Weekly S&P500 ChartStorm - 1 May 2022

This week: monthly charts, asset performance stats, market breadth, equity risk drivers, seasonality, bear market indicator, macro echoes of dot com and 70's, valuations...

Welcome to the Weekly S&P500 #ChartStorm — a selection of 10 charts which I hand pick from around the web and post on Twitter.

These charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

NEW: Sign up to the (free) Chart Of The Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you one of the most interesting charts on our radar, along with commentary/context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! > > > Subscribe Now

1. Happy(?) New Month! Another month, another update to the monthly chart, now tracking clean an clear below its 10-month moving average.

Source: @topdowncharts

2. Monthly Asset Returns: US Large Cap equities were at the bottom of the table in April… basically everything except cash & commodities was in the crapper this month.

Source: Asset Class Returns

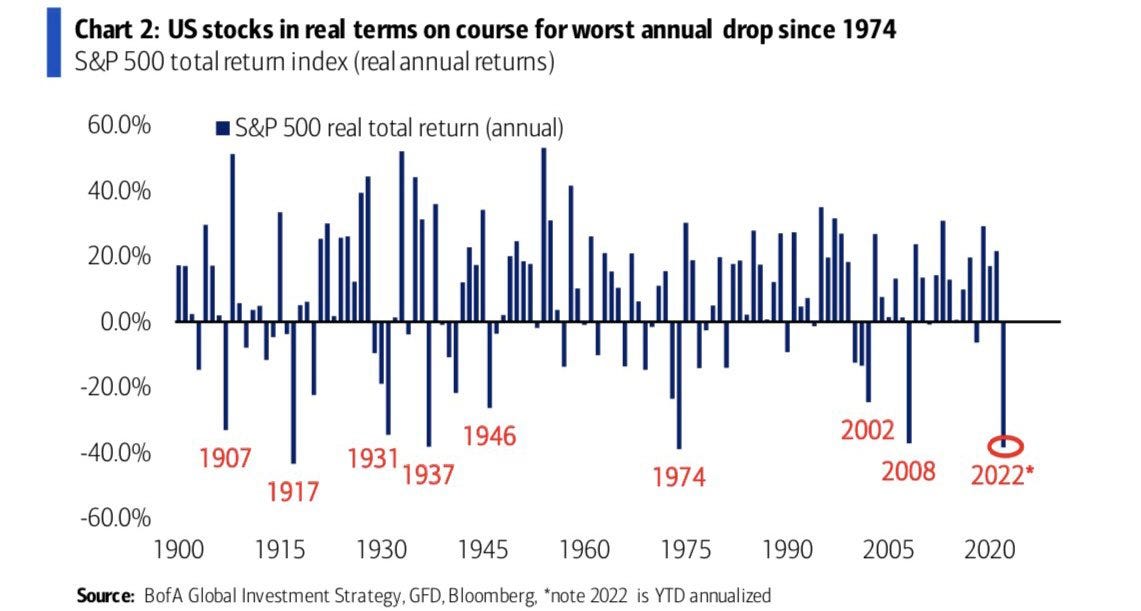

3. S&P500 Real Returns: CPI-Adjusted S&P500 on track for its worst performance since 1974 (and if you wanted a macro analog, the 70's have some similarities... e.g. surging inflation, geopolitical shocks, surging rates).

Source: @Marlin_Capital

4. Rare Returns: As highlighted in chart 2, both stocks and bonds have had a rough and tough time this year. It was always going to be a hard ask for bonds to be a diversifier to stocks when both were extreme expensive -- all was needed was an inflation shock.

Source: @DiMartinoBooth

5. Bad Breadth Update: An update to that 50dma breadth chart from last week: starting to look a little more oversold this week... but I would probably still just call it strong bearish momentum as the index has also taken out a pretty key level.

Source: @MarketCharts

6. Correction-Drivers Update:

-EPOL [Poland ETF] (geopolitics proxy): worsening, high risk of spillovers.

-LQD [IG Credit ETF] (credit/rates): new lows as bond yields spike further + credit risk sentiment is starting to stumble too as the macro outlook dims.

-ARKK [New Tech Fund] (tech burst): new lows as tech reset plays through.

And the index has made an initial break down. Not good.

Source: @Callum_Thomas

7. "SELL IN MAY" (especially May of Mid-Term years)

(of course: past performance - while informative and interesting context - is no guarantee of future results)

Source: @RyanDetrick

8. Let There be no Ambiguity: This is a bear market.

Under the surface the picture is clear as demonstrated in this excellent chart. We are only now starting to see the index roll over in earnest.

Source: @jasongoepfert

9. History Rhymes: Without even delving into the specifics of this chart the thing that is crystal clear is how many parallels there are NOW versus BOTH 2000 (tech boom/bust) AND 1970's (inflation/geopolitical shocks).

