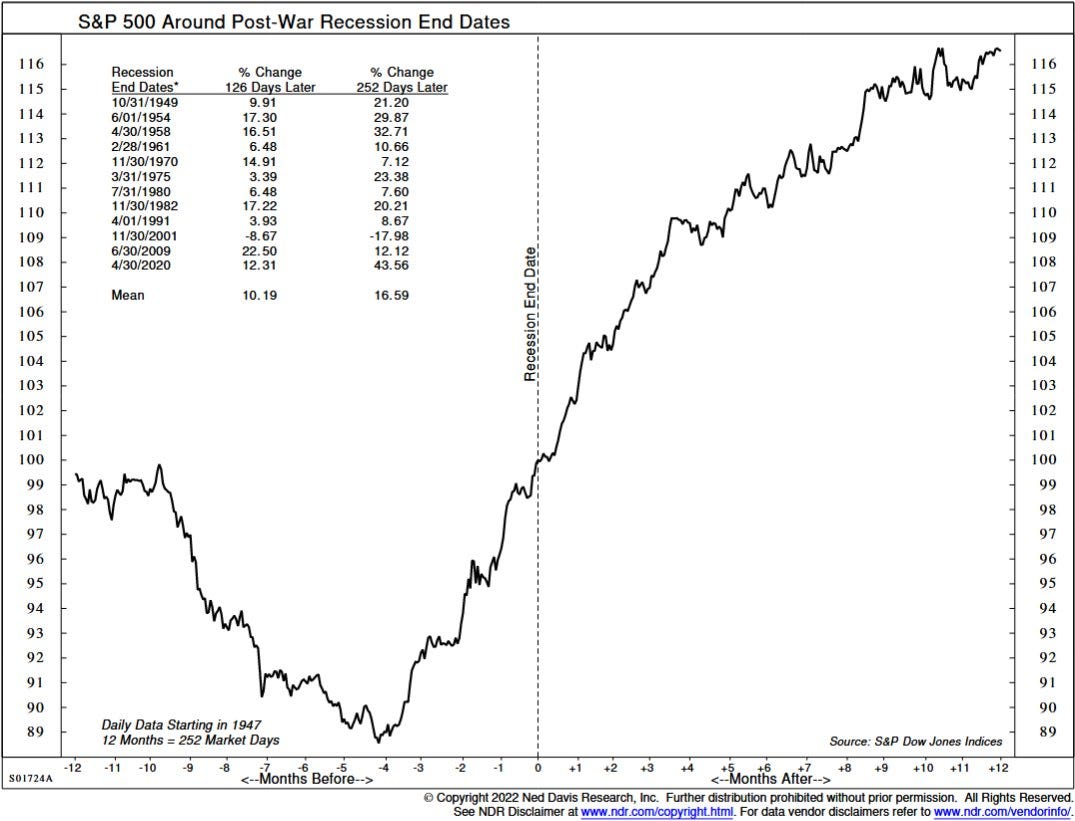

2. Recession Trading: Interesting to note that "on average, the S&P 500 tends to bottom about 4 months before the official recession end date".

(albeit, I don't know if we even have an official recession start date yet! and there are still big open questions about the degree + magnitude of a prospective forthcoming global recession)

Source: @NDR_Research via @DayHagan_Invest

3. Small Put/Call: Apparently small traders are now "spending more on leveraged, expiring bets that stocks will fall than they spend on bets that stocks will rise"

As a twist on Buffett’s old saying… Bears be fearful when others are greedily betting on fear? (of course the other interpretation is that rather than this being traders outright betting on a fall in the market, they are simply trying to hedge… but then we know a lot of folk got into options trading the past 2 years, with pure get-rich-quick speculative intent)

Source: @sentimentrader @JasonGoepfert

4. Cash Allocations: Cash up but not out...

Cash allocations (as measured by Charles Schwab — but from my data, confirmed by AAII survey and ICI actual data) have lifted to multi-month highs, but still miles off some of the major contrarian bullish levels seen in recent decades.

Source: @kevinduffy1929

5. Googling Bears: There’s an interesting dynamic — never before in history has information and sophisticated market analysis/data been so widely available... as such, people are more informed and speed of understanding is generally higher, but still it raises the question: if "everyone expects a bear market", will it still happen?

(I guess part of that is to ask: who is this “everyone“, but also what is driving the market — is it simply just flows and sentiment (which matter in the short-term), or do fundamentals matter eventually)

Source: @FusionptCapital

6. Downgradient: Back on the fundamentals, here comes the earnings downgrades as analysts catch-up (down?) to the deteriorating economic outlook.

