Off-Topic ChartStorm - Commodities

Taking stock of Commodities: an insight into trends across supply, demand, valuations, sentiment and positioning, technicals, and super-cycles...

By popular request, here’s a quick “Off-Topic ChartStorm” on Commodities.

Unlike the usual weekly ChartStorm (which focuses on the S&P500 and related issues), the Off-Topic ChartStorm is a semi-regular focus piece with topics spanning macro, markets, stocks, commodities, regions/countries, and various other issues of interest.

Learnings and conclusions from this session…

Valuation: commodities (asset class level) are cheap.

Cycle: serious underinvestment in supply + cyclical demand upturn.

Monetary: supporting the cyclical upturn is substantial monetary tailwinds.

Sentiment: investor sentiment is lukewarm, allocations are historically low.

Technicals: a new cyclical bull market is getting underway; still early.

Overall, there’s growing evidence for a new cyclical bull market in commodities (following a cyclical bear market from 2022-24). This is likely to become a major macro theme in 2026 (not to mention a very interesting opportunity for investment in both commodity related stocks and commodity prices themselves). Check out the charts and datapoints below and let me know what you think in the comments.

ICYMI: check out the Weekly S&P500 ChartStorm — Best-of 2025 Edition.

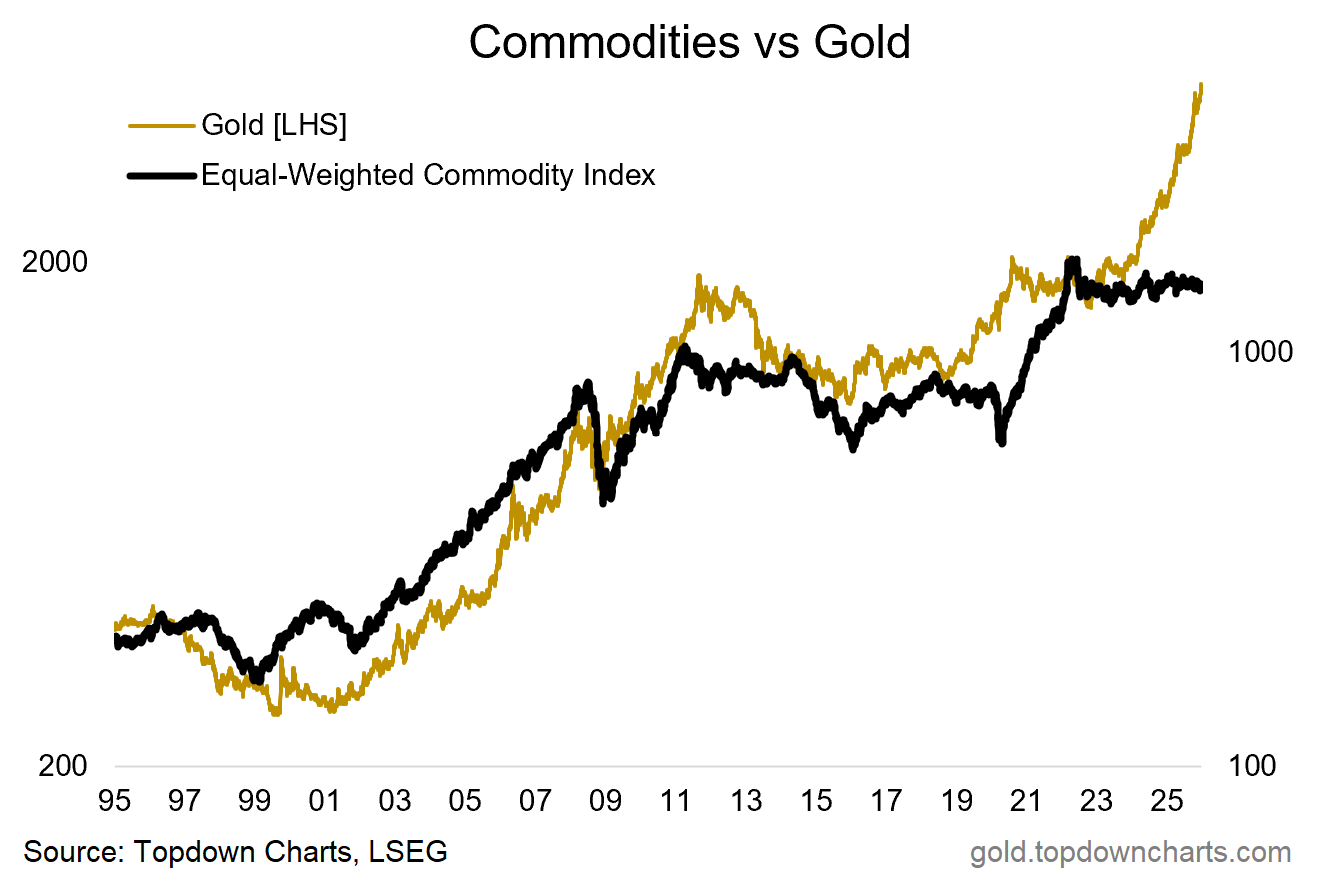

1. Follow the Leader: gold has blazed the path, commodity catch-up comes next.

2. Commodity Stocks Front-Running: similarly, the equal-weighted basket of global commodity stocks is pointing to a new cyclical bull market in commodity prices.

3. Cheap starting point Valuations: meanwhile we’re coming off of cheap valuations for commodities — and you always want to pay close attention when a cheap asset/market is seeing improved technicals.

(and p.s. I mean commodities in the aggregate, i.e. asset class level — and specifically in this case the more diversified GSCI (light energy) index)

Source: Chart of the Week - Commodities

4. Light Allocations: add to that; investor allocations to commodities in the aggregate remain very low (and n.b. most of the uptick in this chart is due to precious metals —allocations to commodities ex-gold is near record lows).

