Weekly S&P500 ChartStorm - 21 November 2021

This week: stockmarket + volatility seasonality, momentum stats, bad breadth, growth vs value, energy stocks, buybacks dividends and payouts, and Buffett...

Welcome to the Weekly S&P500 #ChartStorm (by email!)

The Chart Storm is a weekly selection of charts which I hand pick from around the web (+some of my own charts), and then post on Twitter.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

p.s. if you haven’t already, subscribe (free) to receive the ChartStorm direct to your inbox, so you don’t miss out on any charts (you never know which one could change the whole perspective!)

1. S&P 500 Seasonality Chart: It’s everyone’s favorite chart updated again (maybe for the last time this year?). The S&P500 has been sticking to the seasonality script through most of this year… makes me think about Murphy’s Law tho - maybe the market will start to improvise and go off-script? Either way, the next few weeks seasonally look like sideways action.

Source: @topdowncharts

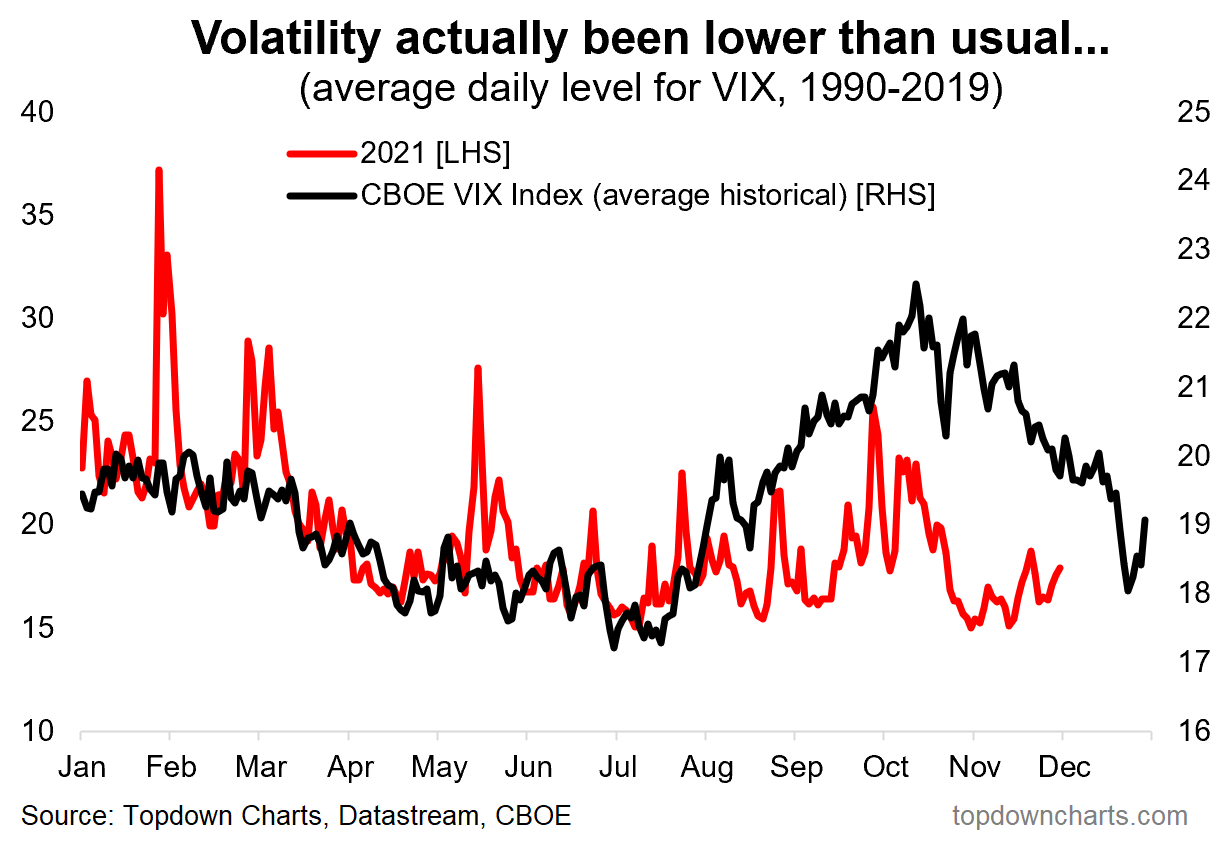

2. Volatility Seasonality: A twist on the previous chart — same concept, but this time with implied volatility. I find it interesting to note that the VIX has actually been a bit lower than usual for this time of the year (and trending up short-term…). One last VIX spike before year-end?

Source: @topdowncharts

3. Stockmarket Statistics: What happens after the market goes up a “crazy overheated” 20%+ over the course of a year?

More Gains.

Historically most of the time if the market closed up 20%+ for the year, the next year was also positive (84% of the time). As of writing, the market is up some 27% YTD (albeit, this year ain't over yet!).

Source: @RyanDetrick

4. Bad Breadth? Fully 1/3rd of stocks are in a downtrend.

(defined as trading below their respective 200dma)

Will this bearish divergence be a problem?

