Off-Topic ChartStorm: Oil & Energy Prices

This week covers: oil market technicals, intermarket signals and macro risks, supply considerations, and inflation implications...

Welcome to the very first “Off-Topic ChartStorm“.

Unlike the usual ChartStorm (which focuses on the S&P500 and related issues), the Off-Topic ChartStorm is basically a semi-regular special focus piece with topics spanning macro, markets, stocks, commodities, regions, and research.

This first edition is a good example of the kind of things I’ll be covering in this section. You should expect to see a mix of the timely (e.g. today’s topic), as well as some more non-obvious areas under the radar. Should be good.

Hope you enjoy!

NEW: Sign up to the (free) Chart Of The Week over at the new Topdown Charts Substack entry-level service: Subscribe to the Chart of the Week

Each week we send you one of the most interesting charts on our radar, along with commentary/context and a key takeaway — so you’re never left guessing on why the chart matters ...and the charts matter! > > > Subscribe Now

1. Oil Support: WTI is at a key level here, and again we are faced with that open question — is this test of support going to be a launch pad, or a diving board?

Source: @matthew_miskin

2. "Crude oil right on the precipice"

Yep. Aside from that key support level, also worth tracking is the 40-week moving average as upside momentum shifts to nascent downside momentum.

Source: @saxena_puru

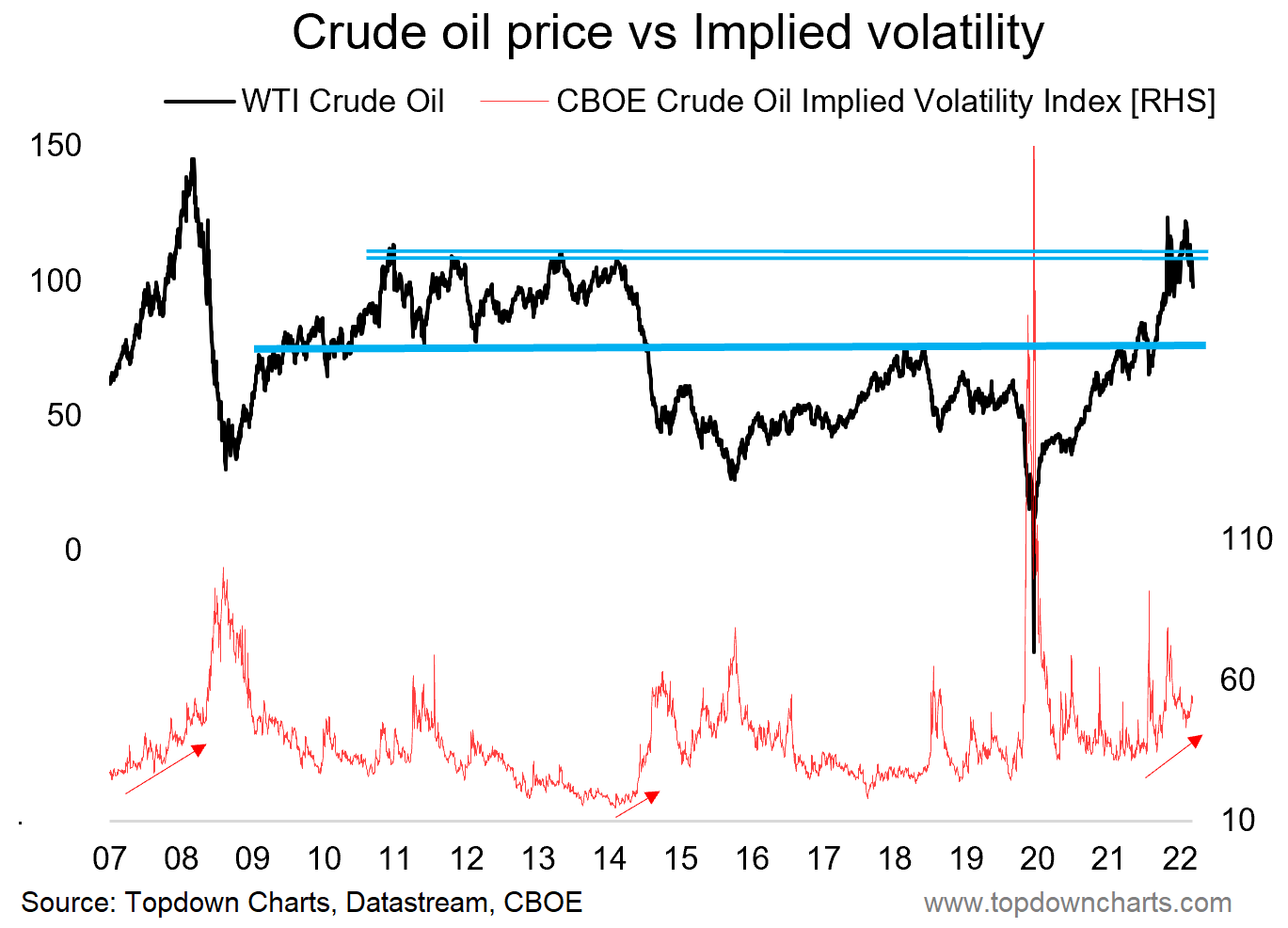

3. Resistance, Risk, and Volatility: It’s easy to miss it, but worth emphasizing — WTI crude has now twice attempted, and twice failed to breakout to new highs.