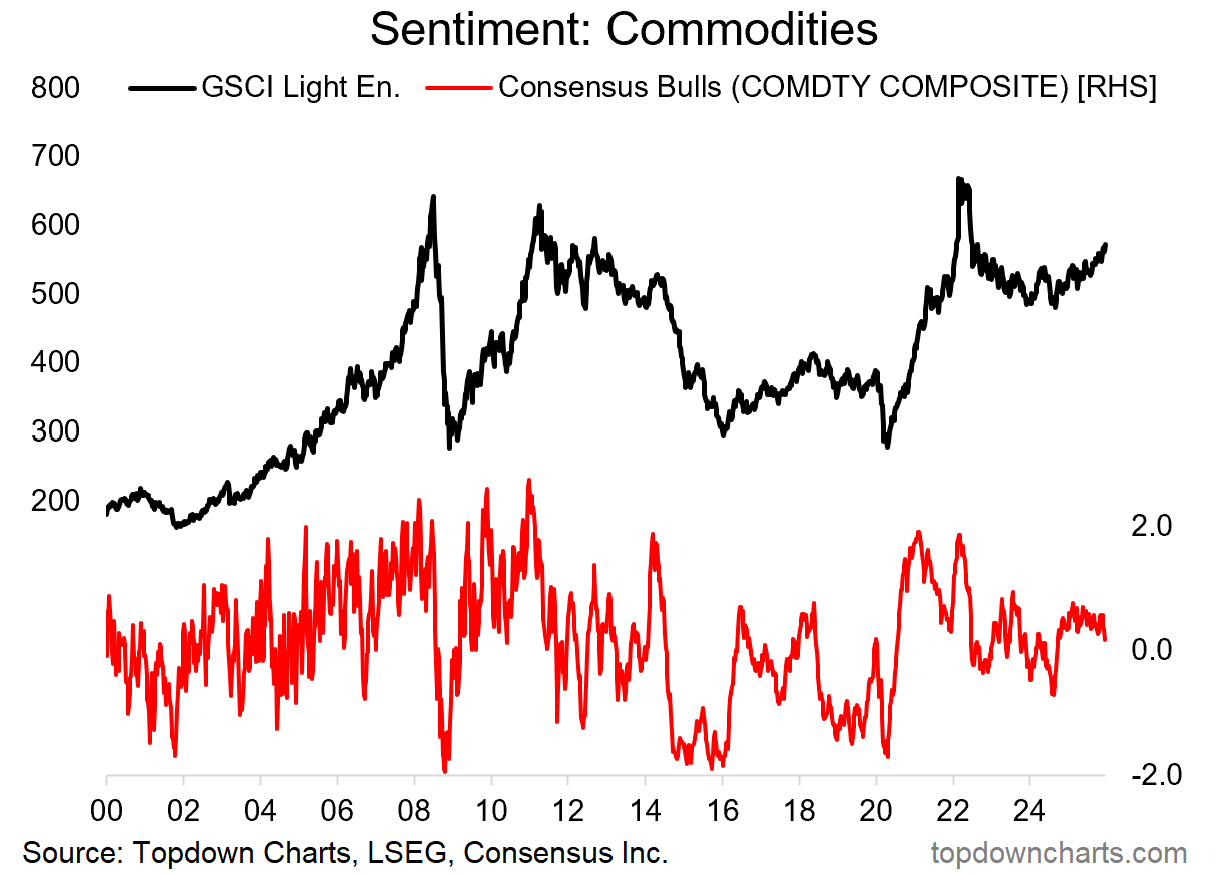

5. Lukewarm Sentiment: sentiment across commodities is basically neutral, lukewarm at best (plenty of room for many minds to change and get on board as commodities begin to rally).

6. Monetary Tailwinds: moving over to the macro/fundamental side of things, we’re seeing the amassing of major monetary tailwinds heading into 2026. Historically this kind of shift to easing has lit a fire under commodities.

Source: GoldNuggets — Commodities in Focus

7. Demand — Cyclical Upturn: a key channel for that is what I expect to be a global growth reacceleration into 2026, these rising macro tides will help lift demand for all commodities (e.g. the annual rate of change in commodity prices tracks closely with the global manufacturing PMI).