Source: @exposurerisk

10. Valuations: I know not everyone likes the Price-to-Book ratio, and fewer still like comparing valuations across time, and people will offer plenty of explanations/reasons for why it’s so high...

But sh*t still expensive.

Source: Vertiginous Valuations

Thanks for following, I appreciate your interest!

oh… that’s right, almost forgot!

BONUS CHART >> got to include a goody for the goodies who subscribed.

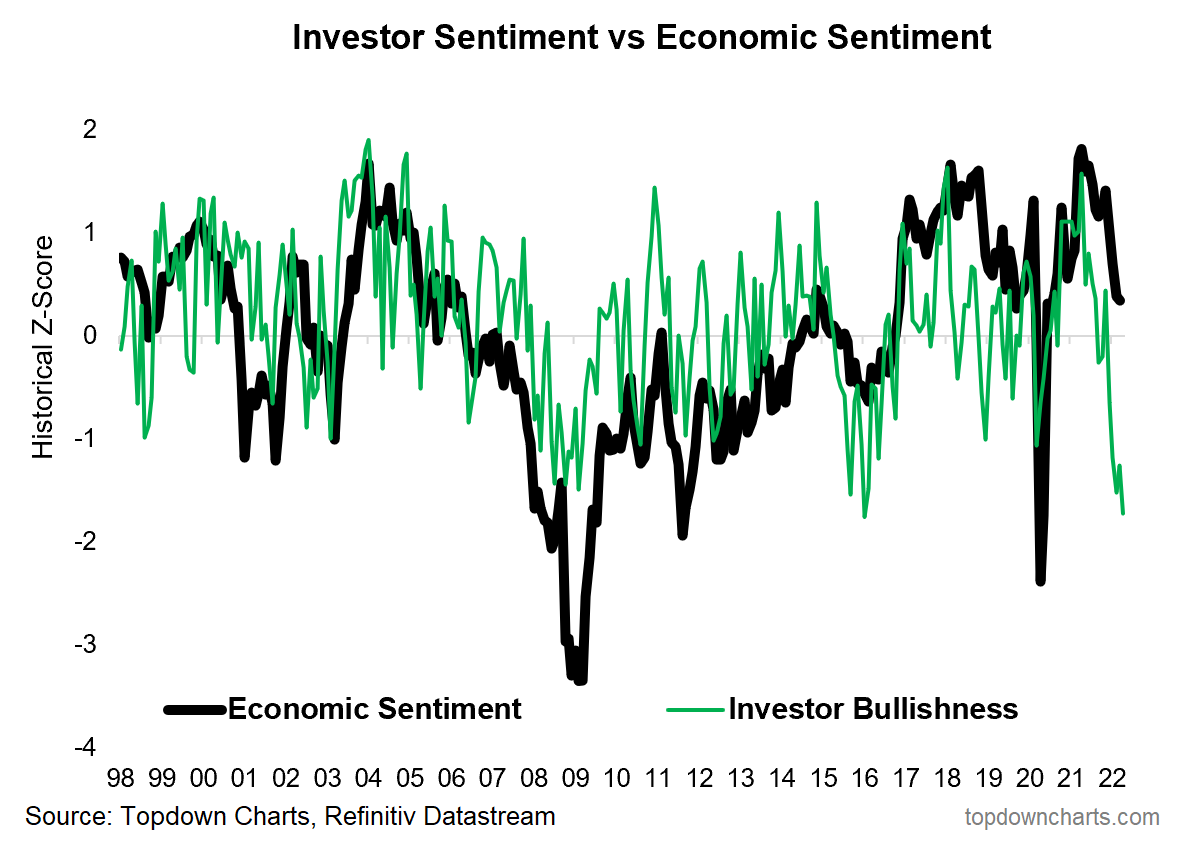

Investor Sentiment vs Economic Sentiment: Another big development this week was the further drop in investor sentiment (e.g. the AAII Survey saw the 5th most bearish reading on record).

But interestingly enough, my combined monthly average sentiment readings still stand in stark contrast to the combined measure of economic sentiment.

Basically, the economic surveys are saying folk are mildly optimistic, while the investor surveys are saying folk are wildly pessimistic.

I suspect this gap will close sooner or later, and likely mostly from the top side as I am seeing more an more leading indicators pointing to a downturn, and if you think about it, the Fed needs to either stand by an let inflation get anchored at high levels or step up and get inflation under control (and likely cause a recession — as a natural and logical part of the process).

As I noted elsewhere, it’s all cycles. And to that end we don’t need to necessarily go and get all pessimistic, just realistic about the reality of cycles and clear-eyed on the stage of the macro/market cycle that we are in. And act accordingly.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)