Weekly S&P500 ChartStorm - 12 November 2023

This week: Fed pause, EM awakening, risk-on sentiment shift, the big reset, positioning, interest expense vs income, uninversion, and asset allocations...

Welcome to the latest Weekly S&P500 #ChartStorm!

Learnings and conclusions from this week’s charts:

Sentiment has undergone a significant shift to risk-on.

This comes after a shakeout in positioning, reset in sentiment.

EM assets are trading as if the Fed is finished on rate hikes.

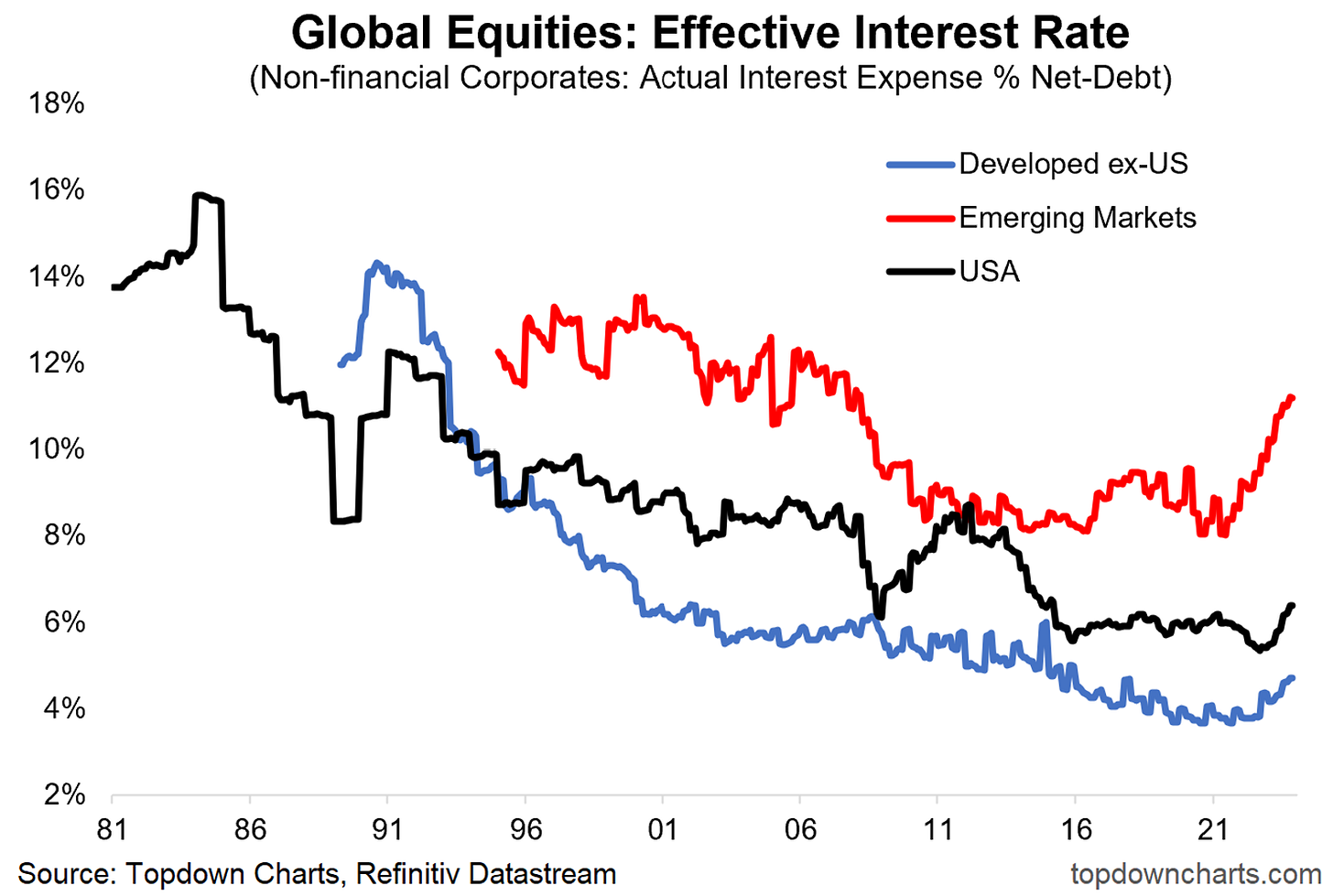

Effective borrowing costs are trending higher for listed companies.

