Here’s a quick Off-Topic ChartStorm on the emerging bull market in China.

Unlike the usual weekly ChartStorm (which focuses on the S&P500 and related issues), the Off-Topic ChartStorm is a semi-regular focus piece with topics spanning macro, markets, stocks and stats, commodities, regions, and various other issues of interest.

And uniquely, this is my first foray into collaborations, as I welcome the contributions of Macro Charts in this note.

Learnings and conclusions from this session:

China is exhibiting all the classic features of a New Bull Market.

Pessimism is entrenched.

Monthly and Weekly trend signals turned up in Q1 2024.

Valuations are extremely depressed.

Breadth has been extremely strong.

Macro and Policy are finally falling into place.

Overall, there is definitely a change in the winds here, I know this piece will be greeted with ample skepticism given the prevailing sentiment and news flow on China, but I urge you to set aside your biases and focus on the charts.

1. Failed Breakdowns to Bullish Breakouts: Both Chinese A-shares (domestic listed) and the MSCI China Index (includes domestic and foreign listings) have rebounded after failed breakdowns to lower support levels, and are in the process of a major turnaround (new bull market type of stuff in the works here).

Source: Weekly Macro Themes Report - China Property & Stocks in Focus

2. Pessimism is Entrenched: “Bull Markets are born on pessimism.” — folk are still shorting China, believing that it’s “uninvestable” and that a crisis is just around the corner …any day now. And who can blame them with the wall of negative press flow and opinion making that has prevailed over previous years. Could the next meme-stock short-squeeze come in the most unexpected of places?

Source: Something Incredible is Happening in China

3. History Rhymes in Markets: Monthly and Weekly trend signals turned up in Q1 2024 for the Hang Seng Index — here’s a comparison of prior Major Bull Markets in China’s HSI Index, suggesting much higher targets over the next 12-24 months.

Source: Something Incredible is Happening in China

4. Hi High HSI: Notably, a repeat of those historical patterns would target the HSI Index at 23-25k BEFORE year-end 2024. That would be an *additional* +24% to +35% upside from current levels.

This would make China probably one of the best performing markets in the world this year, by far. No one thinks these targets are remotely possible. And yet, history shows this is precisely what happened when these sort of technical developments showed up in the past (and a reminder: price always moves faster than narratives and stories).

And this is at the INDEX level… imagine what the leading Stocks could gain in this scenario. Some could advance multiples more.

Source: Macro Charts by MacroCharts

5. Hedge Fund Happening: Just this week David Tepper's Appaloosa reported BABA as its largest position (12% of the portfolio). He was loading up in Q1. In total, nearly 25% of Tepper’s $6.7B disclosed positions are now in Chinese Stocks / ETFs.

Source: The Winds are Changing

6. Burry on Board: Not to be outdone, Michael Burry has 22% of his portfolio — in just three Chinese Stocks: JD, BABA and BIDU. This is a big deal, and a sea change in sentiment among the hedge fund community.

Source: The Winds are Changing

7. China Risk Premium: And the timing is spot-on — news-based policy uncertainty has recently peaked and pushed lower *along with the Equity Risk Premium* (which goes some way to acknowledging that all the negative press and sentiment are already in the price given the elevated risk premium on offer).

Source: Topdown Charts Professional

8. Cheap China: China A-Shares remain cheap vs global stocks and especially vs US equities, and hey; maybe it doesn’t close the gap, but even meeting half-way would be significant upside re-rating.

It also highlights the on/off nature of this market, which now appears to be switched into the “ON” position.

