Off-Topic ChartStorm: European Equities

A closer look at everyone's "most hated" market...

Welcome to another edition the “Off-Topic ChartStorm“.

Unlike the usual weekly ChartStorm (which focuses on the S&P500 and related issues), the Off-Topic ChartStorm is basically a semi-regular special focus piece with topics spanning macro, markets, stocks, commodities, regions, and research notes.

You should expect to see a mix of the timely and front-of-mind issues, as well as some more non-obvious areas under the radar.

Hope you enjoy!

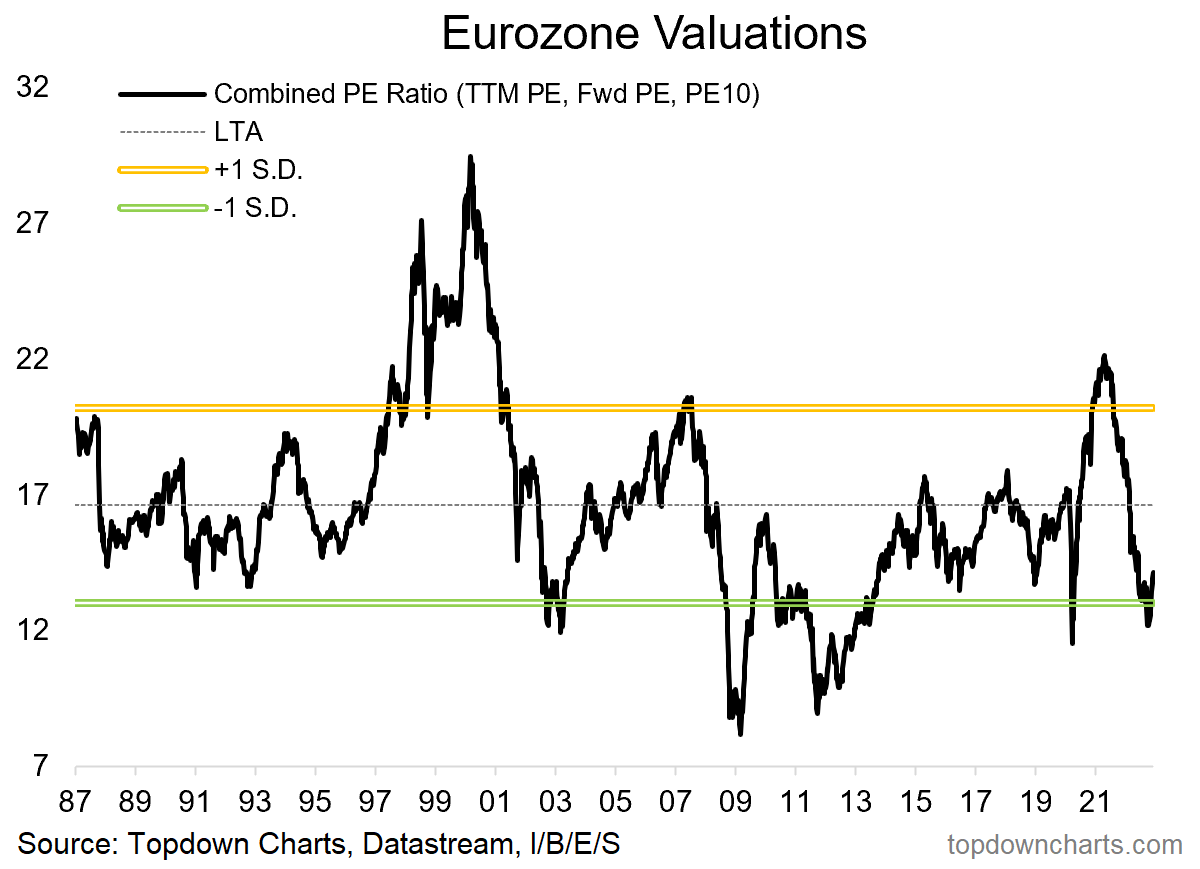

1. Valuations: Eurozone equities in the Cheapzone.

Source: Chart of the Week - Deep Value in the Eurozone

2. Relative Value: European equities appear to be pricing in a much more catastrophic backdrop than US equities — currently trading at a historically extreme cheap valuation discount.

Source: @StephaneDeo

3. Solemn Seers: Strategists see little upside for European equities, and still see substantial downside — basically telling us that the bounce we’ve seen is all you get. Makes me think of that saying: "If it's obvious, it's obviously wrong”.