The yield curve “uninversion” reminds us the importance of risk management.

Overall, the market mood has changed substantially — and it comes from a material reset in sentiment and positioning. For a market looking for (and finding) any excuse to rally and with greed and FOMO focusing folk on the prospect of a possible repeat of October 2022, it’s resolutely risk-on.

1. Pause for Thought: The Fed has kept rates unchanged for 4 months now (after over 500bps of hikes across 17 months), and with payrolls softening and inflation pressures waning, I think it’s safe to call it a pause. Here’s how the market has typically traded around Fed Pauses (and into rate cuts). Interesting for sure, albeit it brings us back to the whole recession: yes or no? issue in terms of the market outlook.

Source: Bloomberg via Daily Chartbook

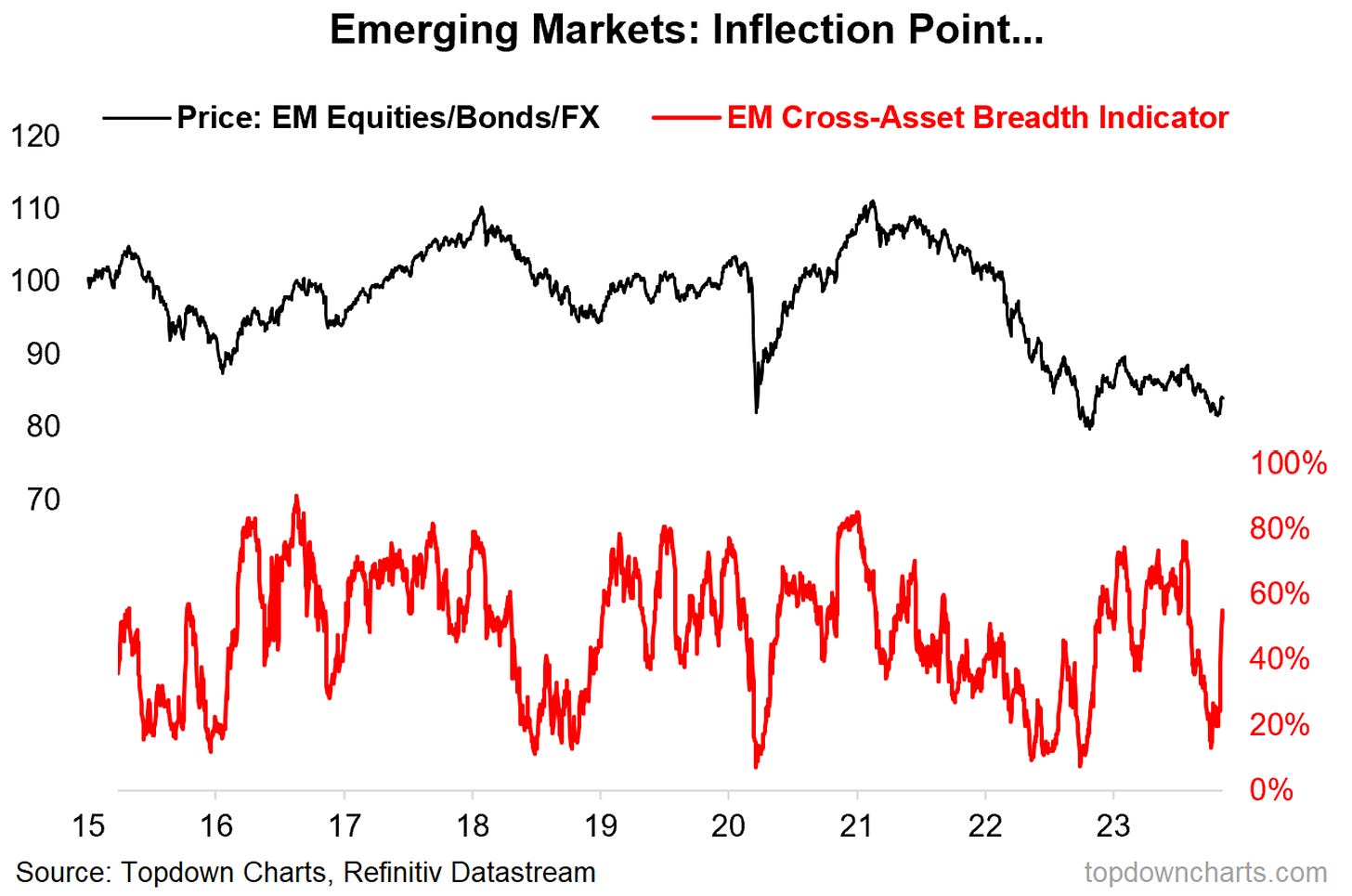

2. EM Assets Awaken: This chart makes me think about how stocks traded off the October 2022 lows — it was a weird rally, hinging almost solely on the belief of a peak in inflation. And there are several parallels to the current market outlook — if the market believes that the Fed has peaked and the next step is rate cuts… that belief by itself may well be enough to ignite another significant rally. And if we look at the price action across emerging market assets (equities, rates, FX), EM investors have made up their minds: the Fed is done, risk-on.