Source: Weekly Macro Themes Report - China Property & Stocks in Focus

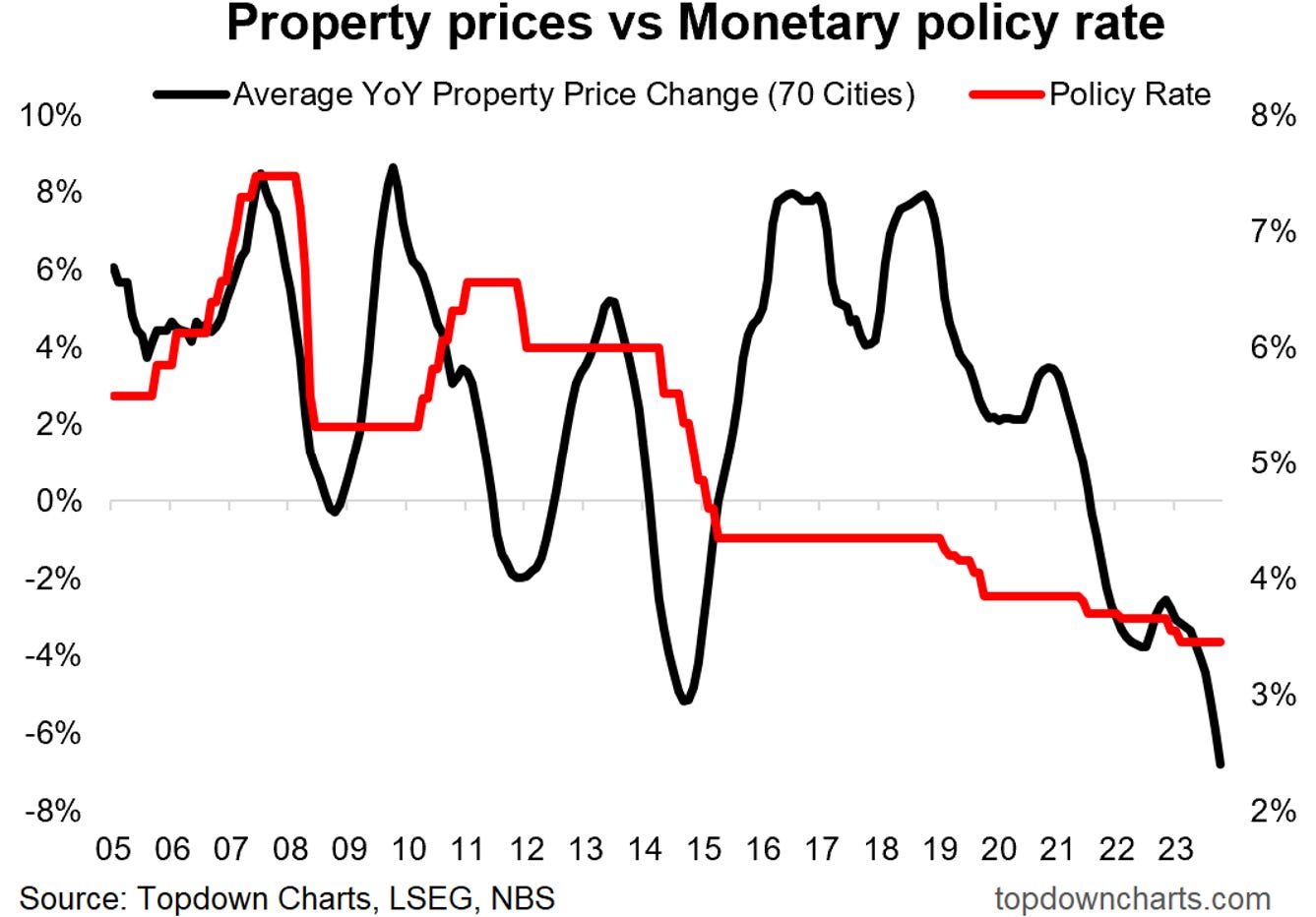

9. Policy and Property: I have been expecting more monetary easing from China for some time, and they have stepped up efforts recently with cuts to long-term policy rates and bank reserve requirements… but just yesterday the government announced a string of measures to stem record property price falls and turnaround an entrenched property market downturn.

China has announced: -25bp cut to housing fund loans, removed the floor on mortgage rates, slashed the minimum deposit for first home buyers to the lowest level since the late-90’s (15%), and a program has been launched for local governments to conduct asset purchases to help rundown excess housing inventories.

This is quite bullish.

These measures and the possibility of perhaps some further incremental monetary policy easing will likely put a floor under house prices, remove some of the associated downside risks, and bolster sentiment for Chinese consumers and stockmarket, but also emerging markets and commodities.

Source: Weekly Macro Themes Report - China Property & Stocks in Focus

10. Meanwhile in Emerging Markets: Emerging market equities in general have been picking up steam – as previously noted, EM equities are breaking out, are above their upward sloping 200-day moving average, and with strong breadth across countries and continuation of their long-term uptrend in local currency terms. China is obviously a big part of this, but it’s not the only part, and either way what’s good for EM is good for China and vice versa.

Source: Topdown Charts

Thanks for reading, I appreciate your support! Please feel welcome to share this with friends and colleagues.

Hopefully you found this collaboration piece useful and interesting.

Thanks to MacroCharts for their contributions

— please see his original post on Chinese stocks for more details on his analysis, examples of previous bullish breakouts in energy stocks to illustrate what is potentially in the works here, and some of his analysis and charts on single stock names (useful for those of you who want stock picks vs index views!)

Thanks and best regards,

Callum Thomas

Founder & Editor of The Weekly ChartStorm + Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

Appreciate the article. Good stuff. But you did seem to nail to the day the short term top at least in China as it’s been straight down since this came out

Very good, thanks