Along with falling earnings estimates, history says we likely see a collapse in "Strong Buy and Buy" recommendations…

Source: @IanRHarnett

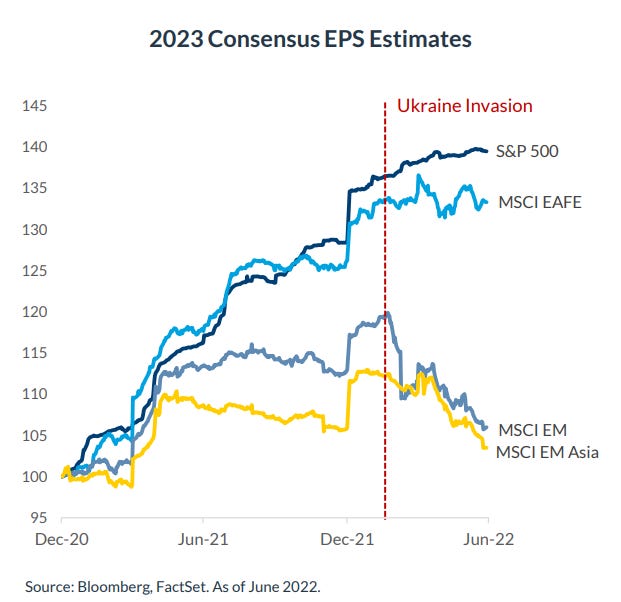

7. Earnings Outlook: Emerging Markets are usually a few steps ahead of developed markets given the heavy weightings in EM equities to traditional cyclical sectors (and hence sensitivity to the ebb and flow of the global economy).

As such, Developed Markets, and more specifically S&P 500 earnings estimates are likely the next shoe to drop in all this.

Source: @Mayhem4Markets

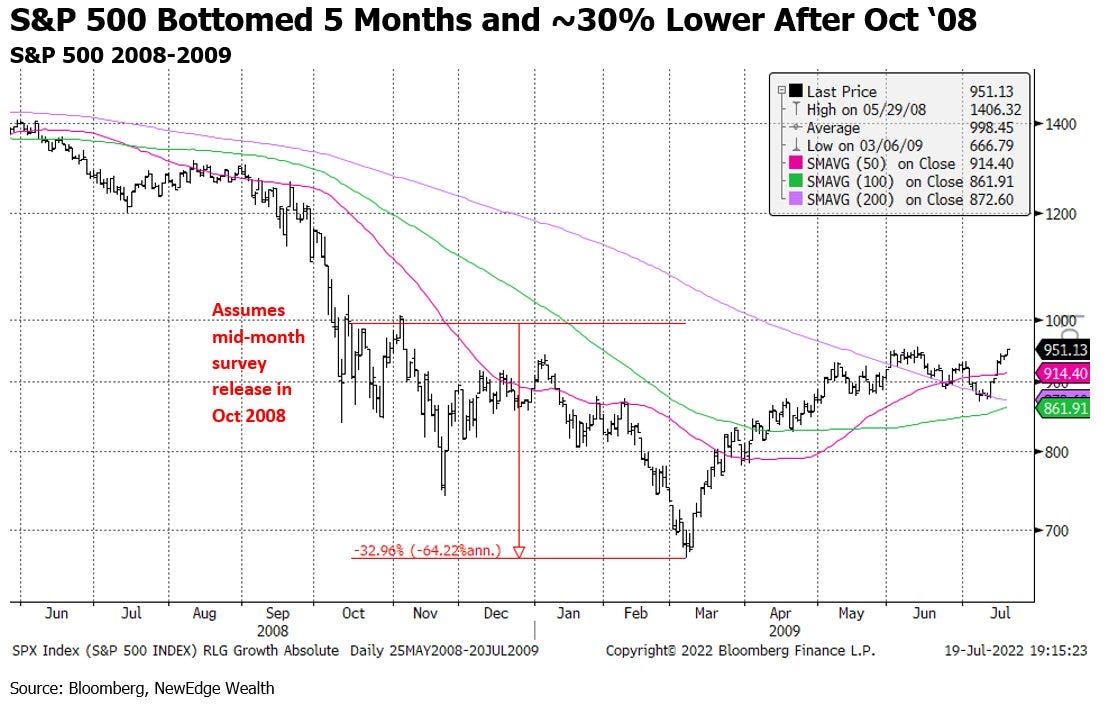

8. Contrarians Beware: The latest BofA Fund Manager survey showed the lowest allocation to stocks since Oct 2008 -- which contrarians would think would be a good thing... right?

But as Cameron Dawson of NewEdge highlights, back then the S&P didn't bottom until 5 months later and ~30% lower. Goes to show that Sentiment/Positioning carries not just contrarian information (at extremes — and sometimes with an early signal), but also momentum information.