Source: Chart of the Week - Emerging Markets Inflection Point

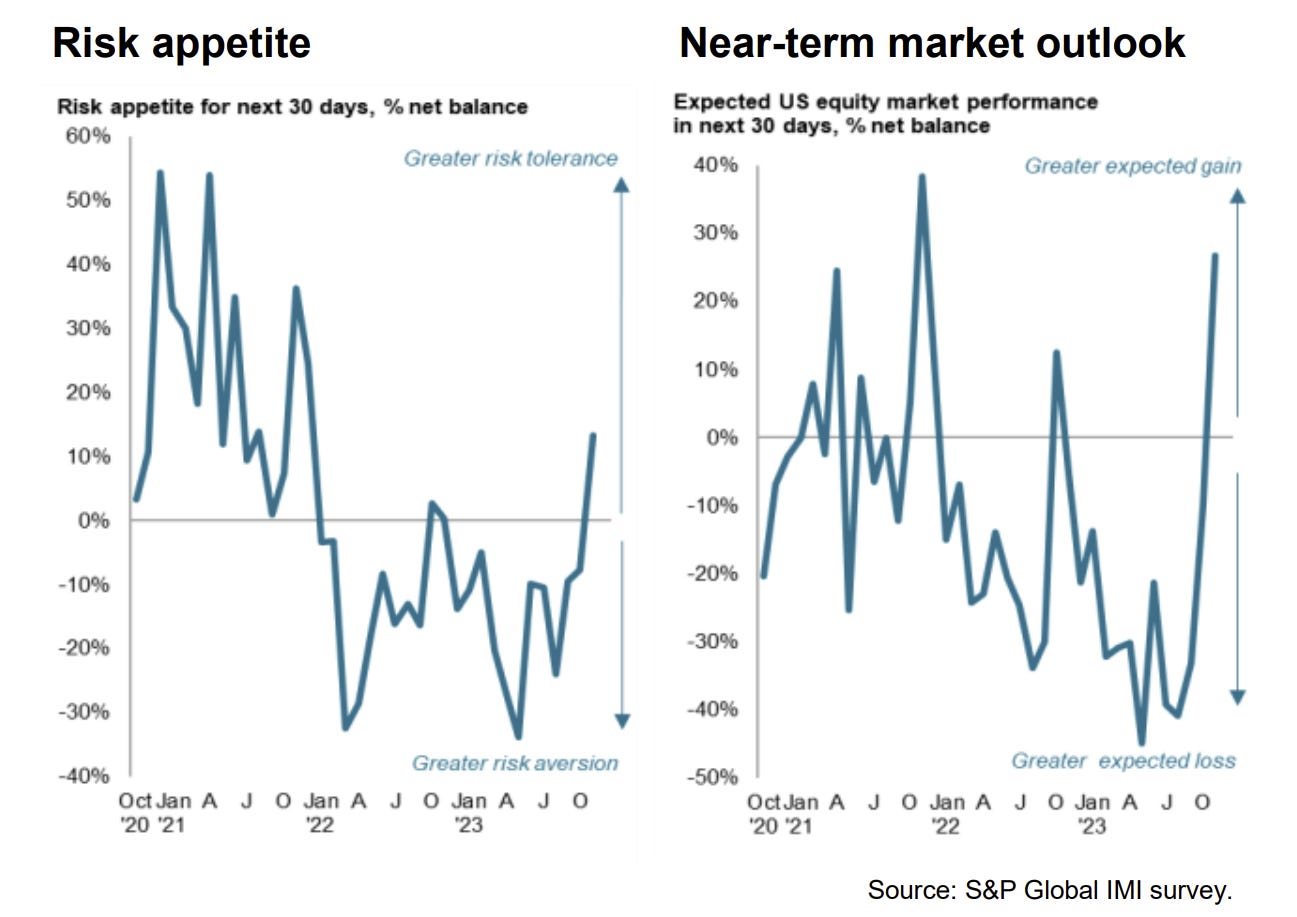

3. Risk-On: Another angle on it is the latest monthly survey of investment managers by S&P Global — it’s the same type of turnaround that we saw in October last year, and on that note… I think probably a lot of them got left behind during that move, and are thinking the same as me here: maybe this is going to be another big rally …and whether or not you think it should, it probably will, and best not to miss it this time (meanwhile those who did ride it last time will be of course (over)confident to jump right back on once again).

Source: Investment Manager Index

4. Institutional Risk Appetite: And interestingly enough, as at the end of October, institutional investors positioning was very risk-averse. Which is another way to say that the market was very ready for really probably just about any excuse to rally… and a Fed pause/peak is just about as good as any reason.

