Weekly S&P500 ChartStorm - 22 January 2023

This week: trendline update, breadth thrusts, intermarkets, global vs US, fund manager allocations, profit margins, "techy sectors", earnings call swearing, and energy sector hatred...

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post exclusively on Substack.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

IMPORTANT NOTICE

As mentioned, the Weekly ChartStorm is now reader-supported (paid).

This will be the last regular free edition — Please Subscribe (only $50/year) to keep receiving the charts and commentary each week.

1. Still Make or Break Time! A quick update on the most-watched trendline in markets. As of Friday’s close the market managed to nudge just above its 200-day moving average, but is still yet to make a move above that down trend line. Next week features a lot of economic data and earnings season steps up (26% of market cap reporting the week ahead), so once again: it’s make or break time…

Source: Topdown Charts @TopdownCharts

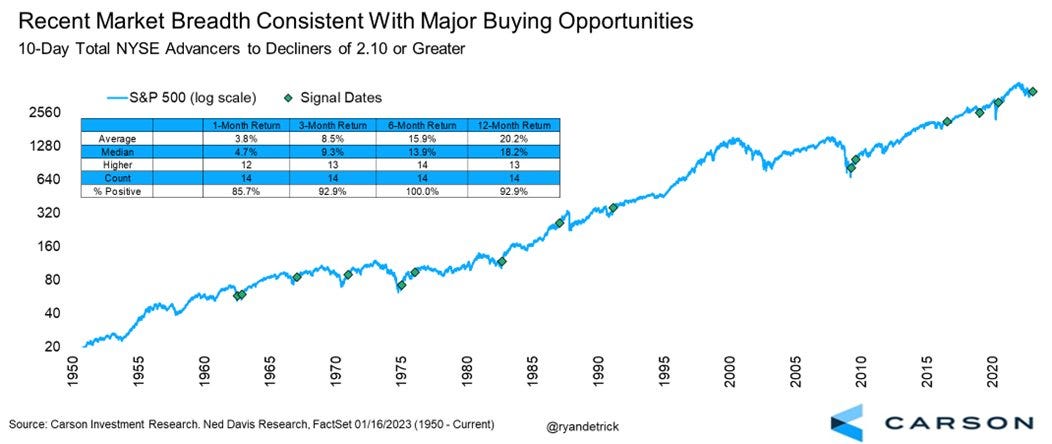

2. Bullish Breadth Signal: As a clue for the make-or-break question, this interesting chart maps out the instances of the total 10-day NYSE advancers vs decliners going above 2.1x — it seems to have a fairly good track record of flagging buying opportunities. Will it be different this time?

Source: @RyanDetrick

3. Breadth But: Here comes the “but” to that previous chart — while the signal has had a mostly excellent track record, there was a period where it triggered false signals over and over again. Albeit that period (1930-1947) featured The Great Depression and World War 2. Which I guess is another way of saying that bad things can happen to good signals!

Source: @BergMilton

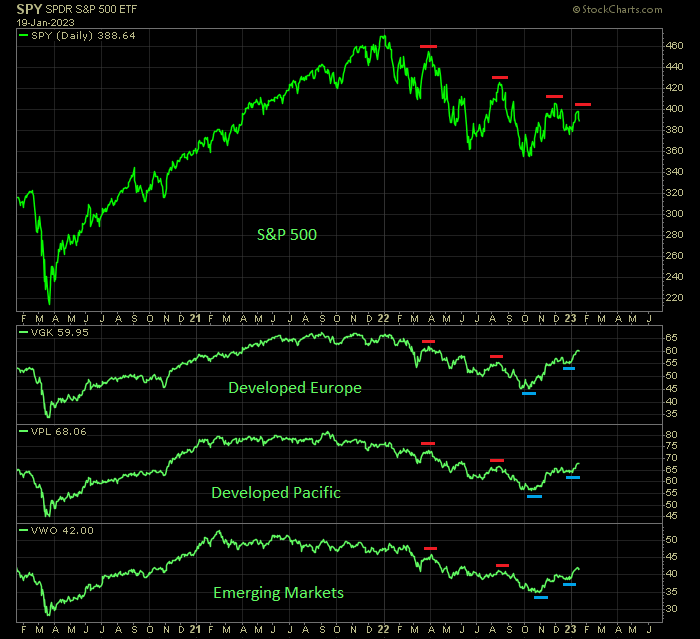

4. USA vs The World: This excellent chart is interesting for a couple of reasons. First, the bullish technical interpretation would say that the improvement in the rest of the world is a sign of things to come for the US (basically intermarket analysis 101 — if two markets that usually move similarly start moving differently: pay attention to what that might be telling us). But it also gives reference to a prospective change in leadership for global equities…