Source: @dlacalle_IA

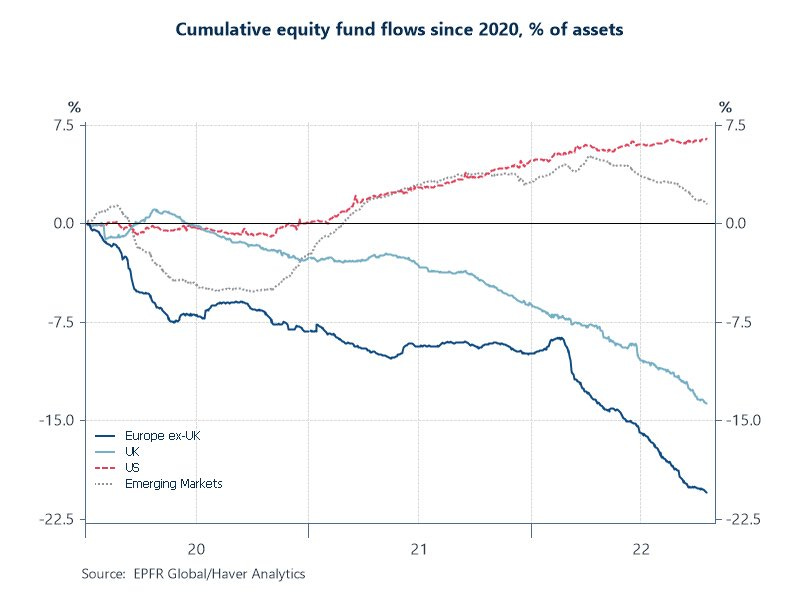

4. Investor Exodus: There are a few interesting standouts on this table, but the biggest standout is Europe -- massive outflows this year.

Source: @MRBullMktEver

5. Most Hated Nation: And another perspective on flows — this one shows flows standardized against AUM, so it's all the more stark to see how investors have been giving up on Europe (even worse than UK!).

Source: @DuncanLamont2

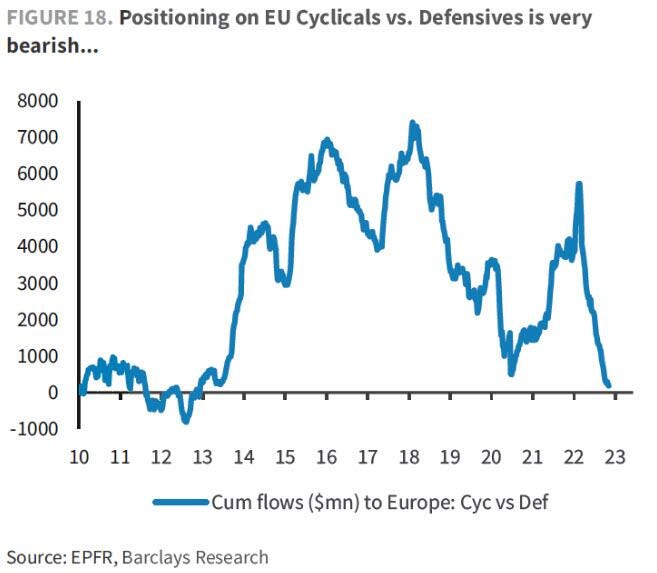

6. Cyclical Flows: And here’s another interesting flows chart — this one shows how after some initial optimism, investors have dumped European cyclicals vs defensives... yet another sign of the extreme pessimism on display in what people are actually *doing* with their money.

Source: @JohnPlassard [Also was featured in the 13-November ChartStorm]

7. Sour Surveyed Sentiment: European surveyed sentiment (combined readings from the Sentix and ZEW surveys) — briefly reached the most pessimistic level on record.

Sentiment so bad it's good? (technically speaking, from a sentiment standpoint, this would be considered a bullish contrarian signal i.e. reaching an extreme pessimism level and then ticking higher).

