Weekly S&P500 ChartStorm - 21 August 2022

This week: technical update, futures positioning, short squeezes, investor actions vs investor opinions, some bullish technical charts, social media stocks, earnings risks, buybacks vs capex, EM vs DM

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

NEW: Sign up to the (free) Chart Of The Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you one of the most interesting charts on our radar, along with commentary/context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! > > > Subscribe Now

1. Welcome to Your New Lower High: All the makings of a lower high...

-failure at the 200-day moving average

-failure at a key overhead resistance level

-RSI rolling over from overbought

-(and (not pictured) a bunch of underlying risk indicators also turned down)

Source: @Callum_Thomas

2. Short Squeeze 2022: A major driver of the last leg up was short-covering. Conceptually this is a key reason why BMRs (Bear Market Rallies) are often sharp and substantial ...and virtually an inevitable feature of a bear market as the market gets stretched too far in one direction (even if that ends up being the "right" direction).

Source: @Mayhem4Markets

3. Asset Manager Futures Positioning: Asset managers continuing to run fairly light futures positioning in US equities. Not a major part of the market dollar-wise, but gives a sense of where the smarter/bigger money is positioned.

Source: @GameofTrades_

4. Saying vs Doing (part 1): Seems to be a disconnect between investors saying they are underweight/bearish equities vs actual equity fund flows. In other words, normally you would have expected to see large outflows from equities. Not this time. Not for now at least.

Source: @unusual_whales

5. Saying vs Doing (part 2): On a similar vein, this chart attempts to amalgamate a bunch of different data where I have observed the same kind of pattern:

-investors say they are extreme bearish in surveys

--but still have relatively high portfolio allocations to equities

---and are still running elevated leveraged positions

And so the key question is: were they just being overly dramatic or is there more selling/deleveraging incoming?

Source: @topdowncharts

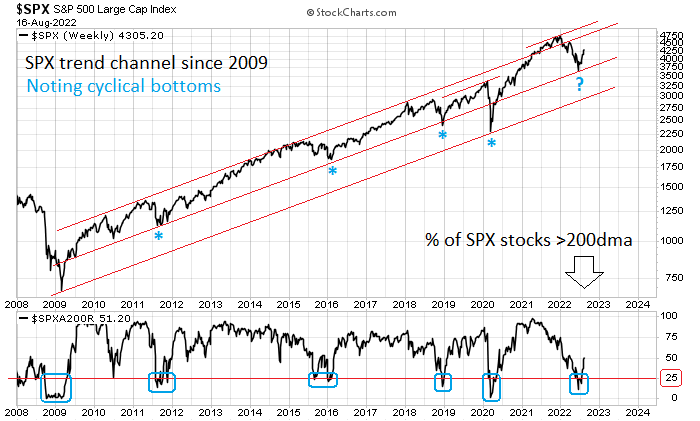

6. Still Bull? (on the other hand), as the excellent Mark Ungewitter suggests or highlights with this chart: “If June 2022 was a cyclical bottom, as increasingly evidenced, it’s not out of character with secular trend since March 2009.“

Source: @mark_ungewitter

7. Trusty Thrusts: Looking at the incidence of momentum thrusts with breadth thrusts (as what has just happened), it seems like the worst case based on 8 samples across a 40yr period is basically a benign/boring ranging with a slight upward drift (e.g. the early 90's).

Source: @WillieDelwiche

8. The Social Media Stock Dilemma: Social media stocks peaked basically right about the time of the release of docudrama film "The Social Dilemma".

Also intriguing is that much of the underperformance of social media stocks has come as pandemic reopening released folk back into the wild... (less need for artificial human interaction back in the real world?)

