Off-Topic ChartStorm: Gold

A chart-driven look at what's going on with Gold (+Silver +Mining Stocks)

Here’s a quick “Off-Topic ChartStorm” on Gold — with gold breaking out to new highs I thought it would be timely and useful to present a set of charts on Gold (+Silver and Miners), to see what’s going on and where things are headed next.

Learnings and conclusions from this week’s charts:

Gold prices are on the rise globally.

Central bank activity + (geo)politics are key drivers.

There’s room to run for the secular bull market in gold.

Silver also sees upside (relative value, macro tailwinds).

Miners are cheap with defensive attributes + upside potential.

Overall, while the move in gold prices over the past couple of years has been sharp, significant, and substantial, there appears to be room to run. I present charts and views below to help illuminate what’s been going on, and frame the prospect for further upside across precious metals and miners.

NOTE: Much of the charts in this report come from my new service; the Monthly Gold Market Chartbook — be sure to check it out and subscribe to the free GoldNuggets Digest publication over there for more gold/metal/macro updates.

1. Gold Price: As noted, the US$ gold price has broken out to new all time highs. This is an extension of the underlying uptrend and secular bull market in gold. It’s also echoed-in and confirmed-by the strength in global gold prices, with the equal-weighted 14-currency global gold price index already breaking out to new highs a few weeks ago.

Source: Gold Market Chartbook - January 2025

2. Gold Drivers — Policy Uncertainty: In terms of what’s driving the strength in gold there’s a few things going on, but most recently a key element is the spike in (geo)political risk. One example of this is tariff risk, which has spurred a spike in COMEX gold inventories (people front-running the risk of tariffs on physical gold imports by moving holdings from London to the USA). But overall there is a clear (geo)political risk premium getting priced-in as the geopolitical norms of the past few decades give way to a new era in international relations.

Source: Global Cross Asset Market Monitor

3. Gold Drivers — Central Bank Buying: Another major driver of the secular bull market has been diversification of central bank reserves (aka central bank buying). Global reserve allocations to gold have doubled over the past 10 years, and this is likely to be an ongoing trend given concerns around US fiscal sustainability and geopolitics (sanctions risk).

Aside from that central banks have also been giving it an extra boost by rushing into rate cuts, expanding M2 money supply, and globally adopting an overall monetary easing bias. These are the kind of trends that tend to be multi-year in nature, and it’s hard to imagine a scenario where you see a sudden shift or reversal in all this, so in other words the current major drivers of the gold bull market are likely to persist.

Source: Monthly Gold Market Chartbook

4. Gold Valuations — Has it gone Too Far? But there is a natural question around “are we too late to get on board?” or simply “has it gone too far too fast?” I think these are the right questions to ask when you’ve already seen a really strong run. Gold bulls will be quick to point out however that there have been much larger, longer, extended moves in the past.

From a practical standpoint a few questions come to mind as a heuristic or framework for thinking about this: a. is it over-valued? (slightly, but my composite valuation indicators are still far from levels where it peaked in recent decades; room to run); b. is the crowd all-in? (the opposite I would say: my data shows ETF *outflows*, very low allocations by retail investors, and media apathy; room to run there too); c. are the monetary tailwinds turning? (nope, still pumping, key cyclical and thematic drivers show no signs of letting up; room to run); and d. are there any technical warning signs? (none of the indicators I track are flagging any immediate risk flags, trend is strong; room to run).

So while these things can change, and these are probably the key questions I would continue to ask, for now there seems to be nothing standing in the way of the secular bull market in gold running further.

Source: Gold Market Chartbook - January 2025

5. Silver Flows: Silver has also broken out, but somewhat less convincing vs gold. One thing in common is the overarching uptrend, but also recently: ETF outflows. As noted, retail appear to be relatively lukewarm on precious metals, perhaps too busy chasing the prospect of larger faster gains in crypto, or performance-chasing in tech.

Source: Topdown Charts Research Services

6. Silver vs Gold: One distinction between silver and gold is that silver has more industrial applications, so it sort of behaves like part precious metal and part industrial metal. In thinking about silver vs gold, silver looks to be undervalued vs gold, and my expectation for the growth outlook is for a reacceleration in global industrial production this year — base metals and growth-sensitive commodities are likely to benefit significantly from that, and thus silver should see some macro tailwinds.