Source: @topdowncharts Topdown Charts

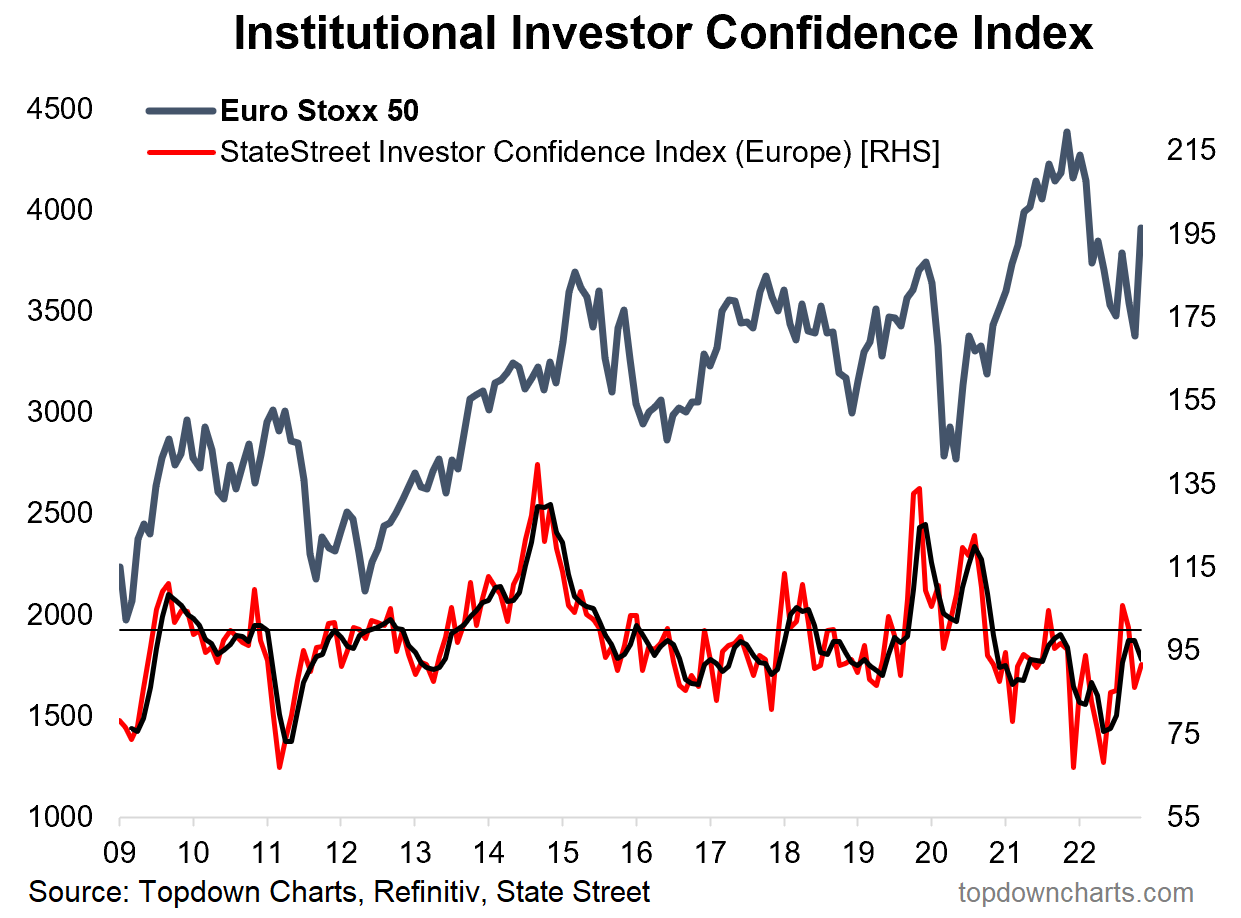

8. Institutional Investor Confidence Index: European institutional investors are becoming slightly less pessimistic. The indicator is still below 100, but clearly improved from the low points; perhaps the improved valuations are helping offset the risk backdrop.