Source: @adaptiv

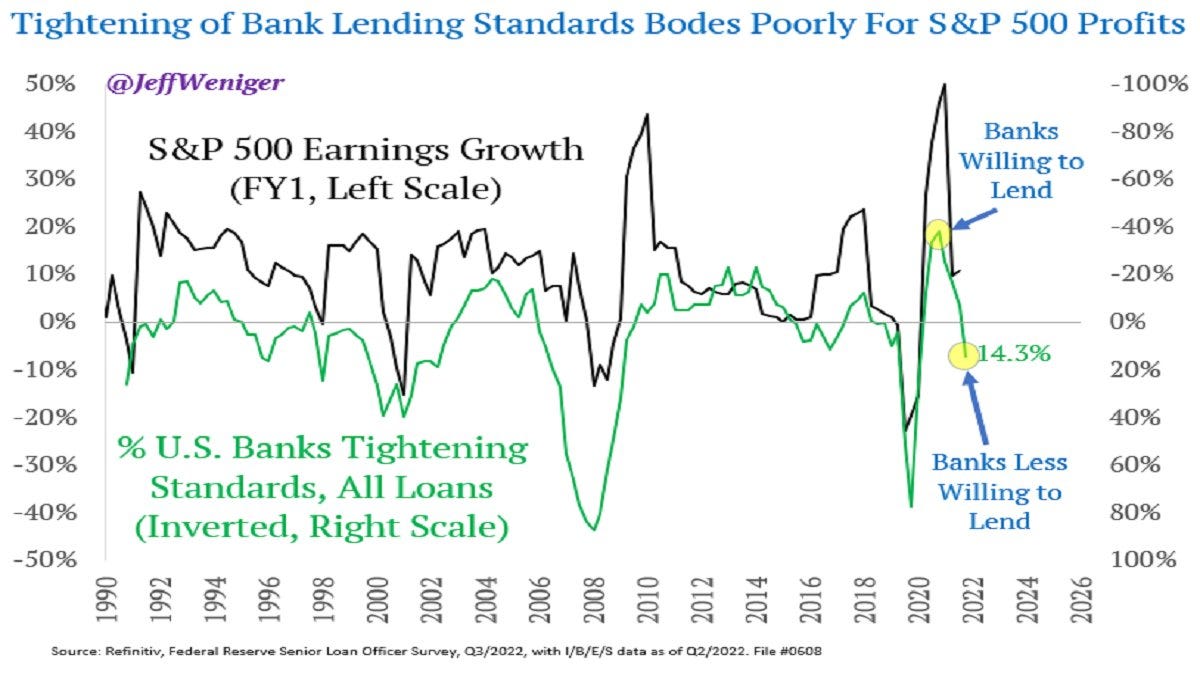

9. Bankers and Earnings: If you ask Wall Street Bank stock analysts, they will tell you earnings are going to go up, but if you ask Main Street Bank *loan officers* -- they will tell you a very different prognosis... Tightening of lending standards by commercial banks is pointing to a contraction in earnings (basically banks are taking precautions as recession risks loom).

Source: @JeffWeniger

10. Buybacks vs Capex: “Why invest for the long-term when you can just give shareholders what they want in the short-term?“

Now there is a bit of nuance to this, because buybacks are just another way of returning cash to shareholders (the other being dividends). This can reflect a reality that companies can’t find profitable enough capex opportunities vs simply returning cash to shareholders.

But it does to a certain degree also highlight some of the potential distortions to corporate behavior from being a listed company (becoming captive to the short-termism, instant gratification, and hyperactivity of investors/analysts in public markets).

Source: @TaviCosta

Thanks for following, I appreciate your interest!

BONUS CHART >> got to include a goody for the goodies who subscribed.