Source: Index Indicators

5. GAARP vs GAAAP: On this metric, growth stocks are the most expensive ever vs value stocks. So it begs the question… Growth at a reasonable price? or Growth at *any* price?

(but then again, who defines what "reasonable" is in a market like this!)

Source: @TheOneDave

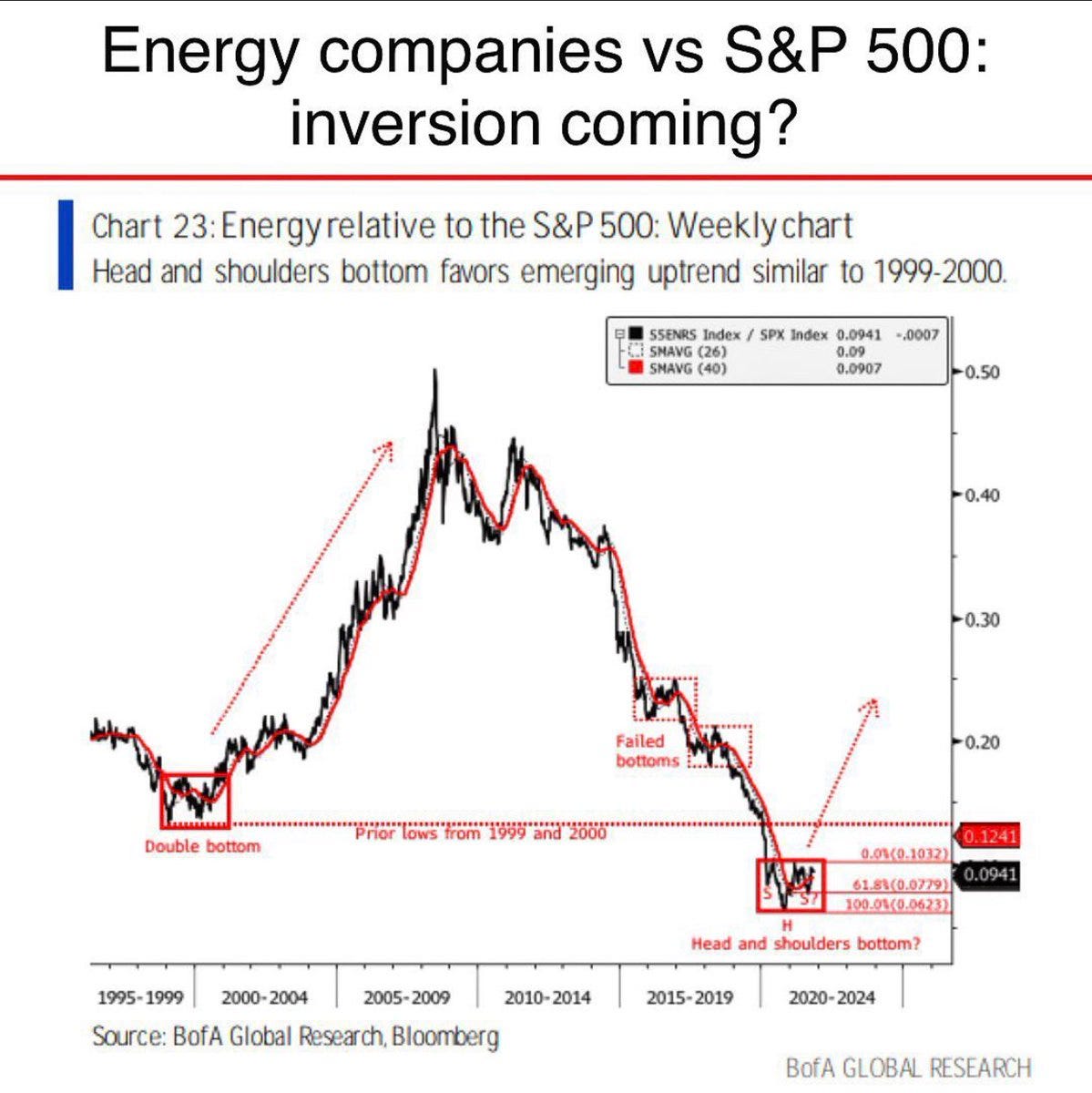

6. Low Energy: Energy stocks are attempting to turn the corner vs the rest of the market, but face high hurdles from the raging tech bull market, rise of ESG investing and regulatory/political hurdles, not to mention commodity market volatility.

What comes down must go up? (or something else?)

Source: @dissectmarkets

7. Buybacks Back: New all-time high for buybacks in Q3 (with 95% reported). Always makes me wonder these trends — you see the majority of buybacks occurring near market peaks… i.e. when valuations are extreme expensive. The opposite of value investing: buy more when its expensive, buy less when it’s cheap — seems like upside-down logic to me, but then again I am a simple man.

Source: @hsilverb

8. Payout Ratio: As an interesting follow-on to the ATH in buybacks/dividends, it’s interesting to note that the dividend payout ratio is actually below average...

Scope to return more cash to investors?