Source: State Street Institutional Investor Indicators

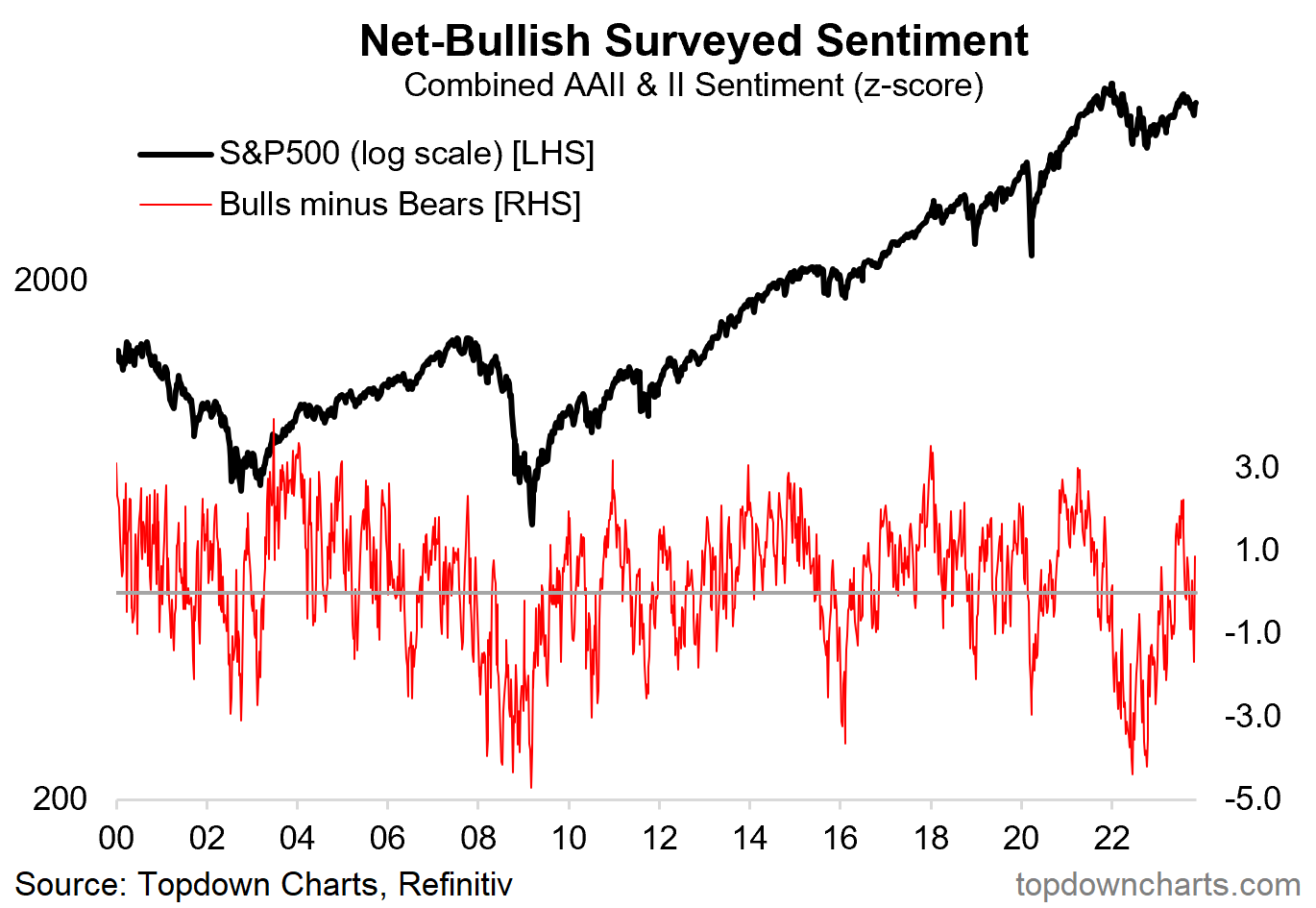

5. Sentiment Shakeout: Indeed, looking at the AAII (retail) and II (advisors) surveys of investor sentiment, we saw a big shakeout around the turn of the month — peak concerns about higher for longer, sharply tightening financial conditions, and geopolitics (fears that the Middle East situation could spillover — which for now have been allayed, as if investors are effectively saying: “if nothing’s happened by now, then probably nothing will happen in terms of a wider and larger conflict”). And in lieu of any imminent crisis/recession, this shakeout was probably enough.