Source: @topdowncharts Topdown Charts

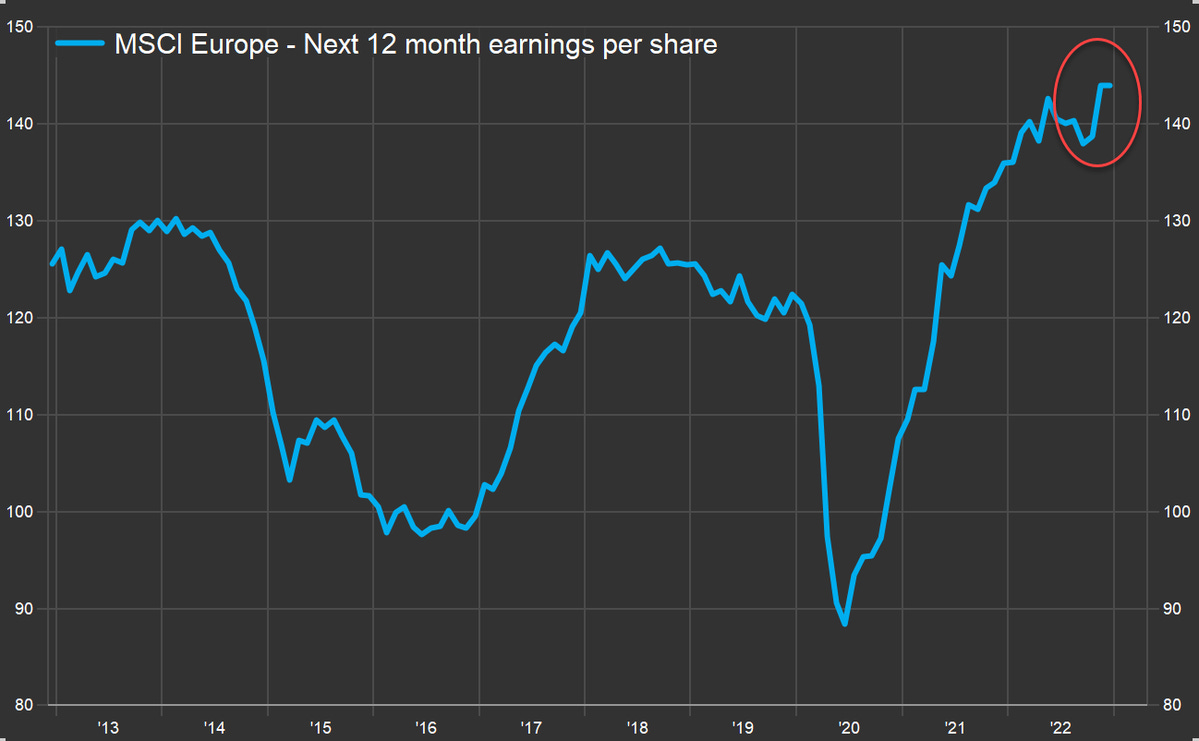

9. Earnings: Amidst all the pessimism you might be surprised to know that next 12-month bottom-up earnings estimates for European equities just hit a 10-year high.

Source: @matthew_miskin

10. Macro Outlook: Of course, one issue for earnings will be a potential recession in Europe (and the rest of the world for that matter)!

Source: @skhanniche via @RollinFrederic

BONUS CHART >> got to include a goody for the goodies who subscribed.

European Recession — First-in First-out? Going by the manufacturing PMIs, Europe was the first to enter recession, and it begs the question as to whether they might end up being the first to exit recession …just as the rest of the world falls into recession!

As a point of background, I had expected Europe to head into recession into 2023, but the Russian invasion of Ukraine basically brought-forward recession in the form of a massive negative shock to confidence (the headline effect, and falling asset prices), and of course the massive shock to expenses in the form of the energy crisis.

So there is a chance that as some of the effects of those shocks begin to fade that Europe could see a relief-rebound in its economy (especially with covid-related fiscal stimulus rebuild measures still flowing through).

However this would be set against the backdrop of still powerful monetary headwinds and a slowing global economy. So I would not necessarily be rushing to get bullish on the European economy.

As for European equities however, the valuation case is falling into place, and sentiment/flows are clearly contrarian bullish. But the last pieces of the puzzle would be for monetary headwinds to fade (or ideally turn to stimulus), and for the economy to bottom and turn up (and ideally for geopolitical risk to become less asymmetric to the downside, and ideally get resolved entirely).

Definitely something there, and something to pay attention to, but perhaps requires a bit of patience and an eye on risk as the puzzle pieces slowly fall into place.

—

Best regards,

Callum Thomas

My research firm, Topdown Charts, has a NEW entry-level service, which is designed to distill some of the ideas/themes/charts from the institutional research service to provide the same high quality insights at a more accessible price.

Give it a try and let me know what you think! :-)

For more details on the service check out this recent post which highlights: What you get with the service; Performance of the service; and importantly: What our clients say about it…

Sentiment definitely got too bearish on Europe in early October, but I also think the sabotage on Nordstream and the German's unwillingness to significantly extend the operating lives of the nuclear reactors will be problematic. Germany has a lot of shale but is unwilling to allow fracking and even Obama said they needed to accept the political costs of fracking after Putin invaded Crimea. Instead, they doubled down on Russian gas.

I've hedged my stake in Vermillion (VET), the largest energy producer in France, Germany and Ireland by shorting EWG since it has more industrial companies than the Euro Stoxx 50. German industry will be hit by more cost inflation from labor and energy than the US, and the ECB doesn't even have a dual mandate to support full employment. A lot has changed since they raised rates in summer 2008.

Some European companies with less industrial exposure will outperform but overall I agree with the adage that Europe is a better place to visit than invest.

1) Great Off-Topic ChartStorm session, nice as it comes with an element of surprise :), thank you!

2) Ref Europe, looks bad but in general when it looks bad, one buys cheap naturally, just need to cherry pick some more probably. On that, I did a stock screener in September in the context of the energy crisis & the geopolitical situation. Maybe interesting & complementary: https://maverickequityresearch.substack.com/p/stock-screening-for-value-in-europe

3) I will make an update on it in Q1 2023 and also other stock screeners in specific pockets of the market (both Europe & US).

Have a great day!