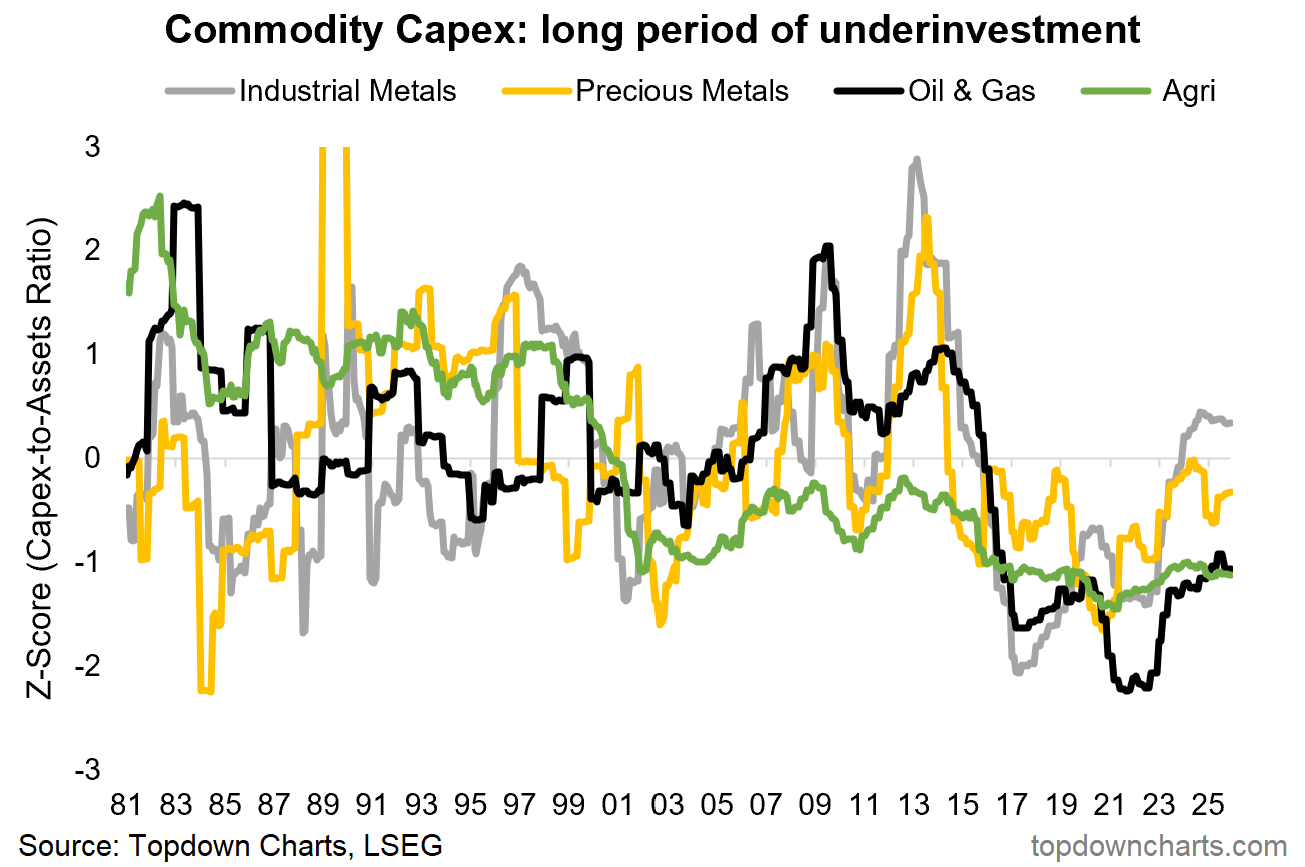

8. Supply — the Commodity Capex Depression: this is all set against a backdrop of serious underinvestment in supply. It’s entirely logical and natural to see a capex slowdown after the prolonged and substantial period of investment that we saw during the 2000’s commodity supercycle. But now the seeds are sown for the next supercycle.