Source: Topdown Charts Topdown Charts Research Services

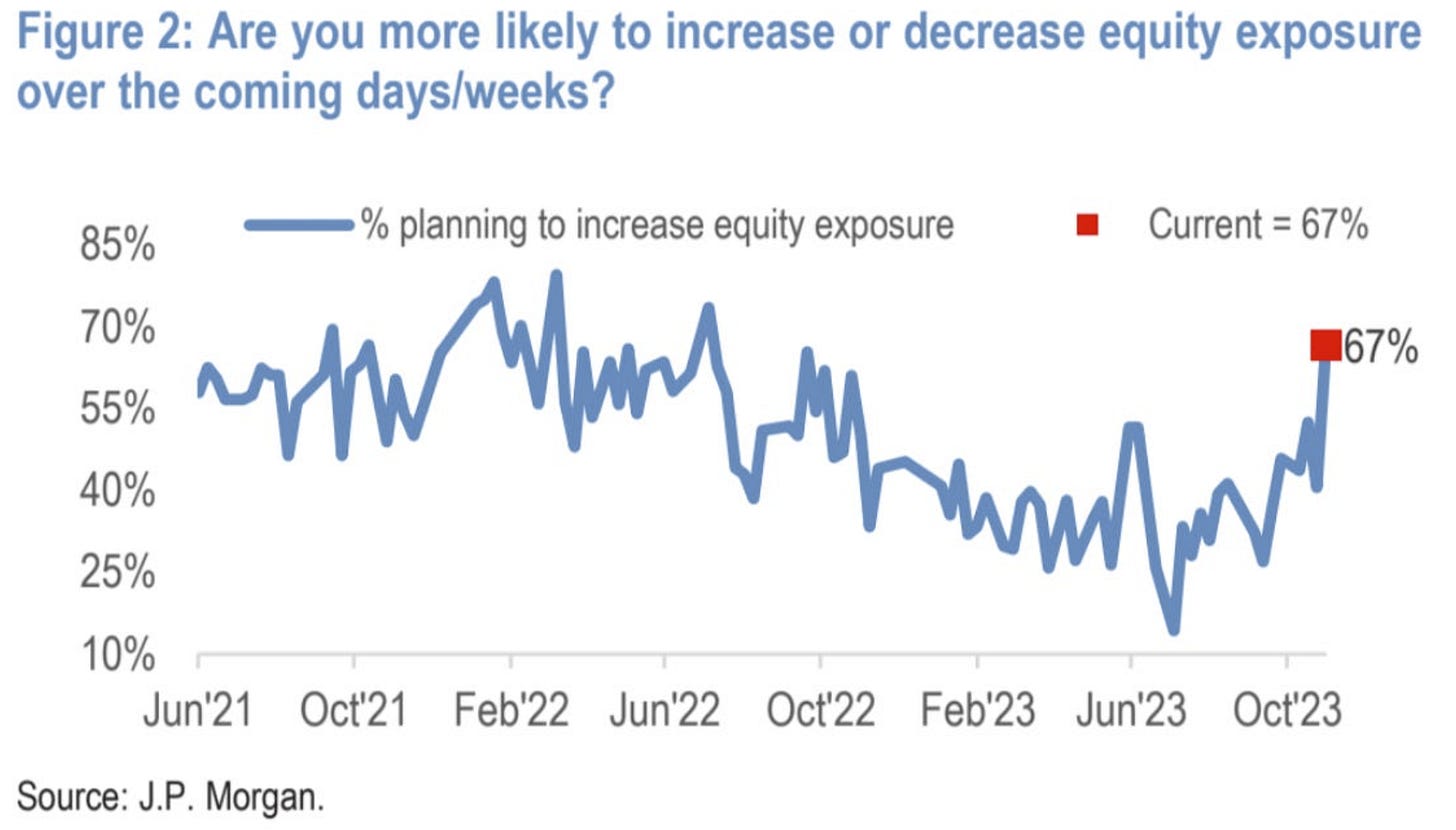

6. Bear No More: Yet another angle on it, this time the JP Morgan client survey — similarly shows investors planning to increase equity exposure. Quite the notable turnaround, and a clear echo of the shift in mood.