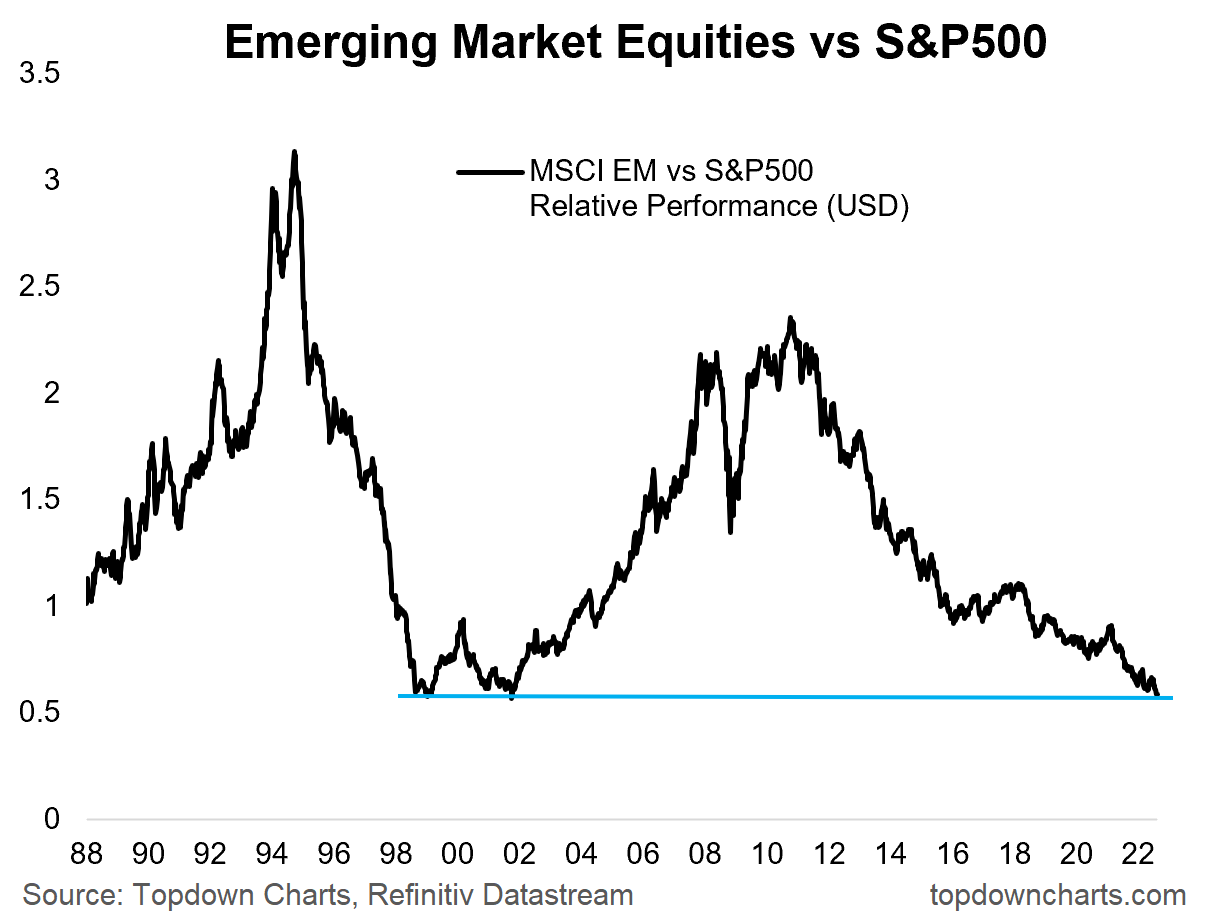

Emerging Markets vs US Equities: that is one heck of a round-trip in relative performance for emerging markets vs the S&P500...

Emerging Markets outperformed the S&P 500 some 4x over the 10 year period from 2001 to 2010, only to give it all back over the subsequent ~10 years.

It’s interesting to look back and reflect on these periods.

The structural bull market in EM vs US featured a period of tech stagnation post-dot com on the US side, vs a big economic catch-up by emerging markets (especially China), and a massive commodities bull market.

The bear market in EM vs US on the other hand saw a period of economic stagnation across emerging markets and a secular bear market in commodities, meanwhile US tech had a decade-long renaissance.

It’s hard to make forecasts, especially about the future, but as to what happens the next decade — it’s probably going to show up in the form of a big secular trend in a chart (like the one above).

I will say one thing though that does kind of help, and that’s valuations. At the extreme around the peak of the dot com bubble, EM traded at almost an 80% discount vs the US. Fast forward, at the peak of the EM frenzy, EM traded at about a 30% premium vs US.

As I write EM is trading about a 50-60% discount vs the US.

It’s not as extreme as that 80% discount all the way back in the day, but it is a major discount and it gives one pause to ponder if all the bad things about EM is already in the price and all the good things about the US is already in the price, and perhaps then some. Thinking about that along with the completion of that massive round trip certainly at the least makes one want to go and do a bit more homework on this one…

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

Very important deck (again) this week, Callum, thank you.

Helpful for me to sit away from the headlines and consider a bigger picture, like we did two months back.

Finally joined that “Covid Club” despite all the care and attentive mask adherence. Stay safe.

To what extent is the EM round trip a China story? Are other EM markets showing the same profile?