Source: @CameronDawson

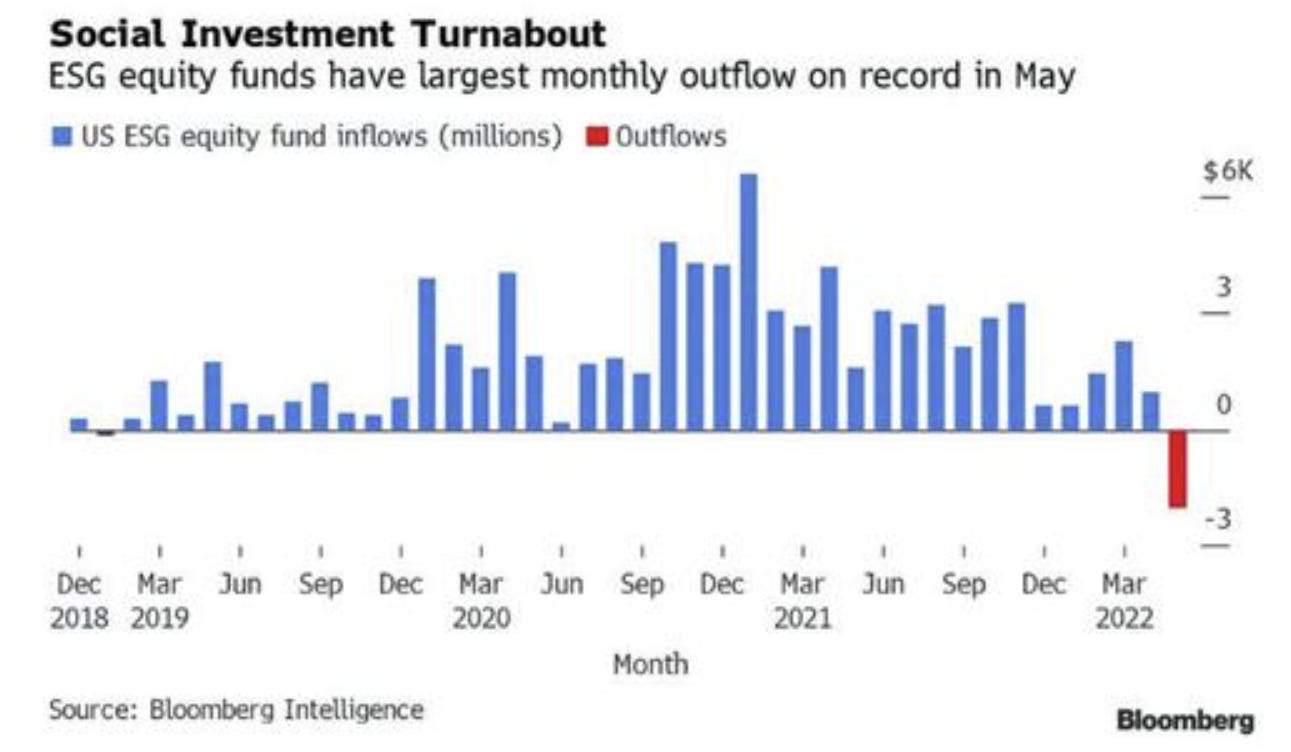

9. Escaping ESG: ESG investing faces its biggest test in the form of poor performance and wavering conviction in the face of an energy security crisis (no one ever said the energy transition was going to be easy!) not to mention big issues around greenwashing and often material mismatch between marketing vs investor intentions (e.g. there is a big difference between just excluding a few stocks vs actually making an impact). And this chart shows what perhaps might be the start of an “ESG winter” in terms of flows.

Source: @LanceRoberts via @zerohedge

10. Investment into bits vs bits and pieces... Interesting chart, interesting trends, and very much reflective of some of the price trends you see in the stock market in terms of sectors, countries, and relative performance.

Source: @MebFaber via @BarbarianCap

Thanks for following, I appreciate your interest!

BONUS CHART >> got to include a goody for the goodies who subscribed.

Market Seasonality Map: I thought it worth reflecting on the market seasonality map… even though frankly average seasonal patterns have not really applied this year, and indeed, the first half of this year was anything but average.

The typical tendency is for volatility (the VIX) to fall and stocks to rise in the first part of the year, and then for stocks to drift lower from July-Oct (and volatility to rise during the same time). All of that to be followed by the fabled year-end rally.

Some might muse, so far this year seems to be running on a reverse seasonality pattern… weakness in the first half, stability in the middle. Maybe then on that upside down logic, markets rally a bit more before an end of year puke!

But one thing I would add to the picture is the seasonality of credit spread levels — typically credit spreads have had a tendency to widen through Q3 (along side rising equity volatility).

One fundamental support for that would be that a lot of the headwinds and leading indicators I have previously discussed point to the recession getting underway in earnest in Q3.

Earnings revisions are starting to take a dive already, the PMIs are wobbling, and as I noted the other day on Twitter, the NAHB is plunging. Not good signs.

While the first wave of the bear market was largely a result of tech correcting + geopolitics and supply shocks + monetary tightening, it may well be that a second wave comes from weaker earnings and economic stress.

That would be the type of thing to drive credit spreads wider.

So I think it’s important to pay attention to price, and be open-minded — not locked into one point of view on the market outlook — but at the same time, not ignore the clear risks and bad macro facing markets at the moment.

Seasonality is not something to rely on, but if it aligns with the bigger picture then there can be something to it. And seasonality is not on the side of risk assets at this time.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

Relevant Tickers Discussed: SPY 0.00%↑ VOO 0.00%↑ IVV 0.00%↑ EEM 0.00%↑

Thank you!

4. Cash Allocations: Ideas and charts are great.