Source: @mark_ungewitter

5. Changing of the Guard: Indeed, we have seen an initial and quite sharp turn in the relative performance line of US vs developed markets — marking what may well be the end of a decade-long relative bull market of US vs rest of world equities. This is perhaps one of the most important themes underway right now, and makes me think I should ought to do an “Off-Topic ChartStorm“ on this issue…

Source: @WillieDelwiche

Just a friendly reminder to upgrade your subscription to paid if you haven’t already.

6. Leaving the USA: As a flow-on, on the topic of shifting prospects for US vs global, it seems fund managers have already made up their minds on this issue, and are voting with their feet. Huge development, and not necessarily a contrarian signal (but it does go to show that a lot of minds are already made up on this).

Source: @Callum_Thomas

7. Marginal Profit Margins: US profit margins have peaked, at least for this cycle, and perhaps for a while. At the very least we likely see profit margins head lower as cost pressures bite, and weaker growth weighs — I reckon growth stocks are going to find it hard to out-grow the macro.

Source: @albertedwards99 via @LanceRoberts

8. Techy Sector Top: Definitely different from the dot com bubble in many respects, but definitely also some excesses that needed to be unwound. My sense is we are still just over midway through this process, and ultimately, again: the tech and tech-related growth stocks can’t outgrow the macro. They also face a fundamental test of leaving the world of zero interest rates behind…

Source: The 10 Charts to Watch in 2023

9. Unsustainably Unprofitable: An astounding 40% of Russell 2000 companies were unprofitable last year. You have to wonder what’s going to happen to these companies in a world where higher interest rates may mean greater rationing of capital vs the freely and cheaply available flood of funding of most of the past decade. Throw in a possible global recession and things could get ugly. No wonder fund managers are rotating out of US equities.

Source: @MichaelAArouet

10. Bleep! Turns out 2022 was a record year for earnings call swearing! Can postulate why, for instance perhaps it’s the multiple-challenging backdrop and frustrations boiling over (but perhaps also an element of the casualization of everything post-pandemic — e.g. phasing out of suits from usual business attire to t-shirts, etc). Pretty interesting chart either way in terms of the human element of it all.

Source: @biancoresearch

Last reminder to upgrade to paid to keep receiving these!

Thanks for reading! Just one more reminder that this will be the last regular free edition of the Weekly S&P500 ChartStorm, and you will need to upgrade your subscription to paid in order to keep receiving these.

BONUS CHART >> got to include a goody for the goodies who subscribed.

Energy Sector Market Share: This chart is fascinating. As of the latest data, the Energy Sector has an earnings weighting basically *twice* that of its market cap weighting.

This is what happens when no one wants to buy energy stocks anymore.

I could probably leave it there as the chart itself speaks volumes, but a few points to ponder…

First, the disconnect probably says as much about possible upside for energy stocks (blue line goes up) due to ESG energy skepticism, as it does about the prospect that falling energy prices in H2 of 2022 brings the black line back down.

Indeed, there are a few examples where the black line did most of the heavy lifting in closing previous sharp disconnects.

But as with many things in macro and markets, the trend is your friend. If this is more about the emergence or shifting into a new upward trend in earnings share, then we are definitely going to want to pay closer attention to energy stocks.

Sure, eventually fusion and other breakthroughs are going to make fossil fuels a thing of the past, but for now we still have to keep the wheels turning one way or another — and we shouldn’t count out the traditional energy sector just yet (whether we like it or not).

—

Best regards,

Callum Thomas

Regarding energy stocks: for some countries there might be an impact of „windfall tax“ ? Not just Oil & Gas stocks, but also Utilities and Renewables. I have lost the overview... may be this could be part of one of the next chart storms ? America, Europe, Asia.