Source: Topdown Charts

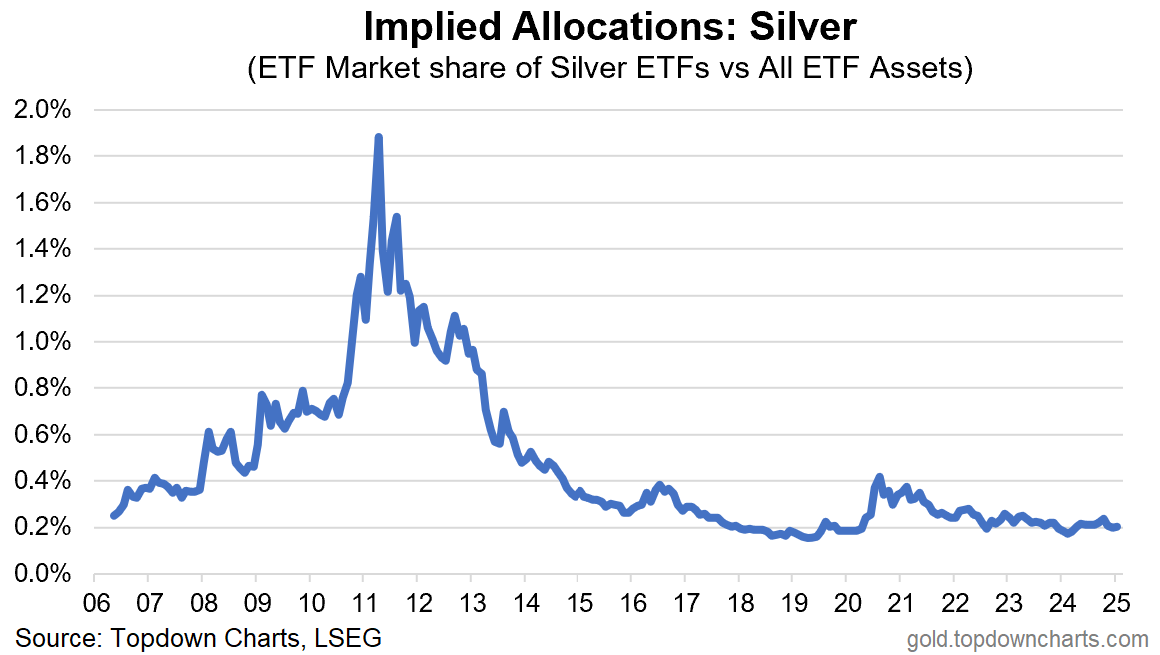

7. Silver ETF Allocations: Lastly on silver, despite the strong run in prices, relative value, and prospective macro tailwinds — ETF investors show very little enthusiasm. Implied portfolio allocations are right at the bottom end of the historical range. I would call that a contrarian signal.

Source: Monthly Gold Market Chartbook

8. Gold Miners Left Behind: Unlike the gold price, gold mining stocks have basically been in a 5-year trading range. They have defied the strong trend in the rest of the stockmarket and in the gold price. The relative performance of gold miners vs the index diverged from the gold price back in 2021 and never caught back up. But with growth stocks looking increasingly overvalued and at risk in an environment of rising (geo)political risk, and gold prices going from strength to strength I think it’s fair to expect some catch-up for miners.

Source: Topdown Charts Professional

9. Gold Miner Valuations: If we look at the valuation side of things, gold miners are trading at the steepest relative value discount since the peak of the dot com bubble. In that respect again, I think this sector can serve as an alternative hedge or diversifier against a tech-driven stockmarket downturn, while also benefitting should precious metal prices run further. So it’s an interesting combination of defensive features with upside potential.

Source: Weekly Macro Themes Report (Gold Miners Topic no. 5)

10. Gold Miners — Investor Allocations: Lastly, echoing the themes for gold and silver, as you might expect given the lackluster performance to date for miners, retail ETF allocations are running near record lows. So it’s a case of unloved, undervalued, and underappreciated upside potential. It’s probably not going to be for everyone, but definitely food for thought for contrarians!

Source: Monthly Gold Market Chartbook [n.b. Reminder to Subscribe!]

I hope you enjoyed this rare off-topic ChartStorm and found it useful/informative. Please be sure to share if you think others will find it interesting, and if you haven’t subscribed as a paid supporter yet I would encourage you to consider upgrading and would appreciate your business :-)

p.s. if there are any other topics of particular interest you’d like to see covered in a future edition please let me know in the comments.

Best regards,

Callum Thomas

Founder & Editor of The Weekly ChartStorm

Thanks for following, I appreciate your interest!

"Global reserve allocations to gold have doubled over the past 10 years, and this is likely to be an ongoing trend given concerns around US fiscal sustainability and geopolitics (sanctions risk)."

This raises a good point: the Global South, particularly Russia and China, will likely become more wary of holding the USD as a reserve currency. Non-USD reserve assets like gold and bitcoin could be one way to hedge risk and bet on increasing de-dollarization.

The rise in Bitcoin has given gold a new shine and the gold mining stocks should follow suit. Bitcoin is often referred to as digital gold.