Source: Daily Chartbook

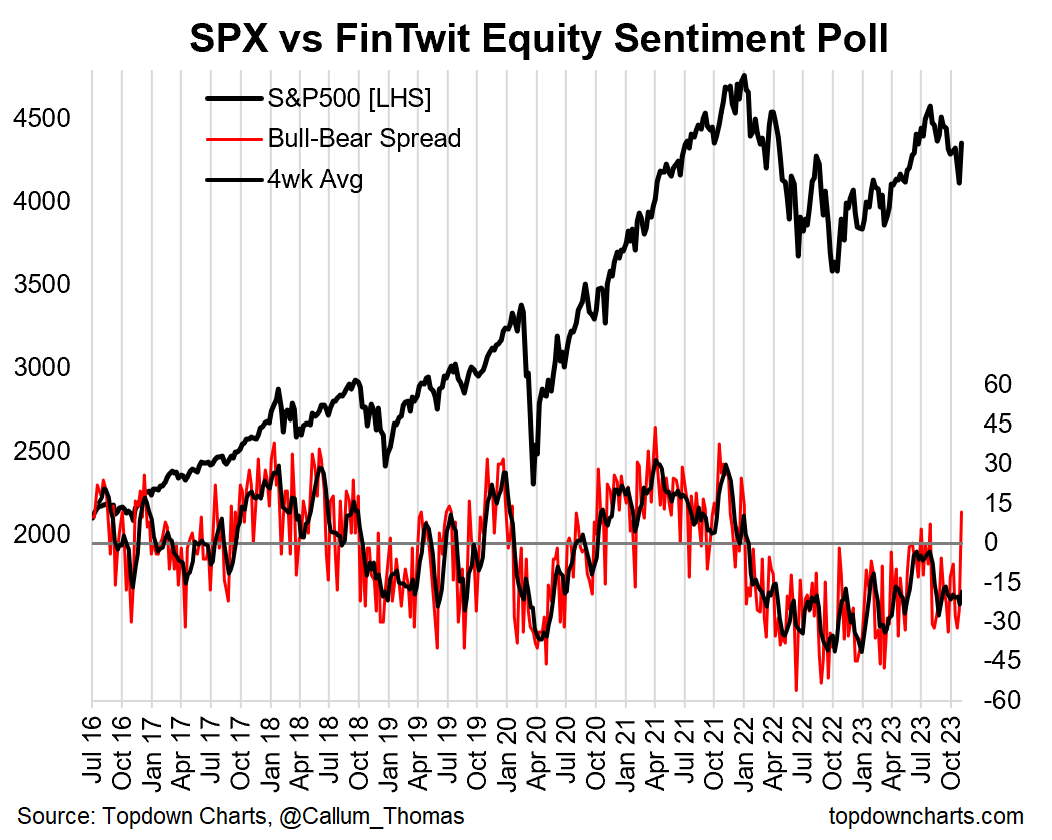

7. FinTwit Survey: I’ve been running a weekly survey on Twitter(/X) since 2016, and after a prolonged period of entrenched bearishness, last weekend saw the most bullish reading since 2021. Again the mood has changed, and animal spirits are stirring.

Source: @Callum_Thomas

8. Of Interest: Interesting chart showing the surge in interest received by S&P500 companies (notably, a lot of Big Tech have big cash holdings, and those cash holdings went from earning next to zero, to now mid-single digit %). Meanwhile the lift in interest paid has been material, notable, but slower to filter through.

Source: Substack Notes Platform

9. Rising Interest: But it would be wrong to say that rising rates have had no impact. I crunched the numbers based on LSEG/Refinitiv data for public companies, and effective trailing 12-month interest rates have clearly turned the corner — most notably for EM where central bankers went earlier and more aggressively on rate hikes (and where, as a result, they are now pivoting to rate cuts).

Source: Chart of the Week - Corporate Interest Expense

10. Uninverting: Here’s what happened in the past when the US yield curve materially uninverted. Clue: mostly bad things. Albeit one thing to ponder is that yield curves usually uninvert because of rate cuts into recession. And if you got a mild recession or a mixed-cession (where some parts of the economy went into recession, but others didn’t) you could get a more benign early-90’s type situation. Regardless though it does serve as a reminder to keep risk management in mind as a risk-on fervor begins to take hold.

Source: @hussmanjp via @MebFaber

Thanks for reading, I appreciate your support! Please feel welcome to share this with friends and colleagues — referrals are most welcome :-)

BONUS CHART >> got to include a goody for the goodies who subscribed.