Now with the the implied volatility index for oil (basically the VIX of the oil world) trending up, WTI crude is at risk of dropping back to next logical line of support ~$75

Source: @topdowncharts

4. Breakevens: This one of those situations where markets rhyme and echo, and while the chart is a day or two out of date, the key message breakevens are sounding is that inflation/growth risks are turning down... oil is on notice.

Source: @BurggrabenH

5. Metal Meltdown: Similarly, industrial metals are going into freefall as demand doubts come into focus — the implication for energy prices being that weaker demand will ultimately translate into weaker energy prices (industrial metals are usually the first to know about global macro inflection points!).

This is probably as good a chart as any for tracking a prospective shift in macro-market narrative from inflation risk to growth risk.

Source: Chart of the Week - Heavy Metal Omen for Energy Prices

6. Recession Drawdown: "Recessions see oil prices fall by 20% to 70%"

So basically, being bullish on oil at this point is either betting against history or betting against recession.

Source: @IanRHarnett

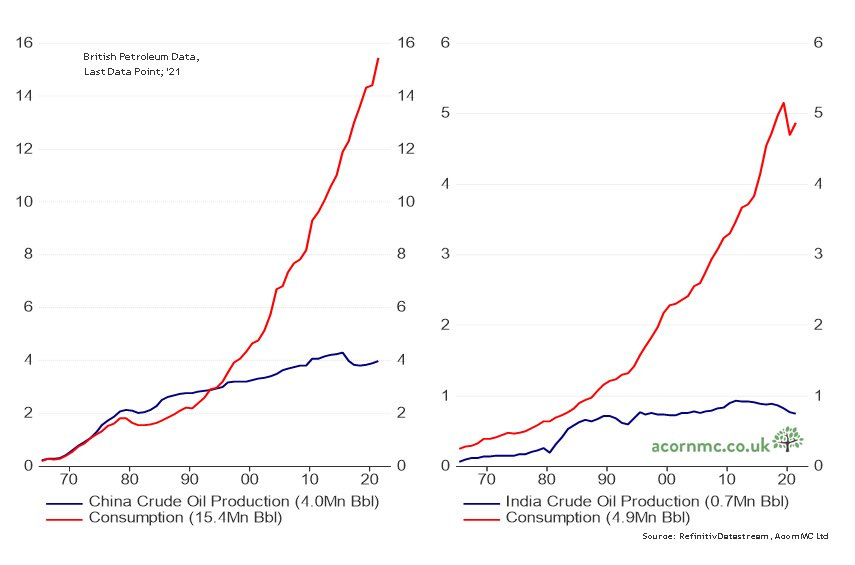

7. Emerging Demand: China (and India) oil demand is pretty much on an exponential path... Also in the immediate term, China is reopening from covid lockdowns (albeit tentatively, and still somewhat stop-start) and potentially(?) stimulating (again though: still waiting for more detail and concrete actions on that front), so it's not all doom and gloom on the outlook as such.

Source: @RichardDias_CFA via @MichaelAArouet

8. Tactical Petroleum Reserve: US has been frantically dumping its strategic reserves. That’s a major short-term (finite) supply headwind for oil prices...

Source: @StephaneDeo

9. Rushin’ Back: Another supply headwind = the return of Russian oil.

"We're definitely seeing more Russian oil routed through the Middle East. *Routed* being the operative word."