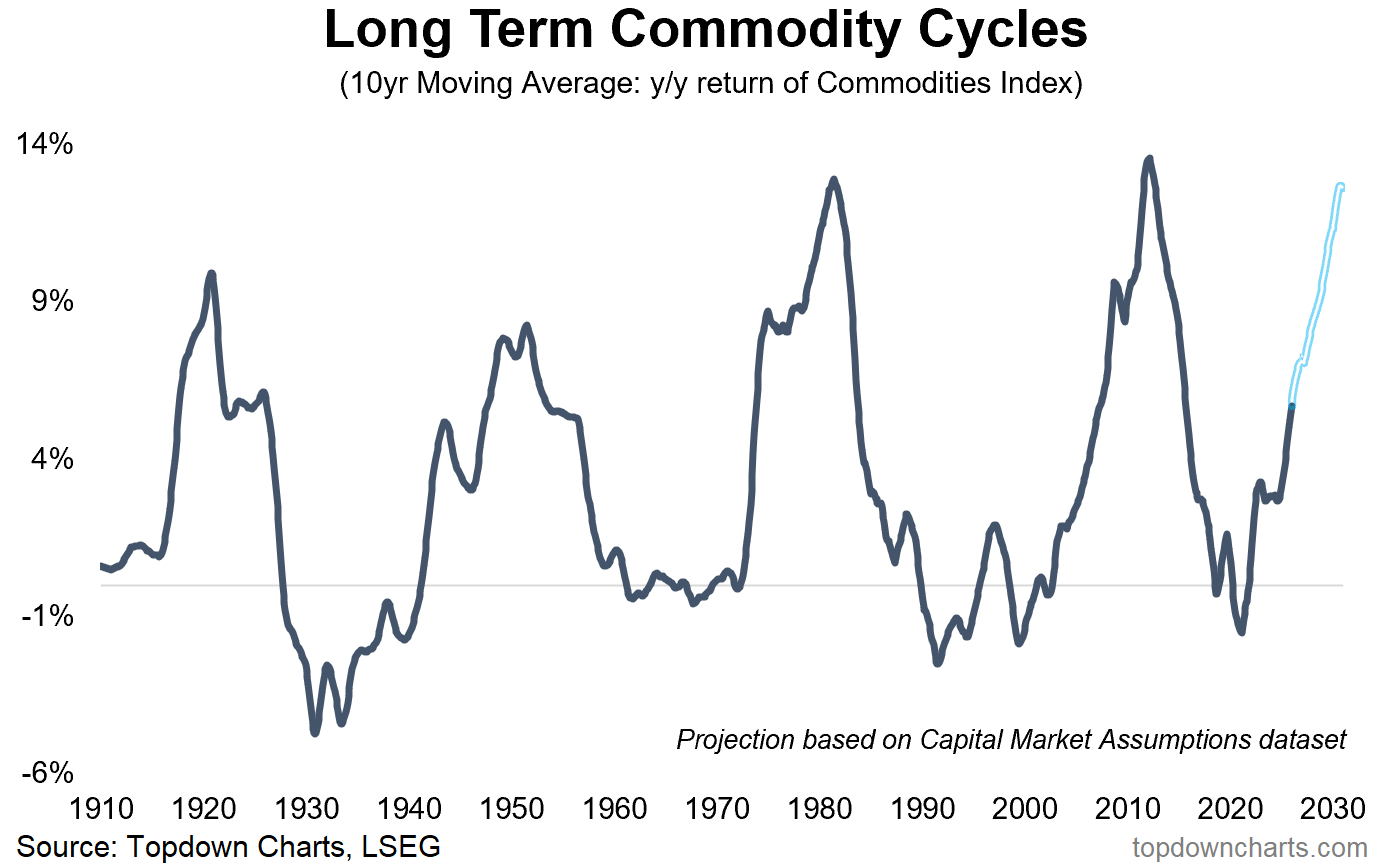

9. Supercycling: speaking of which, it looks like we are already in a new supercycle for commodities, and the way I see things; we’ve basically just wrapped up a cyclical bear market (from 2022-2024) and a new cyclical bull market is now underway. This is significant because it’s set against a structural bull case (underinvestment in supply, thematic demand drivers such as electrification and energy transition, new space race, AI & robotics race, geopolitics, and infrastructure (re)building). So we shouldn’t underestimate the opportunity in commodities as bullish forces set in motion, nor the upside risks this will present to inflation.

Source: Topdown Charts

10. Only Just the Beginning: lastly, to close out, while selected commodities like gold and silver have had an exceptional run, my view is we are still early in the new cyclical bull market. A key case in point is average pair-wise correlations across commodities: for now the rally is somewhat narrow, and we are yet to see the crowd arrive (i.e. when you tend to see all commodities bid up and moving together as investors and speculators buy anything and everything — like what we saw in the mid-to-later stages of the 2000’s commodity bull market (and again more recently into 2022)).

So I would advise taking a bit of time out as we reflect on 2025 and ponder 2026 to study up on this often overlooked asset class…

Source: Topdown Charts Professional

Thanks for following, I appreciate your interest!

—

Best wishes,

Callum Thomas

Founder & Editor of The Weekly ChartStorm

and Head of Research at Topdown Charts

Twitter/X: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/

Other services by Topdown Charts

Topdown Charts Professional —[institutional macro/multi-asset research]

Topdown Charts Entry-Level Service —[entry-level version of the above]

Weekly S&P 500 ChartStorm —[US Equities in focus]

Monthly Gold Market Pack —[Gold charts]

Australian Market Valuation Book —[Aussie markets]

Solid case for the commodities setup! The capex depression chart really nails it, reminds me of the late-90s energy underinvestment that eventually turned into the 2000s boom. One thing I'm wrestling with though is the monetary tailwinds argument given that policy transmission to commodites usually lags by 12-18 months. If we're seeing easing now, wouldn't that put peak demand closer to mid-2027? Also the correlation breakdown point is clever, narrow rallies tend to broaden before peaking, but gold's outperformancecould also just be macro hedging rather than true commodity cycle confirmation.

I'm curious how you prefer to position for commodities. Do you prefer individual names, sector ETFs or commodity futures?