Weekly S&P500 #ChartStorm - 14 March 2021

Your weekly selection of charts...

Welcome to the Weekly S&P500 #ChartStorm (by email!)

Just to be clear, the chart storm will continue as always on Twitter, this is just a means by which to make access more convenient and consistent for those who happen to miss it on Twitter for whatever reason.

1. Looks like the previously highlighted bearish divergence has been resolved after a brief -5% selloff/correction...

2. Very different picture for the Nasdaq tho: 50dma breadth got completely washed-out/oversold after a chunkier -12.5% correction.

Shot across the bows for the frothy tech sector...

3. That price action in Nasdaq is likely the main driver behind the NAAIM equity exposure index dropping to a 10-month low...

h/t @michaelsantoli

4. Similarly, Hulbert Nasdaq Newsletter Sentiment took a sharp dive. Problem is: sentiment moves like this during corrections AND turning points. This might not be *it*, but we are late in the cycle...

h/t @TN

5. Positioning. Clean. Out.

h/t @modestproposal1

6. Lol, who cares about #valuations?

(I do) :

7. “BTFD” ?

h/t @SarahPonczek

8. Stockmarket says *US* reopening is a done-deal.

As a side note, I would say UK is significantly underpriced here (both in terms of this chart but also the broader picture)

h/t @choffstein

9. S&P 500 dividend payout ratio history

(wonder what it would look like with buybacks)

h/t @MrBlonde_macro

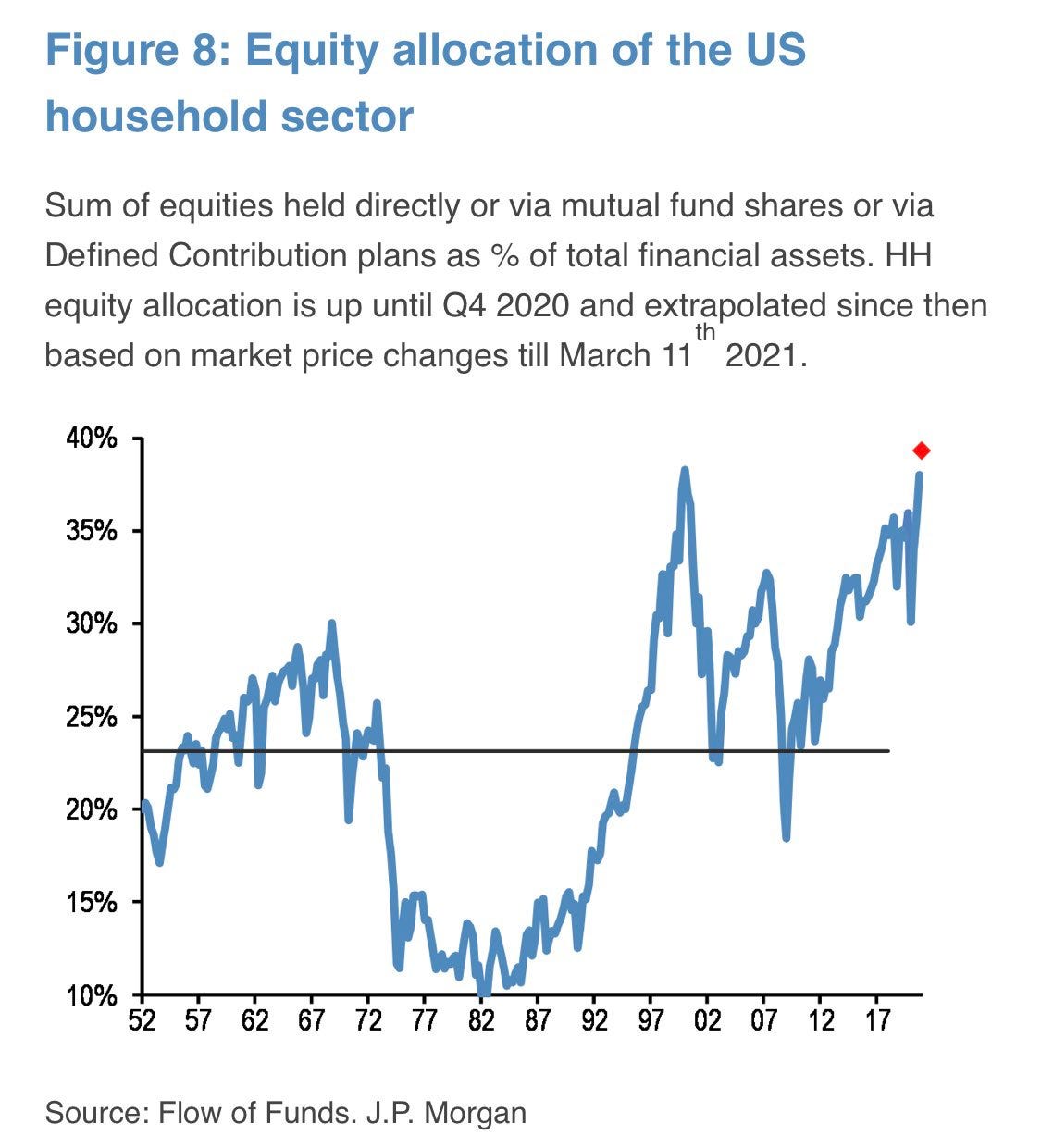

10. New ATH!!

US households equity allocations at a new record high... wonder what it looks like for crypto (or SPACs and NFTs)

h/t @jsblokland

Again, this is only the second edition of the email version, so let me know if there are any issues in viewing the charts.

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

UK before vs after Brexit: UK equities went from trading at a premium to Eurozone equities around the time of the Brexit vote to now at a decade low (trading at a deep discount). I think this chart is interesting for a few reasons: 1. the clear longer-term mean reversion tendencies; 2. the UK is making much faster progress towards herd immunity vs Europe (vaccination rollout); 3. people still are relatively bearish/ignorant of UK equities (after all the Brexit drama, they sort of dismiss them). Interesting setup…

Best Regards,

Callum Thomas