Source: @ayeshatariq

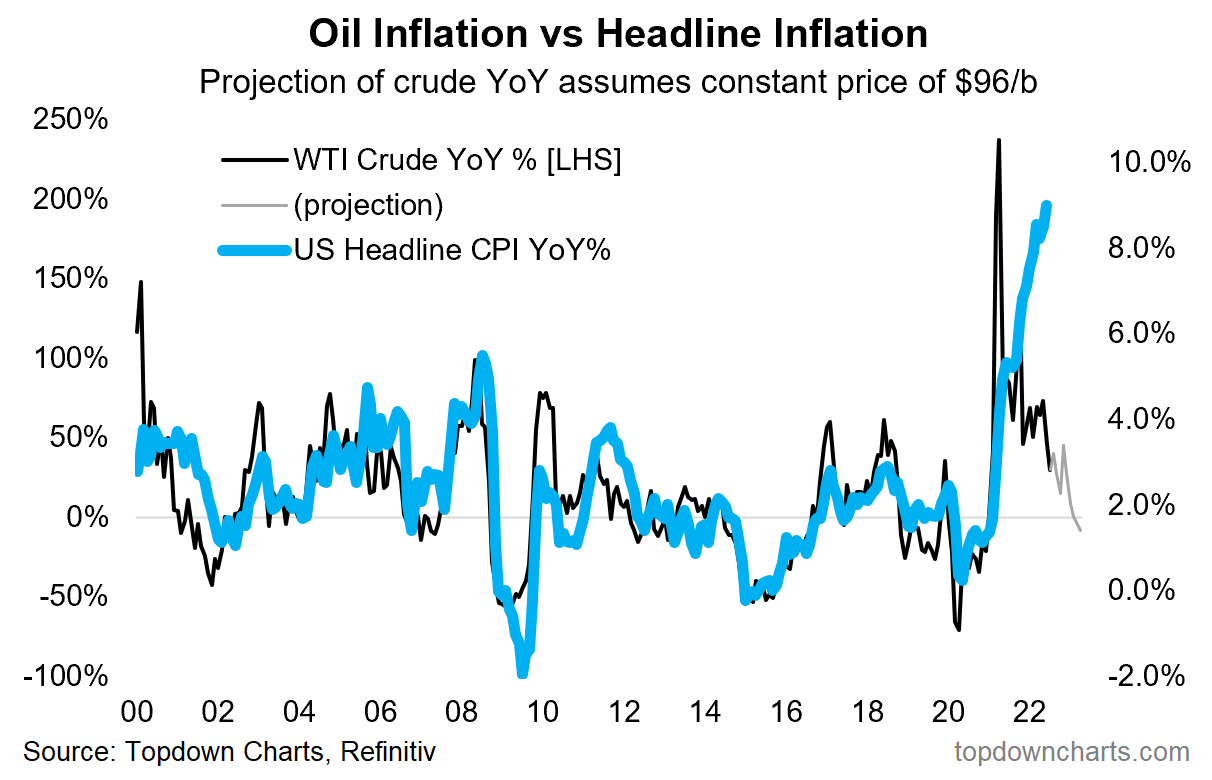

10. Inflation Implications: If WTI crude simply stays at current levels (let alone potentially dropping further), inflation is likely to drift lower.

There are few reasons for this... e.g. the importance of energy prices in the CPI, the pass-through/indirect effects of energy prices, the influence of surging energy prices/inflation on Fed policy (and hence significant monetary tightening, which reduces demand and boosts USD: another headwind to oil), and the demand aspect in that at the margin it also reflects swings in demand. So again, we could soon see the macro-market narrative shift from inflation risk to growth risk.

BTW, one of my US clients mentioned to me that the inflation outlook is a hugely political issue, which was kind of astonishing to me — I could not care less about whose team wins, I am just trying to figure out the macro-market currents …and how to best position for that. But I am a simple man!

Source: @topdowncharts

Thanks for following, I appreciate your interest!

Summary and Closing Thoughts

To sum up, the technical picture for crude oil has been steadily deteriorating, with a number of key downside triggers now in close proximity. While some short-term supply headwinds have been coming into play (SPR sales and Russian oil), the demand story is increasingly going to be the big issue — with recession now more or less becoming the base case.

Clearly this has important implications across a multitude of markets, but from an asset allocation standpoint, the biggest beneficiary of these emerging themes is likely going to be treasuries (treasuries are the clear winner in environments of disinflation and falling growth).

Anyway, that’s it for this session. Hopefully you found this new semi-regular email interesting and useful (I think I’ll do this just about weekly — assuming I’m not run off my feet with other stuff, and assuming there’s not just plain nothing to talk about at all!).

Appreciate your ongoing support and interest.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a new entry-level Substack service, which is designed to distill some of the ideas/themes/charts from our institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

Relevant Tickers Discussed: OIL 0.00%↑ DBC 0.00%↑ TIP 0.00%↑ USO 0.00%↑ UCO 0.00%↑ SCO 0.00%↑ DBO 0.00%↑

Three more downers for the list: "WTI crude futures fell below $97 per barrel on Monday as top US energy envoy Amos Hochstein indicated confidence that major producers in the Middle East have spare capacity and are likely to boost supplies following President Joe Biden’s visit to the region. Rising virus cases and the prospect of fresh lockdowns in top importer China also weighed on crude prices as the country reported 691 new Covid-19 cases for Saturday, with locally transmitted cases hitting the highest since May 23. Moreover, the newly-installed head of Libya’s National Oil Corp. said the country's oil output will resume from all shuttered fields and ports after meeting groups that have blockaded the facilities for months."