Weekly S&P500 ChartStorm - 2 May 2021

Your weekly selection of charts...

Welcome to the Weekly S&P500 #ChartStorm (by email!)

The Chart Storm is a weekly selection of 10 charts which I hand pick from around the web (+some of my own charts), and then post on Twitter.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

1. S&P500 Monthly Chart: Happy New Month! Welcome to May. Here’s an update of the monthly chart - that vertical move got a few people talking… albeit the log chart is not as stark. Aside from that, it is still handily above the 10-month (~200day) moving average [a simple trend indicator].

Source: @topdowncharts

2. Short-term Bearish RSI Divergence: Kind of speaks for itself - the textbook definition of a bearish divergence is a higher high in the index vs a lower high in the relevant indicator. It’s not necessarily a done deal, but I can think of a few prospective triggers for a short-term selloff/correction.

Source: @Callum_Thomas

3. Short-term Bearish Breadth Divergence: Same as the previous chart, but this time looking at market breadth rather than price momentum. Some might argue that it’s natural to see price momentum taper off after a sharp move, but I find developments in breadth (basically weakness showing up in the underlying components) are typically less easy to explain away.

Source: @Callum_Thomas

4. Leveraged ETF Trading Activity: This indicator has also moved into the risk zone (indicator tracks the ratio of volume traded in leveraged long vs short/inverse US equity ETFs). Couple things to note: a. the signal doesn’t always work, and b. sometimes it flags a big correction, other times a simple selloff.

Source: @topdowncharts

5. AUM of leveraged-long equity ETFs at a new ATH: Just another sign of folk leveraging up in a FOMO frenzy to chase evermore gains.

Source: @topdowncharts

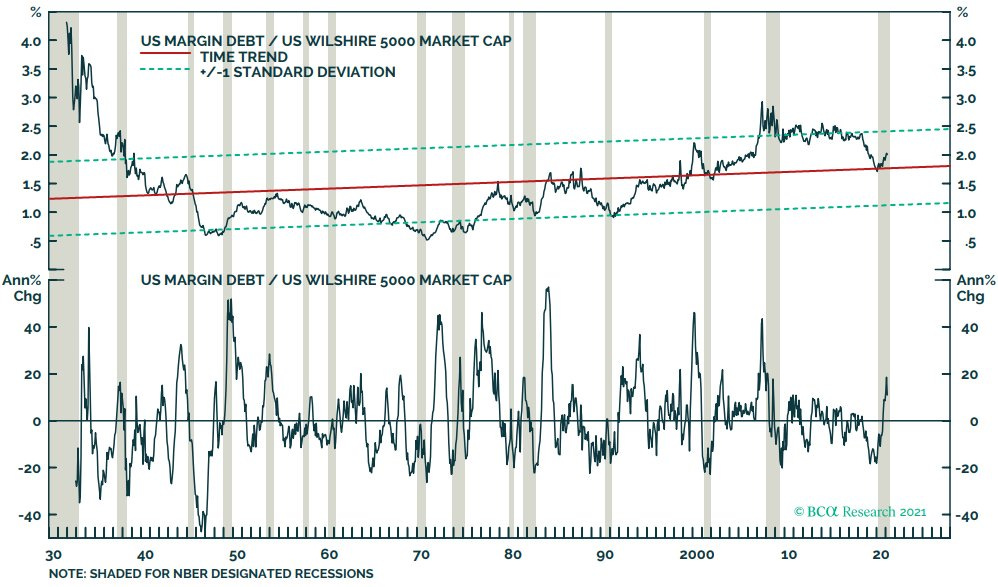

6. Margin Debt Warning: Seems to be a theme here… some short-term risk flags, and a medium-term risk flag here. One more warning: n = 2. (also see the next chart, and also keep in mind the very low base comparator in March last year - arguably it’s a little overstated in that respect)

Source: @Not_Jim_Cramer

7. Margin Debt - ADJUSTED: Here’s how it looks if you adjust margin debt for market cap (which you probably should do). As a proportion of market cap it’s high, but not really crazy by any means. We still see a clear acceleration - and in that respect it is consistent with the other anecdotal and data evidence that show excess optimism and greed pervading markets.

Source: @MrBlonde_macro

8. Earnings Sentiment: Earnings call sentiment has surged after crashing last year - even gone on to a new All Time High.

Source: @daniburgz

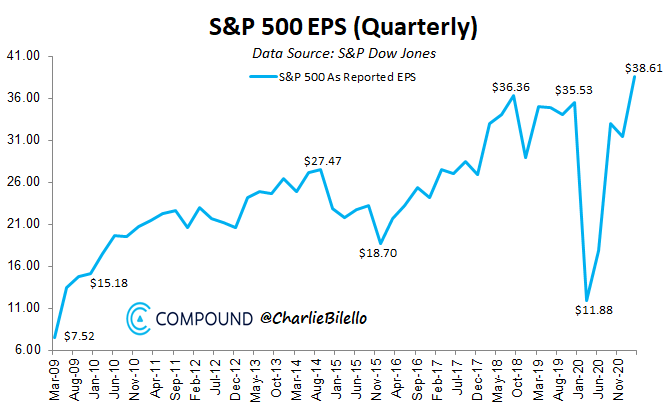

9. S&P500 Earnings: EPS also hitting a new ATH. So there certainly is some fundamental reason to be optimistic (actual data is recovering, vaccine rollout, massive fiscal + monetary stimulus, pent up demand). I guess the issue is at this point it’s fairly obvious, while this time last year only a few were bold enough to suggest such an outcome.

Source: @charliebilello

10. Financials - Relative Value Indicator: I’ve done a bunch of similar work that shows financials/banks very cheap on a relative basis (and it’s even more compelling at a global - especially global ex-US level). I usually find valuations speak for themselves at extremes, so this chart is very interesting to me.

Source: @KailashConcepts

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

Neutral Sentiment — Neutral No More: this peculiar chart of mine shows the rolling 12-month average of “Neutral“ sentiment from a couple of popular investor surveys.

The interesting thing is how neutral sentiment has absolutely collapsed. Clearly most of this has gone to the bullish side, but there are a few holdout bears still too.

As a market and societal observation, it’s perhaps one of the best quantitative examples of the polarization that has taken hold - and at the same time the fascinating crowd psychology we’re seeing in markets.

As a timing instrument it’s a little problematic - we’ve seen this indicator collapse before, but there’s no real reliable signal e.g. benign/bullish in the early 90’s, very bullish in the late 90’s, bearish around 2000, bullish in the early 2000’s, bearish in the lead up to 2008, and mixed/slightly bearish into 2018.

Arguably a similar feature across these instances is that collapses in the indicator tend to be bearish later in the cycle. In that respect, if you consider the 2020 macro/market events to be a reset rather than a cycle-end, you could argue the signal is bearish.

One to ponder…

—

Best regards,

Callum Thomas