Source: @ChrisDagnes

9. Buffett Indicator: Looks like this indicator has reached a permanently higher plateau! (kidding of course - echoing the famous last words of Irving Fisher back in 1929) Interesting stat to note: to make this indicator as cheap as where it got to during the financial crisis lows the market would need to fall over 70%. Definitely not a prediction, but interesting nonetheless. I would say I have multiple quibbles with this indicator, I think CAPE and ERP are better valuation metrics, but that’s a topic for another day.

Source: @KailashConcepts

10. Buffett the Compounder: Speaking of Buffett, a lesson in compounding.

Source: @DividendGrowth

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

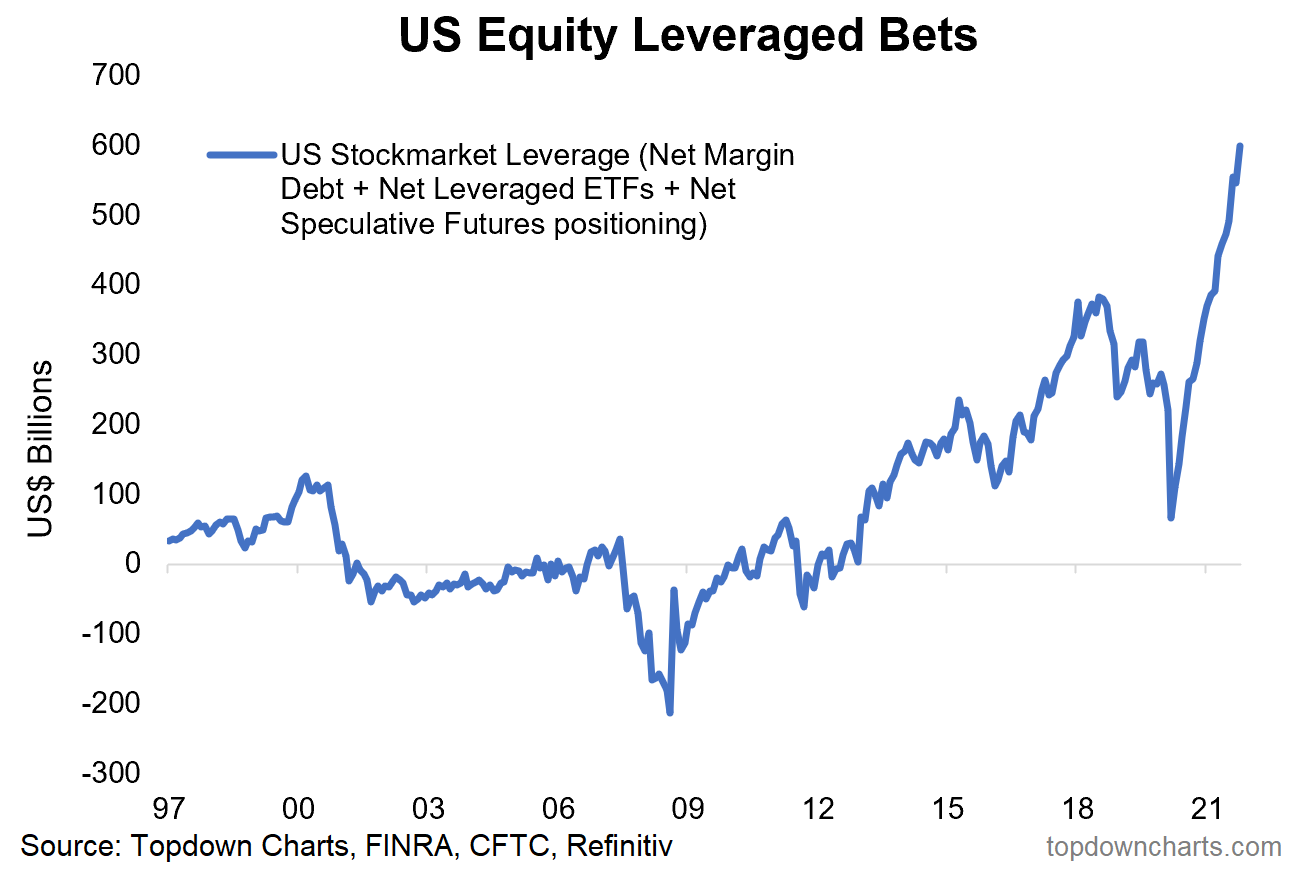

Leveraged Equity Bets: here’s what it looks like if you add up margin trading debt, leveraged ETF assets, and speculative futures positioning…

Basically, a lot of leverage.

While the chart above shows the nominal dollar amounts, which are definitely not small, the next chart standardizes it against market cap.

When you look at it this way it’s not *that* high, but it is still close to record highs, and again, it’s definitely not insignificant by any means.

By itself this chart is kind of interesting, and certainly gives some context as to the risks in the system. When you add into the picture the fact that most valuation metrics for US equities are at extremely elevated/expensive levels, the procession of mini-bubbles we’ve seen across markets/assets, and an eventual (already making baby steps with taper) withdrawal of Fed stimulus… it perhaps takes on a little bit more meaning.

Until then, it’s just another sign of the times of this big bull market.

—

Best regards,

Callum Thomas

SPONSOR: ( …he’s me!)

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the key ideas and themes from the institutional fund manager service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think